Summer Storm Keeps Building as Second Dip of Great Recession Approaches

by David Haggith, The Great Recession Blog:

These updates to my list of “Seven Troubles Assailing the US Economy” are far too important to remain buried at the end of that article since many readers may not return to the article to check for updates. The summer economic crisis I’ve been predicting is building even more rapidly than when I reported a week ago. It’s almost here:

These updates to my list of “Seven Troubles Assailing the US Economy” are far too important to remain buried at the end of that article since many readers may not return to the article to check for updates. The summer economic crisis I’ve been predicting is building even more rapidly than when I reported a week ago. It’s almost here:

Total household debt now exceeds the peek it hit just before the economic collapse into the Great Recession. While the number of households is also up, wages are correspondingly down, so households have maxed out … again:

Total U.S. household debt was $12.73 trillion at the end of the first quarter of 2017, up $473 billion from a year ago, according to a Federal Reserve Bank of New York survey. Total indebtedness is now 14 percent above the 2013 trough of household deleveraging brought on by the 2007-2009 financial crisis and Great Recession. The previous peak, in the third quarter of 2008, was $12.68 trillion…. Auto loan and credit card delinquency flows are now trending upwards, and those for student loans remain stubbornly high.” The survey showed lenders tightened borrowing standards for home and auto loans, a sign of their increased caution. (Newsmax)

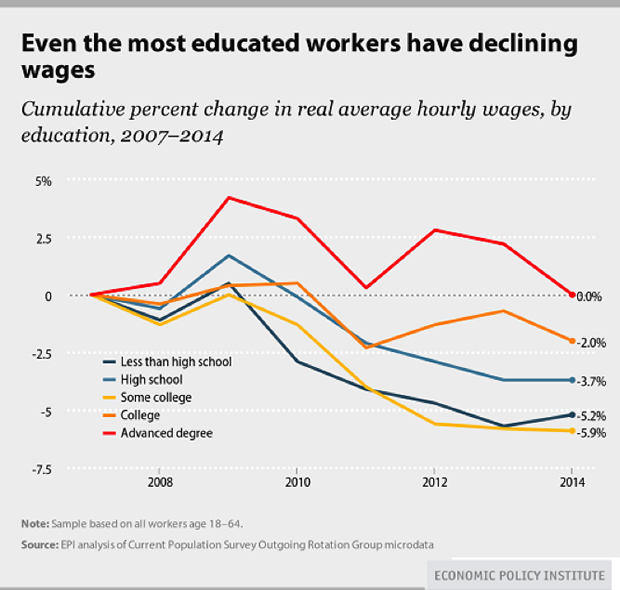

While population rose about 7% between 2007 and 2014, wages for most people have dropped about 5% during that time. (The time frame of the graph above.) Those two changes roughly cancel each other out. With lenders now tightening borrowing standards for mortgages and auto loans out of caution, they are draining liquidity out of those markets. That may be contributing to the decline in those markets as listed above. Lowered liquidity at at time when we are hitting peak debt again are combined factors that will likely keep those markets down.

Housing and all other construction take another big drop as we move into June, following March’s rise:

U.S. construction spending recorded its biggest drop in a year in April as investment in both private and public projects fell…. The Commerce Department said on Thursday that construction spending tumbled 1.4 percent…. Economists polled by Reuters had forecast construction spending increasing 0.5 percent in April…. In April, private construction spending fell 0.7 percent, also the biggest decline in a year…. Investment in private residential construction fell 0.7 percent after six straight monthly increases…. Investment in residential and nonresidential structures such as oil and gas wells was one of the economy’s few bright spots in the first quarter. (Newsmax)

So, now, even one of the few bright spots is gone.