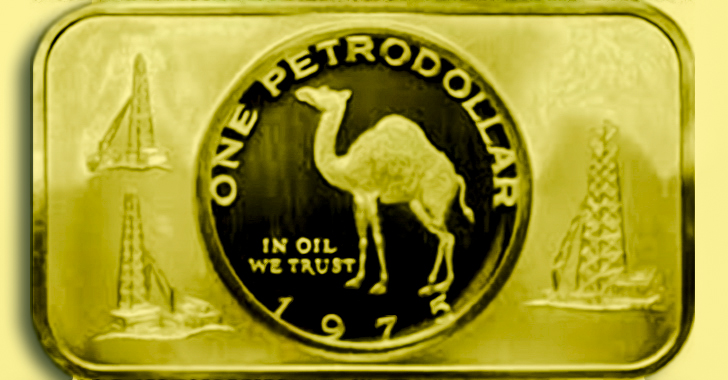

Russia and China Declare All Out War on US Petrodollar — Prepare for Exclusive Trade in Gold

The formation of a BRICS gold marketplace, which could bypass the U.S. Petrodollar in bilateral trade, continues to take shape as Russia’s largest bank, state-owned Sberbank, announced this week that its Swiss subsidiary had begun trading in gold on the Shanghai Gold Exchange.

Russian officials have repeatedly signaled that they plan to conduct transactions with China using gold as a means of marginalizing the power of the dollar in bilateral trade between the geopolitically powerful nations. This latest movement is quite simply the manifestation of a larger geopolitical game afoot between great powers.

According to a report published by Reuters:

Sberbank was granted international membership of the Shanghai exchange in September last year and in July completed a pilot transaction with 200 kg of gold kilobars sold to local financial institutions, the bank said.

Sberbank plans to expand its presence on the Chinese precious metals market and anticipates total delivery of 5-6 tonnes of gold to China in the remaining months of 2017.

Gold bars will be delivered directly to the official importers in China as well as through the exchange, Sberbank said.

Russia’s second-largest bank VTB is also a member of the Shanghai Gold Exchange.

To be clear, there is a revolutionary transformation of the entire global monetary system currently underway, being driven by an almost perfect storm. The implications of this transformation are extremely profound for U.S. policy in the Middle East, which for nearly the past half century has been underpinned by its strategic relationship with Saudi Arabia.

THE RISE & FALL OF THE PETRODOLLAR

The dollar was established as the global reserve currency in 1944 with the Bretton Woods agreement, commonly referred to as the gold standard. The U.S. leveraged itself into this power position by holding the largest reserve of gold in the world. The dollar was pegged at $35 an ounce — and freely exchangeable into gold.

By the 1960s, a surplus of U.S. dollars caused by foreign aid, military spending, and foreign investment threatened this system, as the U.S. did not have enough gold to cover the volume of dollars in worldwide circulation at the rate of $35 per ounce; as a result, the dollar was overvalued.