Gold Reset To $10,000/oz Coming “By January 1, 2018” – Rickards

– Trump could be planning a radical “reboot” of the U.S. dollar

– Currency reboot will see leading nations devalue their currencies against gold

– New gold price would be nearly 8 times higher at $10,000/oz

– Price based on mass exit of foreign governments and investors from the US Dollar

– US total debt now over $80 Trillion – $20T national debt and $60T consumer debt

– Monetary reboot or currency devaluation seen frequently – even modern history

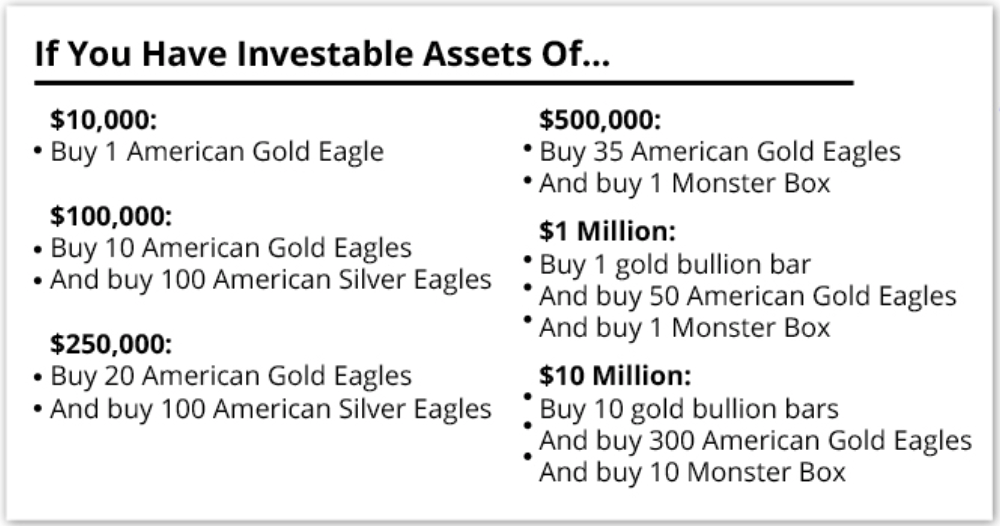

– Buy gold eagles, silver eagles including monster boxes and gold bars

– Have a 10% allocation to gold, smaller allocation to silver

Editor: Mark O’Byrne

A new monetary standard which will see the dollar “reboot” and gold be revalued to $10,000/oz according to best-selling author and Pentagon insider Jim Rickards.

A monetary ‘reboot’ is not unprecedented

Articles about an imminent return to the gold standard are not exactly infrequent in the gold world and it can be easy to become immune to them and dismiss them without considering the facts and case being made.

Many of the articles are not just based one ever-wishful daydreams. Much of it comes from information that is true about today and is then applied to situations that we have seen in the past.

Rickards makes this point himself. A monetary reset is not unheard of. Since the Genoa Accord in 1922 there have been a further eight reboots. The most recent was in 2016 in what Rickards refers to as the Shanghai Accord which purportedly saw deals done that would allow China to ease without leading to a sharp correction in the US stock market.

Rickards isn’t the only one who is speculating that there could be some big monetary changes on the horizon. In March intelligence service Stratfor wrote:

Trump may consider unilateral or, failing that, multilateral currency interventions to bring it back down…Negotiating a new coordinated monetary intervention

Click here to continue reading……