What is the Most Important Item When Analyzing a Balance Sheet

by Marin Katusa, Katusa Research:

When oil is trading at $45 per barrel, the answer for oil producers to the question above is “debt.”

When oil is trading at $45 per barrel, the answer for oil producers to the question above is “debt.”

Now that oil is down 18% from this year’s high, debt is a large and growing concern in the oil patch. And if you’re a stock investor, this should concern you too.

That’s because of where debt and equity lie in a company’s capital structure. The people who own a company’s debt are first in line to get paid back if a company declares bankruptcy. The equity owners are last in line. The people who own a company’s debt are first in line to get paid interest before shareholders see a dime in dividends.

Debt is the single most important item on the balance sheet to understand when analyzing a company’s stock.

When a company takes on debt, the debt holders are usually first secured by the tangible assets of the company. In the oil patch, the asset would be the projects…. the oil and gas fields. Along with the debt come many debt covenants, which are basically rules the company must follow to stay in the good graces of its creditors.

If the company for whatever reason breaches any of those covenants, the company is in default. Default means the company must pay back the debt or renegotiate with the debt holders. Either way, the shareholders get screwed.

In the oil and gas sector, the pattern over the years has been almost like clockwork. Management teams take on massive amounts of debt when oil is doing well. Big name brokerages and banks “advise” the management teams how this makes sense, the bankers get their fees, the management teams get their money via the debt package and the debt holders get security on the asset and collect a high interest rate that they couldn’t get elsewhere. The shareholders get shafted.

Not Katusa Research subscribers.

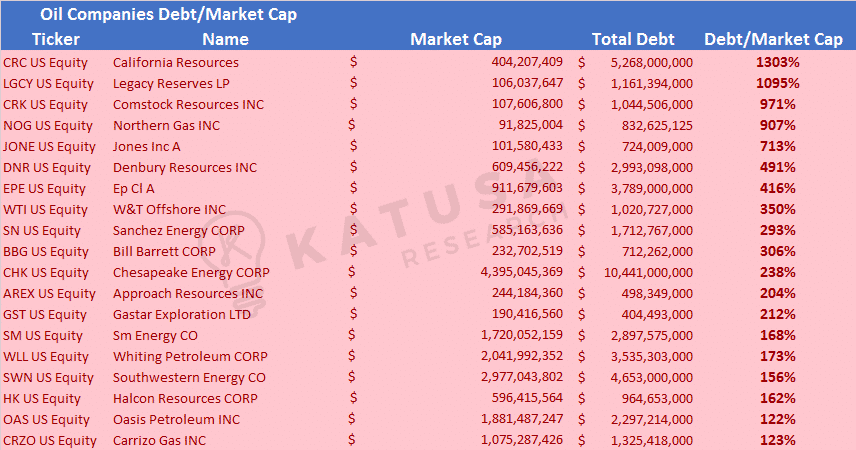

The table below shows the publicly-listed U.S. oil producers that have total debt exceeding their market caps by more than 100%. Debt to Market Cap is a simple ratio that shows how much more debt the company has compared to its market value. As you will notice, the “hot red” color is intended to act as a signal to stay away from these companies.

For example, California Resources has $5.268 Billion in debt. Its market capitalization is just over $400 Million. The debt was taken on expecting higher oil prices, not lower. If the company breaches any covenants, the debt holders will be first in line to get paid. The shareholders will be the last. Debt comes before equity. Please remember that when you are looking at speculating in any company.

Extend and Pretend

In the oil patch, there is a saying, “Extend & Pretend.” This means oil companies and their bankers know that debt covenants will be breached and the debt will be in violation of the original agreements.

But in almost all cases, the debt holders don’t want to take over an asset in a bad oil price environment. Hence, the company will have some room to negotiate, “roll over” the loan, extend the debt, and pretend everything is OK. The corporate managers keep their lofty salaries and bonus packages. The bankers collect more fees. The debt holders keep getting paid. The shareholders lose.

All is not Lost

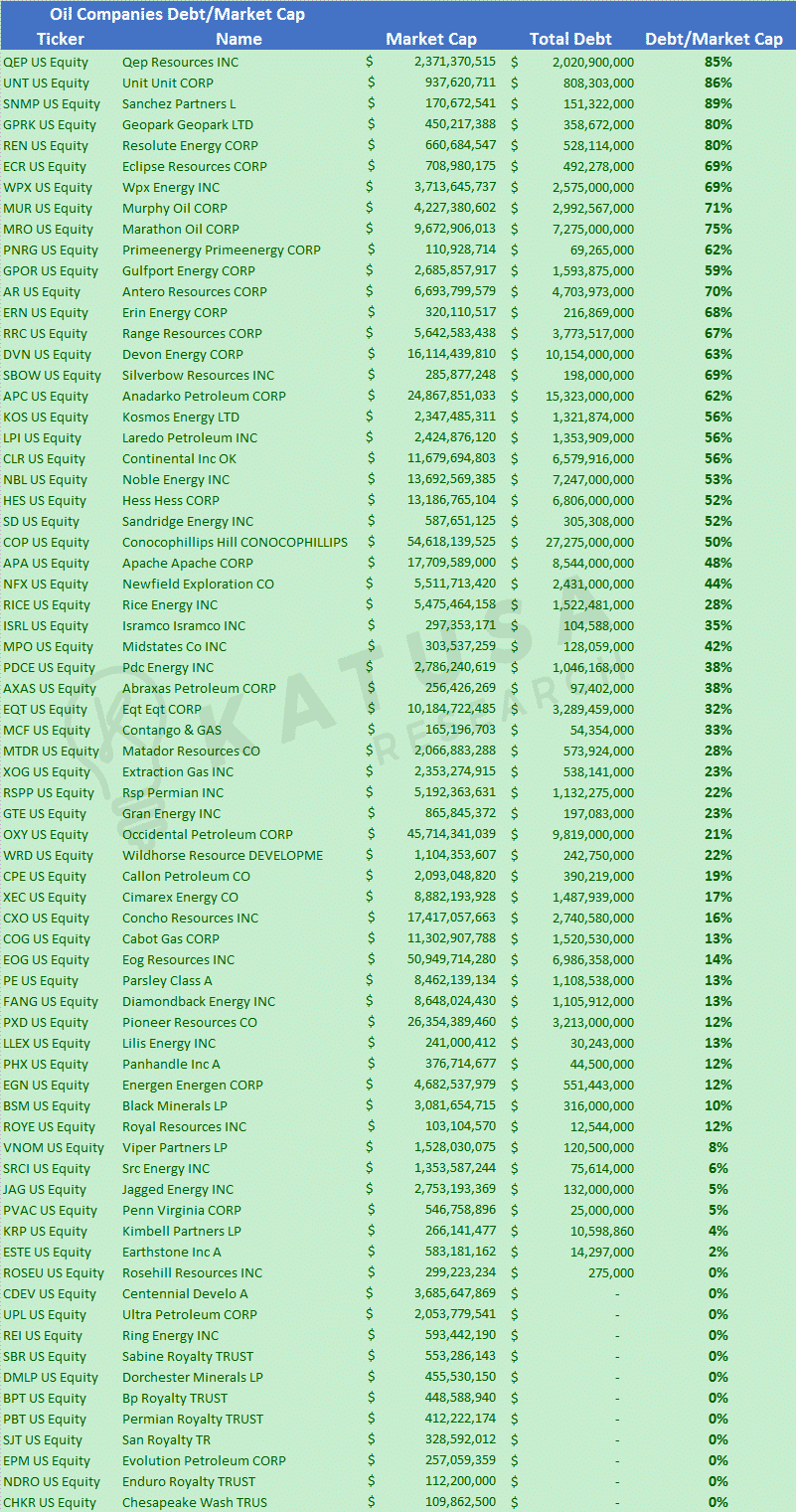

The below table shows the exact same thing, but of companies with below 100% Debt to Market Cap ratios. Does this mean the companies below are safe? No. But what it does mean is the management teams of the companies below have much better discipline than the managers of the companies in the list above.

One important key to being a good oil analyst is not to waste your time, especially on companies with bad financials and debt happy management teams.

Debt happy is a term that I use for management teams that believe debt is a great way to grow. It usually isn’t in the resource sector, especially when a company takes on too much debt and the price of oil turns negative after the debt is taken on.

There is over $200 Billion in debt outstanding right now in the U.S. oil patch.