America’s Secret Weapon In The Oil War

This report is a PAID ADVERTISEMENT from Oilprice.com

As Saudi Arabia spins from crisis to crisis, U.S. oil hasn’t missed a beat. It’s stronger and more resilient than ever–and it has nothing to do with OPEC oil production cuts.

In this war, U.S. oil wins, and the recent purge of billionaire princes in Saudi Arabia is icing on the cake.

But when Saudi Crown Prince Mohammad bin Salman arrested key members of the royal family on corruption charges two weeks ago all of them his rivals–oil shot up. West Texas Intermediate (WTI) spiked more than $2 a barrel, closing around $57 a barrel—a nearly two-year high.

OPEC cuts have done little to boost oil prices, and Royal Family arrests are welcome news for oil tycoons the world over, but it’s still not what’s kept the U.S. on the winning side in this war: Fracking bust the U.S. through the front line, and major advancements in enhanced oil recovery (EOR) are cementing the victory.

This is a sophisticated technology story, and one little-known company might just tell it best because it’s sitting on the first-ever technology which has the ability to produce oil from massively untapped U.S. oil sands plays, with price targets for production at around $22 a barrel.

The company is Petroteq Energy Inc. (TSX:PQE.V; OTCQX:PQEFF), and it’s all about American oil for America. But it’s not just about market-defying prices … It’s about a tech breakthrough that renders dirty oil sands production process clean—for the first time.

And Petroteq isn’t aiming just to be producing cheaper oil—it intends to license its advanced technology globally, targeting not only the 1 trillion-plus barrels of oil in sands in Utah, Colorado and Wyoming, but the tens of trillions everywhere around the world.

Now, with oil prices rising and predictions of future upwards movement, new tech winning the war for North America, and Blockchain potentially transforming every industry on the planet, here are 5 reasons to watch Petroteq (TSX:PQE.V; OTCQX:PQEFF) very closely:

1) 87 Million Barrels of Oil Equivalent

The State of Utah is home to more than half of all U.S. oil sands deposits, and the Unitah region has been producing oil since the 1950s. It’s got more than 32 billion barrels of oil sands waiting to be extracted from 8 major deposits. It’s also got fantastic infrastructure, with 5 major refiners with truck routes to Salt Lake City, and a royalties set-up that makes great sense for operators.

And it’s right here—in Asphalt Ridge—that Petroteq has 87 million barrels of oil equivalent.

Even better, this is heavy oil-producing oil sands that can be accessed directly from the surface, so there’s no risk of running into a ‘dry well’.

Better still, costs to produce expected to come in at only $22 a barrel.

With one plant, Petroteq says it’s potential is $10 million a year in profit with $20-$30 per barrel production costs at today’s oil prices.

They acquired Asphalt Ridge for $10 million, and they’ve already proved that they can extract the oil from the sands and the shale. Permits to produce are already in place, and 10,000 barrels were produced in 2015.

Now the modular plant has been moved even closer to oil resources and is being reassembled. New production is scheduled to launch in early 2018, and the goal is 5,000 bpd in 2019 at a cost of production of as low as $18 per barrel. And there’s potential, says Petroteq, to achieve 30,000 bopd with proven reserves.

Demand is expected to be voracious with oil that comes in at a $20 discount to WTI. And that’s just the oil from a single plant: This story gets much bigger if you read on…

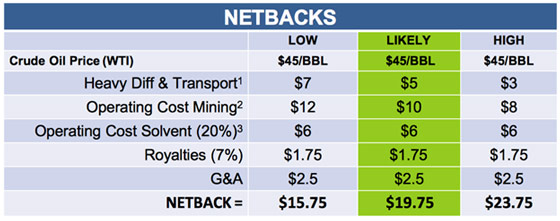

The projected netbacks are impressive…

So, while oil sands in Canada are prohibitively expensive to produce in today’s oil-price environment, Petroteq has found a way to produce in Utah for a targeted $22 per barrel.

And it’s doing it in a clean, safe and efficient way with proprietary technology …

2) War-winning Proprietary EOR Tech

Winning the oil war against OPEC, and helping the U.S. to become energy independent is all about technology. And U.S. national interest right now is all about increasing domestic energy sources. This means that technological advances such as Petroteq’s (TSX:PQE.V; OTCQX:PQEFF) proprietary Liquid Extraction System will become a key focus for developing U.S. oil sands deposits—and not just in Utah.

Petroteq’s already has a significant claim to fame: Its patented oil extraction technology is the first ever to generate sales from Utah’s massive heavy oil resource.

Existing oil sands extraction technologies use tons of water and leave toxic trailing ponds. Petroteq’s system produces oil and leaves behind nothing but clean, dry sand that can be resold as fracking sand or construction sand or simply returned to Mother Nature.

In tests to date, it extracts over 99% of all hydrocarbons in the sand, generates zero greenhouse gases and doesn’t require high temperatures or pressures.

For Utah’s 32 billion barrels this tech is the Holy Grail.

This is how it works:

The end result? The extracted crude oil is free of sand and solvents and then pumped out of the system into a storage tank.

The only other place that has oil sands tech is Canada, and it doesn’t compete. It’s designed for wet oil sands and Petroteq is after the dry oil sands bonanza.

“The wet tech kills the environment,” says Petroteq Chairman and CEO Aleksandr Blyumkin, “but we use green additives that allows the sand to be removed in a very clean manner. No other company has what we have in this space.”

Technology like Petroteq’s can help make American oil for Americans at a time when energy dependence is as important to the national interest as security and diplomacy.

Utah, Colorado and Wyoming represent over 1.2 trillion barrels of oil equivalent in oils sands and shale, and Petroteq is uniquely positioned to use its proprietary tech to tap into this resource and contribute to the U.S. energy independence equation in a significant way.

3) 3 Major Upside Factors That Will Surprise You

Oil sands has long been sidelined because it’s dirty. So, proprietary technology that can extract oil sands without leaving behind toxic trailing ponds is highly sought after.

This is far from a simple story about another small-cap oil producer. Petroteq’s technology could generate millions in licensing fees around the world, and it is eyeing the opportunity to file patents in all countries with oil sands reserves.

This technology is aimed to be deployed to cleanly unlock oil resources representing hundreds of millions of barrels of oil around the world. LIcensing is a revenue stream that can flow to Petroteq (TSX:PQE.V; OTCQX:PQEFF) with no associated capital expenditure.

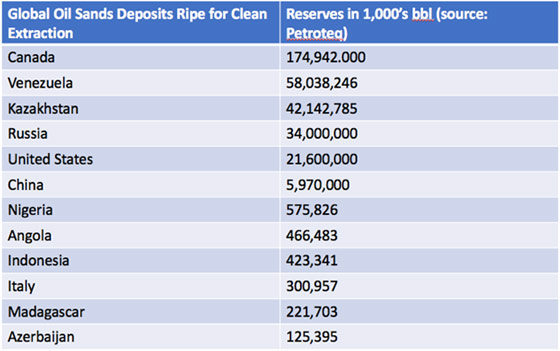

Worldwide, the licensing opportunities are vast, with over 12 countries home to major oil sands deposits.

Fortunes can be built on licensing fees, and Petroteq could have this segment cornered.

There’s even more upside beyond global licensing: Petroteq’s technology can be used for remediation, cleaning the tailing ponds created by traditional extraction methods for oil sands.

And the third area of upside is the most surprising because it brings Petroteq into one of the hottest sectors in centuries: blockchain technology, the backbone of cryptocurrency.

Even supermajors BP, Shell and Statoil are getting into blockchain because it’s what computers were three decades ago and it could make oil and gas trading a lot easier. Their goal? To create a secure, real-time blockchain-based digital platform for physical energy transactions from start to finish. No more paper contracts, automatic authentication and verification, and – the death of the middle man. It promises to reduce costs for the industry, vastly improve the quality of data and bolster security—all the while, speeding things up exponentially.

Every single industry the world over will likely switch to blockchain because it’s efficient; it’s transparent; and it creates savings.

Petroteq is in the process of signing an agreement with First Bitcoin Capital, which specializes in crypto currency and blockchain development. The visionary small-cap will be licensing the blockchain built by IBM and will use this to make it industry-specific, giving the entire spectrum of oil—from upstream to downstream—access to massive data.

Once the product is finished in about six months, the intention is that there will be a free open source blockchain for massive oil data, including everything from how much oil someone bought to how much they paid and how long it took to deliver, where it was drilled, how it was refined—absolutely everything.

This is where the Internet of Things (IoT) becomes the Energy of Things. The trading houses will hate it, but no one owns blockchain, and Petroteq sees the opportunity to make massive data work for the entire industry.

Petroteq’s masterminds have already been busy courting major energy players on multiple continents to get involved.

Bitcoin might be worth over $7,000 per coin, but the real cryptocurrency is data—and this could be a gold mine for the energy industry.

4) Skin in the Game Expert Management Team

This management team is savvy and forward-thinking. That’s why it sees the opportunity not only in producing the first clean oil sands, but also in licensing its proprietary tech worldwide, and embracing the even bigger picture—blockchain.

Petroteq (TSX:PQE.V; OTCQX:PQEFF) is hoping to position itself as a sort of “Google” of the energy industry, with its no-holds-barred focus on technology. They aren’t looking 10 years into the future, they are looking into right now.

This is where some of the brightest minds in extraction tech, chemistry, and blockchain come together to form a dream team with extraordinary vision.

The Chairman and CEO of Petroteq, Aleksandr Blyumkin, has championed this Company and technology with millions of dollars, including an interest-free loan to expand the production capability at its Temple Mountain facility in Utah.

Founder and CTO Dr. Vladimir Podlipskiy is a 23-year veteran in chemistry, R&D and manufacturing, and a chemical scientist from UCLA. He’s the oil extraction tech genius with a line-up of patents for everything from oil extraction and mold remediation to fuel reformulators.

President Dr. R. Gerald Bailey is a former Exxon president of Arabian Gulf operations, Dr. R Gerald Bailey. He believes in the technology and the company’s ability to not only turn a profit, but protect the environment while doing so. He’s got more than 50 years of international experience at all spots along the oil and gas chain behind him, including as operations manager of Qatar General Petroleum Corp., Exxon Lago Oil in Aruba and Esso Standard Libya.

Chief Geologist Donald Clark, PhD, a widely published geologist and consultant, is the blockchain tech genius in this group, responsible for providing input to financial models, analyzing commodity price fluctuations and handling operational and transportation costs of oil and natural gas.

And the team supporting them will be working towards licensing-Petroteq’s technology in as many countries as they can.

By February 2018, when production is expected to resume from the relocation of their modular facility, Petroteq may be in the spotlight for many investors.

And in the meantime, heavy oil demand looks promising, oil prices are for the first time in years on a trending upswing and blockchain, well, that’s simply changing the way business is done.

5) Prices on the Rise, Heavy Oil Demand Shifting Up

Now could be a good time to get back into oil because they’re calling the bottom and the market is in an upswing.

And prices could be kept higher by military action in the Middle East, the Kurdish independence drive and the specter of more U.S. sanctions on Iran, says Barrons. And Goldman Sach’s says near-term sentiment should remain bullish.

It’s a good time for heavy oil, too. Billions of dollars will be deployed to rebuild U.S. infrastructure and it requires exactly the kind of heavy oil that Petroteq (TSX:PQE.V; OTCQX:PQEFF) is scheduled to start producing again in February, 2018.

U.S. production growth has focused on light oil, and heavy oil is in strong demand, particularly on the Gulf Coast, where the billions of dollars put into heavy oil refineries means it needs a lot of oil to feed them.

Heavy oil traditionally trades at a discount, but as demand rises, the discount is disappearing.

This is a story of extracting $22 oil… in a $55-barrel world. Or, maybe even a $70-barrel world by next year.

This company breaks down everything and makes a much bigger picture out of the smaller pieces.

- Its technology breaks down oil sand extraction in a clean, low-cost, efficient closed-loop process.

- The clean sand has an upside of potential re-sale for fracking or construction.

- The proprietary tech itself can be used for cleaning up other oil sands messes around the world.

- And it will be licensed globally for major revenue potential from the Americas to Africa, and everywhere in between.

- It could all come together with the energy blockchain, harnessing the power of massive, transparent data for every stop in the oil and gas chain.

While Saudi billionaires are languishing in prison, Petroteq’s (TSX:PQE.V; OTCQX:PQEFF) innovative dream team is taking the re-emerging oil bull market by the horns, and riding the biggest digital wave of our time—blockchain. This is where energy and technology come together definitively, and one they piece it all together, it could be a very large force in a small-cap world.

By. Ian Jenkins

**IMPORTANT! BY READING OUR CONTENT YOU EXPLICITLY AGREE TO THE FOLLOWING. PLEASE READ CAREFULLY**Forward-Looking Statements

This news release contains forward-looking information which is subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ from those projected in the forward-looking statements. Forward looking statements in this release include that PETROTEQ will be able to produce oil as currently scheduled and at the targeted low prices from its Utah property; that oil at cheaper prices will be as much in demand in future as currently expected; that PETROTEQ will obtain operating permits on its properties; that the oil when produced by PETROTEQ will be high quality suitable for standard use; that PETROTEQ’s technology is protected by patents and that it doesn’t infringe on intellectual property rights of others; that PETROTEQ will find licensees for its technology and that it can patent its technology in many countries; that PETROTEQ’s technology will work as well as expected; that blockchain technology will help PETROTEQ achieve its goals; and that PETROTEQ will be able to carry out its business plans. These forward-looking statements are subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ materially from those projected in the forward-looking information. Risks that could change or prevent these statements from coming to fruition include that the Company’s patents and other technology protection are not valid, patents may not be granted in countries where PETROTEQ wants to license its technology; it may not get regulatory approval for its operations, aspects or all of the properties’ development may not be successful, production of oil may not be cost effective as expected, PETROTEQ may not raise sufficient funds to carry out its plans, changing costs for extraction and processing; increased capital costs; the timing and content of upcoming work programs; geological interpretations and technological results based on current data that may change with more detailed information or testing; potential process methods and mineral recoveries assumptions based on limited test work with further test work may not be viable; blockchain technology may not be developed to assist PETROTEQ achieve its goals; additional high value oil opportunities may not be available for PETROTEQ to acquire, or PETROTEQ may not be able to afford them; competitors may offer better technology; the availability of labour, equipment and markets for the products produced; and despite the current expected viability of its projects, that the oil cannot be economically produced on its properties, or that the required permits to build and operate the envisaged facilities cannot be obtained. Currently, PETROTEQ has no revenues. The forward-looking information contained herein is given as of the date hereof and the Company assumes no responsibility to update or revise such information to reflect new events or circumstances, except as required by law.

DISCLAIMERS PAID ADVERTISEMENT. This communication is a paid advertisement and is not a recommendation to buy or sell securities. Oilprice.com, Advanced Media Solutions Ltd, and their owners, managers, employees, and assigns (collectively “the Company”) has been paid by the profiled company or a third party to disseminate this communication. In this case the Company has been paid by PETROTEQ sixty two thousand five hundred US dollars for this article and certain banner ads. This compensation is a major conflict with our ability to be unbiased, more specifically:This communication is for entertainment purposes only. Never invest purely based on our communication. Gains mentioned in our newsletter and on our website may be based on end-of- day or intraday data. We have been compensated by PETROTEQ to conduct investor awareness advertising and marketing for TSXV:PQE and OTCQX:PQEFF. Therefore, this communication should be viewed as a commercial advertisement only. We have not investigated the background of the company. The third party, profiled company, or their affiliates may liquidate shares of the profiled company at or near the time you receive this communication, which has the potential to hurt share prices. Any non- compensated alerts are purely for the purpose of expanding our database for the benefit of our future financially compensated investor awareness efforts. Frequently companies profiled in our alerts experience a large increase in volume and share price during the course of investor awareness marketing, which often end as soon as the investor awareness marketing ceases. The investor awareness marketing may be as brief as one day, after which a large decrease in volume and share price is likely to occur.We do not guarantee the timeliness, accuracy, or completeness of the information on our site or in our newsletters. The information in our communications and on our website is believed to be accurate and correct, but has not been independently verified and is not guaranteed to be correct. The information is collected from public sources, such as the profiled company’s website and press releases, but is not researched or verified in any way whatsoever to ensure the publicly available information is correct. Furthermore, it is certainly possible for errors or omissions to take place regarding the profiled company, in communications, writing and/or editing.

DISCLOSURE. The Company does not make any guarantee or warranty about what is advertised above. This article and the information herein are provided without warranty or liability.

NOT AN INVESTMENT ADVISOR. The Company is not registered or licensed by any governing body in any jurisdiction to give investing advice or provide investment recommendation. ALWAYS DO YOUR OWN RESEARCH and consult with a licensed investment professional before making an investment. This communication should not be used as a basis for making any investment.

INDEMNIFICATION/RELEASE OF LIABILITY. By reading this communication, you agree to the terms of this disclaimer, including, but not limited to: releasing The Company, its affiliates, assigns and successors from any and all liability, damages, and injury from the information contained in this communication. You further warrant that you are solely responsible for any financial outcome that may come from your investment decisions.

RISK OF INVESTING. Investing is inherently risky. While a potential for rewards exists, by investing, you are putting yourself at risk. You must be aware of the risks and be willing to accept them in order to invest in any type of security. Don’t trade with money you can’t afford to lose. This is neither a solicitation nor an offer to Buy/Sell securities. No representation is being made that any account will or is likely to achieve profits or losses similar to those discussed on this web site. The past performance of any trading system or methodology is not necessarily indicative of future results

All trades, patterns, charts, systems, etc., discussed in this message and the product materials are for illustrative purposes only and not to be construed as specific advisory recommendations. All ideas and material presented are entirely those of the author and do not necessarily reflect those of the publisher.

TERMS OF USE. By reading this communication you agree that you have reviewed and fully agree to the Terms of Use found here http://oilprice.com/terms-and-conditions If you do not agree to the Terms of Use http://oilprice.com/terms-and-conditions, please contact Oilprice.com to discontinue receiving future communications.

TheDailySheeple Legal Notice: The content in this article is provided by TheDailySheeple.com as general information only. The ideas expressed herein are solely the opinions of the author(s) and do not necessarily represent the opinions of sponsors or firms affiliated with the author(s). Members of the TheDailySheeple.com staff and/or owners of TheDailySheeple.com currently own no shares in the company mentioned. We will not purchase shares in the next 30 days. TheDailySheeple.com has been compensated for a two week marketing campaign. We were paid directly by OilPrice.com, a third party media company. Any action taken as a result of information, analysis, or advertisement on this site is ultimately the responsibility of the reader. The information herein is not intended to be personal legal or investment advice and may not be appropriate or applicable for all readers. If personal advice is needed, the services of a qualified legal, investment or tax professional should be sought. Never base any decision on a single email. The companies mentioned in this post are intended to be a stock ideas, NOT recommendations. The ideas we present are high risk and you can lose your entire investment. We are not stock pickers, market timers, investment advisers, and you should not base any investment decision on our website, emails, videos, or other published material. Please do your own research before investing. It is crucial that you at least look at current SEC filings and read the latest press releases. Information contained in this profile was extracted from current documents filed with the SEC, the company web site and other publicly available sources deemed reliable. Our report is not intended to be, nor should it be construed as an offer to buy or sell, or a solicitation of an offer to buy or sell securities, or as a recommendation to purchase anything. This publication may provide the addresses or contain hyperlinks to websites; we disclaim any responsibility for the content of any such other websites.

Delivered by The Daily Sheeple

We encourage you to share and republish our reports, analyses, breaking news and videos (Click for details).

Contributed by Ian Jenkins of OilPrice.com.