Silver: A Real Breakout Is Coming

by Lior Gantz, Streetwise Reports:

I’m a silver bull. It’s the one asset class that has gone from bad to worse to nonexistent for most investors, and this is why Wealth Research Group places it at the top of our natural resource rankings.

I’m a silver bull. It’s the one asset class that has gone from bad to worse to nonexistent for most investors, and this is why Wealth Research Group places it at the top of our natural resource rankings.

How did this precious metal bring so much desperation and frustration to investors?

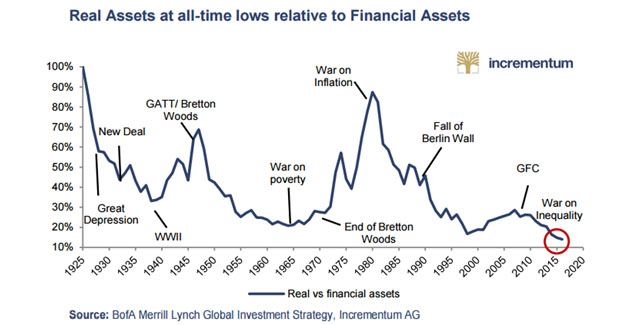

Real assets (commodities) haven’t been this cheap in a century.

2008 changed the global landscape from Asian expansion to global economic crash mode.

It brought about experimental financial practices and the need to create a “wealth effect,” which has probably skipped you if you’re not a multimillionaire and is why you’re completely ready for a complete makeover of the system we are ruled by.

This transition has not gone unnoticed by money-hungry, power-driven politicians, which are capitalizing on the renewed rise of populism.

We are transitioning away from monetary policy (Fed intervention) to fiscal policy (government intervention). Trump’s infrastructure plan, his tax plan, and his defense plan are only the beginning.

Financial assets are rising into uncharted territories, while disposable income is mostly declining. In other words, for eight consecutive years, our financial system has transferred immense amounts of paper wealth to the elite.

This has brought about the rise of cryptocurrencies, among other effects, and the disgust voters have for the establishment has been growing.

Since the economy was slow, materials and industrials were deemed “dead assets,” and because of low interest rates, the financial sector wasn’t attractive either.

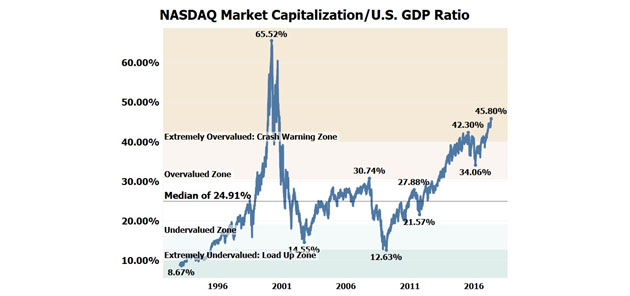

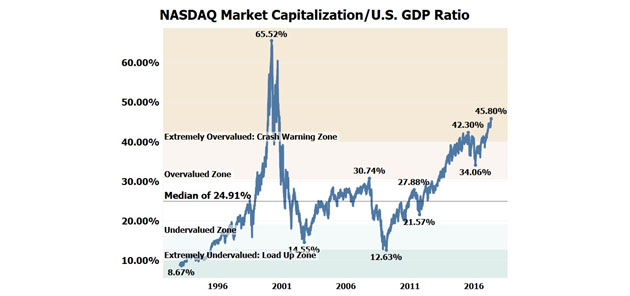

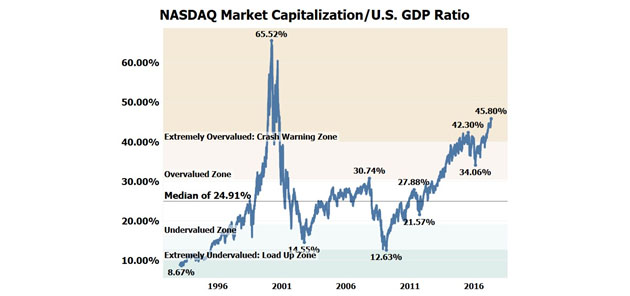

Out of the last 6,162 trading days going back to the beginning of 1993, the NASDAQ has been more overvalued than today with a market cap/GDP ratio exceeding its current level of 45.8% on a total of only 201 trading days, or 3.26% of the time.

The U.S. economy, by all measures, is currently operating at its full potential growth rate. This slow-growing economy can’t move any faster—debt is the overhanging cloud that prevents growth.

The U.S. economy always peaks as job growth reaches maximum employment, and then a recession follows.