The Truth About Bundesbank Repatriation of Gold From U.S.

– Bundesbank has completed a transfer of gold worth €24B from France and U.S.

– Germany has completed domestic gold storage plan 3 years ahead of schedule

– In the €7.7 million plan, 54,000 gold bars were shipped and audited

– In 2012 German court called for inspection of Germany’s foreign gold holdings

– Decision to repatriate from Paris and New York was ‘to build trust and confidence domestically’

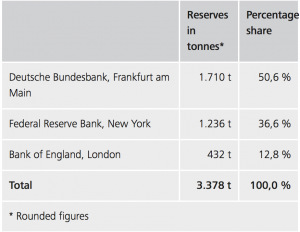

– 1,236t or 37% of German holdings remain in New York Fed facility

– Bundesbank wants to hold gold bullion

– U.S. government declines to audit gold reserves … doesn’t want world to realise gold’s importance in the global monetary system

Editor: Mark O’Byrne

Last Monday, U.S. Treasury Secretary Mnuchin feigned to inspect the U.S. gold reserves in Fort Knox and joked flippantly that he assumed it was there.

A day later the Bundesbank, announced that they had repatriated much of their gold reserves from the U.S. and France. Coincidence or coordination?

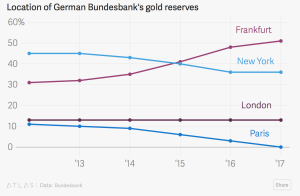

In 2013 the Deutsche Bundesbank announced plans to store half of its gold reserves in Germany. At the time, only 31% was stored in the country. The Gold Storage Plan involved bringing gold home from both Paris and New York.

The plan was expected to take seven years. At the time many asked why it would take so long to return just 674t of gold. The Bundesbank has completed the plan three years ahead of schedule.

The German gold repatriation was in response to the critics and or in order to safeguard the German gold reserves and ensure they are owned in a safe, allocated and segregated manner by the Bundesbank.

In the last five years the German central bank has 374t and 300t from Paris and New York, respectively. The Bundesbank opted to keep 432t in the Bank of England vaults.

Whilst the tables above (from the Bundesbank) show the repatriation of gold was ultimately successful, it has promoted much discussion about the security of gold in central banks.

The decision to move the gold back to home soil has also vindicated many who have long argued about the murky gold reserve dealings of the United States.

Click here to read full story on GoldCore.com

Important Guides

For your perusal, below are our most popular guides in 2017:

Essential Guide To Storing Gold In Switzerland

Essential Guide To Storing Gold In Singapore

Essential Guide to Tax Free Gold Sovereigns (UK)

Please share our research with family, friends and colleagues who you think would benefit from being informed by it.