Even in the Cryptocurrency Markets, the 1% Own More Bitcoins Than the Other 99% Combined

by Kenneth Schortgen, The Daily Economist:

Ever since the 2008 financial crisis and subsequent rise of central bank programs that have helped engineer the wealth of nations into the hands of the 1%, nearly every single market has seen this anomaly take place as access to cheap money has allowed those who control capital to multiply their wealth immensely.

Ever since the 2008 financial crisis and subsequent rise of central bank programs that have helped engineer the wealth of nations into the hands of the 1%, nearly every single market has seen this anomaly take place as access to cheap money has allowed those who control capital to multiply their wealth immensely.

And perhaps the saddest part in this is that even the cryptocurrencies are not immune to their being accumulated into the hands of a few as new analysis of Bitcoin wallet holdings shows that less than 1% of Bitcoin owners control more than the other 99% combined.

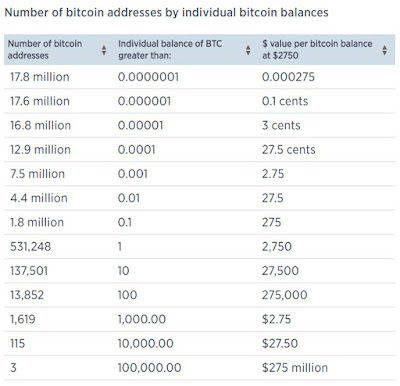

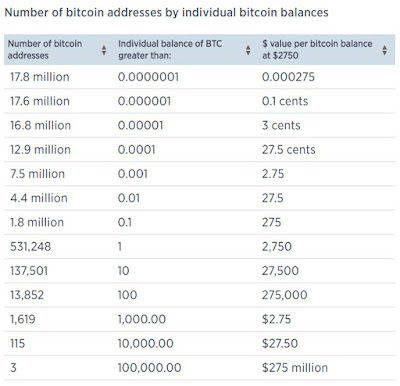

A breakdown of the data in this chart confirms that the majority of Bitcoins are currently held by a small minority of individuals or entities.

99%

(17.8+ 17.6+ 16.8+ 12.9+ 7.5+ 4.4+ 1.8 millions) = 78.8 million Bitcoin wallets.

(1.78+ 17.6+ 168+ 1290+ 7500+ 44000+ 180000) = 232,958 total Bitcoins.

1%

(531,248+ 137,501+ 13,852+ 1619+ 115+ 3) = 684,338 Bitcoin wallets.

(531,248+ 1,375,010+ 1,385,200+ 1,619,000+ 1,150,000+ 300,000) = 6,360,458 total Bitcoin.

We are also taking note of the fact that according to Bitcoin mining statistics, there are supposed to have been over 16 million Bitcoins having been mined as of June 25, 2017, and this data is pointing to the fact that nearly 10 million of these coins have not been registered as being tied to a Bitcoin wallet. And invariably this is leading to both an assumption and a conjecture that those coins are either being held outside the active Bitcoin blockchain by one or more select entities, or have been lost due to their original wallet holders having somehow eliminated them from existence through a myriad of circumstances such as hard drive failures, or lost and forgotten passwords to their wallets.