Depending on Where You Stand, This is Either Thrilling or Terrifying

by Marin Katusa, Katusa Research:

One of the most fascinating things about the age we’ve living in is how the “rate of change” (or ROC) is increasing.

One of the most fascinating things about the age we’ve living in is how the “rate of change” (or ROC) is increasing.

Driven by huge increases in computing power, technology is advancing at an exponential rate. This not only means that conventional change is occurring… but the rate at which it is occurring is speeding up.

Depending on where you stand, this is either thrilling and lucrative… or confusing and harmful.

For example, think about ride-sharing service Uber. Uber caused massive change in an entrenched industry in just a few years.

One day, the taxi business is big and powerful. The next day, it’s road kill.

You also have Netflix gutting movie-rental chain Blockbuster in just a few years.

Those kind of tectonic industry shifts used to take a lot longer to play out. Sometimes decades.

Retail stocks are another recent example of how seemingly stable and dominant entities can lose their power and value in a very short time. Amazon and other online businesses are killing many retailers.

Of course, Amazon has been Amazon for a long time. It’s been eating into bricks and mortar for a long time.

But the speed at which retail stocks have been falling over the past 24 months is incredible.

One day, you’re big bad Macy’s. You’re the retailer people say is the “best of breed.” You have your own Thanksgiving parade. Your share price is in a steady uptrend and just hit $65.

Less than two years later, you’re in shambles. Your share price is $23.

Again, depending on where you stand, the fact that seemingly powerful companies and industries are getting demolished in a few years is great news or bad news. If you don’t like to change with the times or learn new skills, then you’re in trouble. But if you’re willing to learn and look out for these changes, you can make a lot of money in a very short amount of time.

As the taxi business was crippled, early Uber investors made fortunes. Netflix is up 990% since it went public. Netflix founder Reed Hastings is a billionaire.

Of course, you don’t read Katusa Research for commentary on Silicon Valley. But as a resource investor, you should know how rapid changes in technology can make or break your portfolio. Yes, technology is bringing incredible change to the “old school” industries like mining and oil.

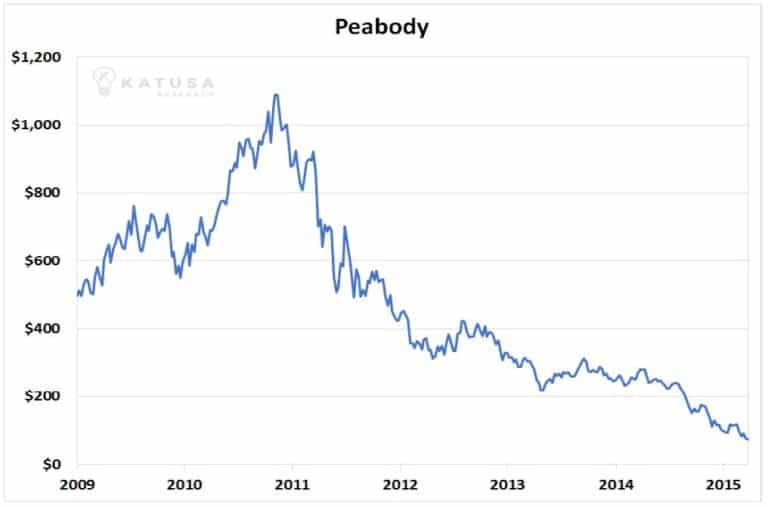

For example, the introduction of fracking technology has increased energy production so much that the price of natural gas fell from $5.82 to $1.61 per MMBtu in just over six years. This crushed natural gas stocks. Since coal is competitive to natural gas in the electrical power generation industry, coal and coal companies plummeted in price as well. The bluechip coal producer Peabody Energy went bankrupt.

The rapid deployment of fracking technology has supercharged oil production in the US. And the rest of the world’s top oil producing nations are taking notice.