the VAT rate, rationalizing tax concessions and exemptions, and accelerating the implementation of new excises on automobiles and petroleum products.

MARIT STINUS-CABUGON

TAXATION is a means for a nation to mobilize local resources to fund the programs and operations of its government. Too heavy reliance on foreign loans or other schemes with big foreign players could threaten long-term national interest. While we can always question the wisdom of the priorities of the government, the efficiency of project implementation and how the government conducts its business in general—are we getting value for our tax money?—substantial funds are obviously needed for even just the most basic of services such as education and health care, among others.

Manila Times

The Tax Reform for Acceleration and Inclusion (TRAIN) that took effect on January 1, is expected to raise an additional P90 billion for the government in 2018. This isn’t really that much when compared to the P3.8 trillion national budget for 2018 and the total revenue target of P2.8 trillion. But every peso counts.

On the downside of the new taxes is the fact that the increased excise taxes on fuel will have an inflationary effect on prices since fuel is used in production and transportation of goods. The full-year average inflation rate for 2017 was 3.2 percent, much higher than the 1.8 percent in 2016. This might not seem as much but for millions of Filipinos even the smallest increase in prices is felt. For them, every centavo counts. While 7.5 million individual income tax payers will enjoy lower tax rates—6.8 million taxpayers will be completely tax exempt—the very large group of Filipinos who earn their living in the informal economy will feel the impact of higher prices without the matching increase in take-home pay. For perspective, the Philippine Statistics Authority puts the total number of employed Filipinos at 41.5 million (PSA, October 2017).

WBANK http://www.worldbank.org/en/understanding-poverty

Fewer people live in extreme poverty than ever before. Even as the world’s population has grown, the number of poor has gradually fallen. LIE

In 1990, almost 4 in 10 people were living under the international extreme poverty line of $1.90 a day.In 2013, that figure had fallen to just over 1 in 10. But that still represents more than 767 million people. Poverty remains unacceptably high. IT WAS 1.00 IN 1990,

“Poverty headcount ratio among the population is measured based on national (i.e. country-specific) poverty lines. A country may have a unique national poverty line or separate poverty lines for rural and urban areas, or for different geographic areas to reflect differences in the cost of living or sometimes to reflect differences in diets and consumption baskets. Poverty estimates at national poverty lines are computed from household survey data collected from nationally representative samples of households.” NOT TRUE THEY ARE SET BY THE PPP ADJUSTED RATE OF THE 1990 ONE DOLLAR A DAY

USAID https://www.usaid.gov/frontiers/2014/publication/section-1-extreme-poverty-philippines

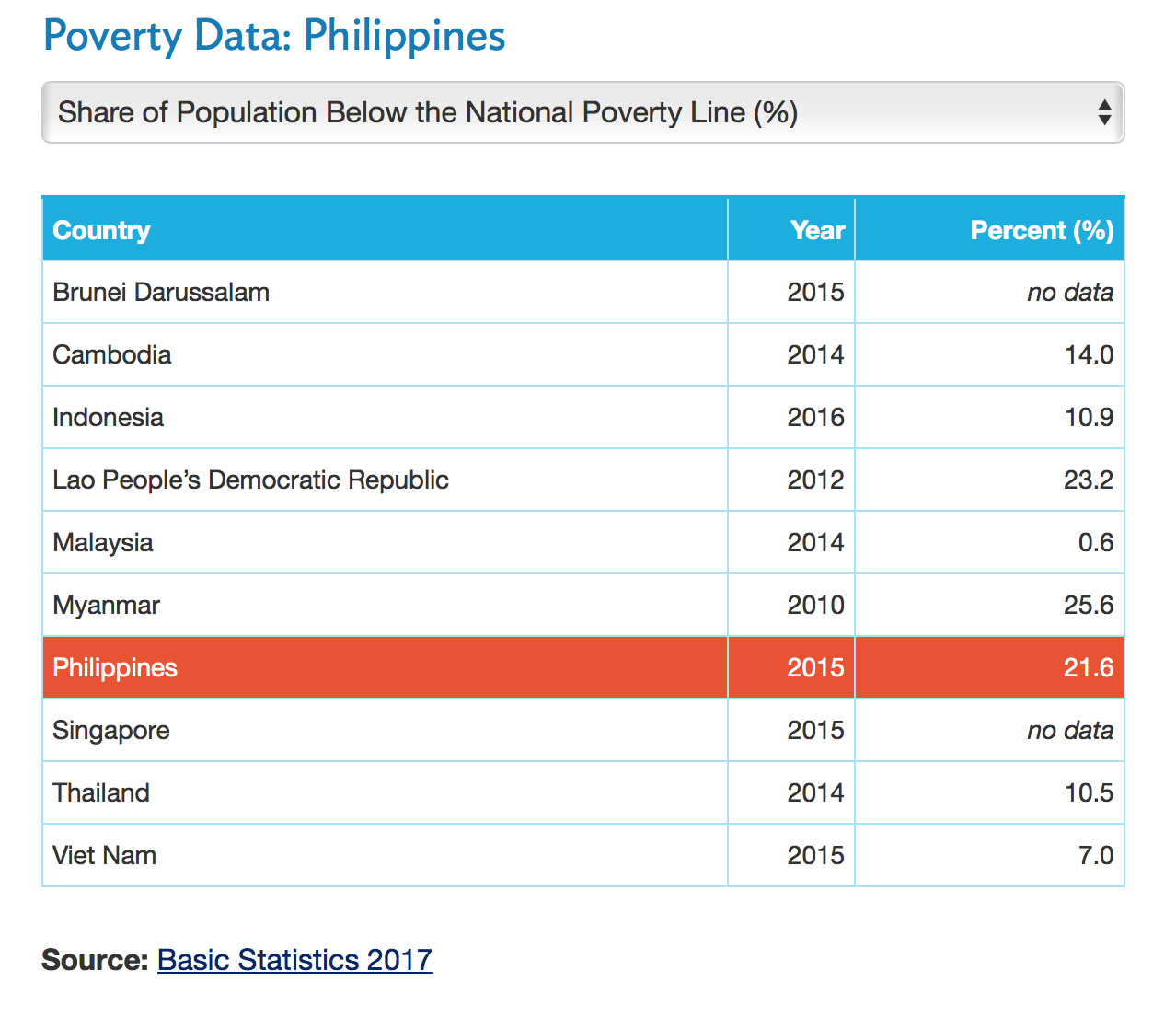

In 2012, extreme poverty in the Philippines was estimated at 19.2 percent of the population, or about 18.4 million people, based on the international poverty line of $1.25 per day. Most of the poor in the Philippines live in rural areas and work in the agriculture sector, mainly in farming and fishing. Urban poverty, however, has been increasing in recent years. Migrants without jobs or with low-paying jobs are unable to afford decent housing. As a result, Philippine cities have high proportions of informal settlers who are among the poorest of the poor.

Moreover, poverty is severe in parts of the country with high levels of conflict. The Philippines’ 10 poorest provinces are considered either conflict-affected or vulnerable to conflict.

https://psa.gov.ph/content/psa’s-2017-annual-poverty-indicators-survey-start-july-2017

https://psa.gov.ph/poverty-press-releases

https://psa.gov.ph/content/poverty-incidence-among-filipinos-registered-263-first-semester-2015-psa

The Philippine Statistics Authority (PSA) releases its latest report today on the country’s official poverty statistics for the first semester of 2015. The PSA report provides the estimates of poverty incidence using income data from the first visit of the Family Income and Expenditure Survey (FIES) conducted in July 2015.

Poverty incidence among Filipinos1 in the first semester of 2015 was estimated at 26.3 percent. During the same period in 2012, poverty incidence among Filipinos was recorded at 27.9 percent 2.

On the other hand, subsistence incidence among Filipinos, or the proportion of Filipinos whose incomes fall below the food threshold, was estimated at 12.1 percent in the first semester of 2015. In the first half of 2012, the subsistence incidence among Filipinos is at 13.4 percent 3. Subsistence incidence among Filipinos is often referred to as the proportion of Filipinos in extreme or subsistence poverty.

Food and Poverty Thresholds

Food threshold is the minimum income required to meet basic food needs and satisfy the nutritional requirements set by the Food and Nutrition Research Institute (FNRI) to ensure that one remains economically and socially productive. It is used to measure extreme or subsistence poverty. Poverty threshold is a similar concept, expanded to include basic non-food needs such as clothing, housing, transportation, health, and education expenses.

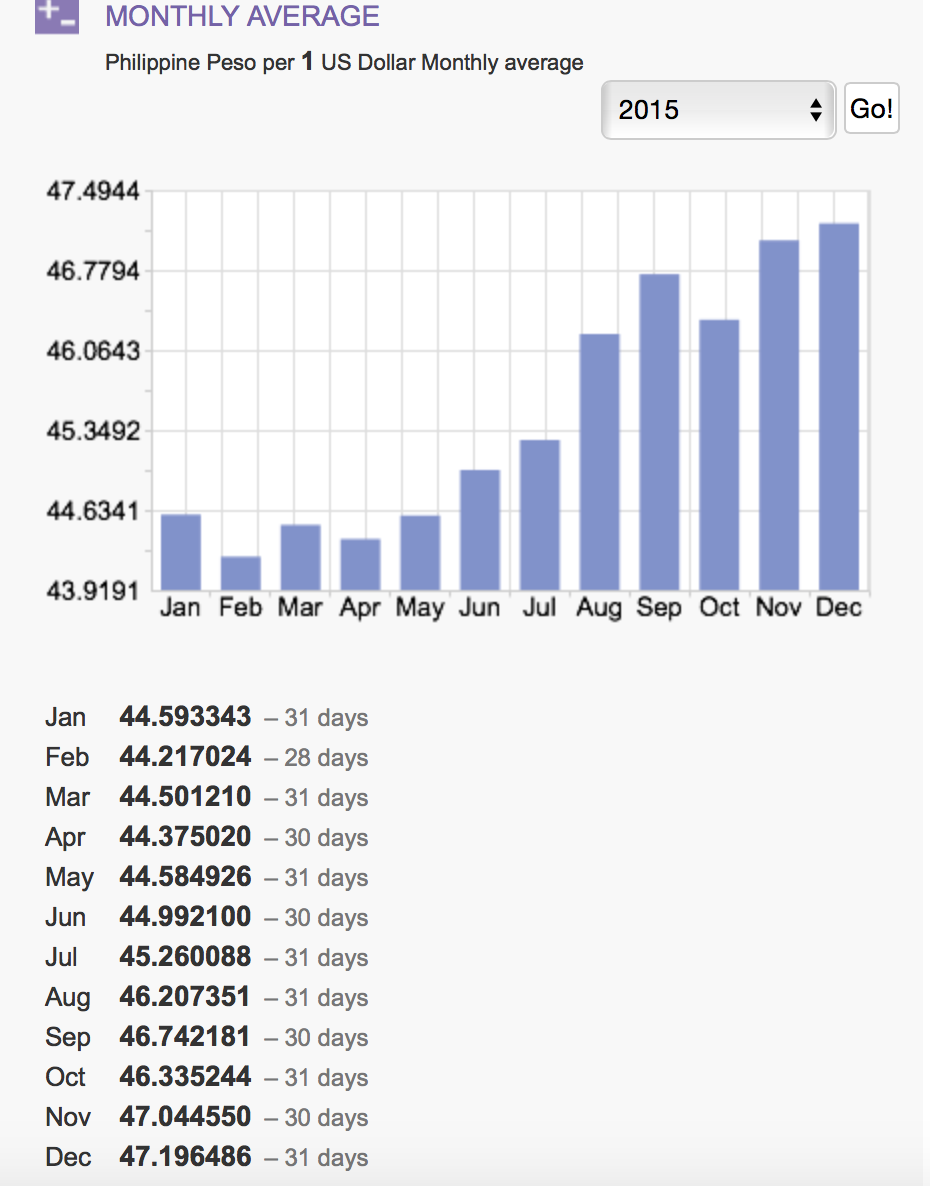

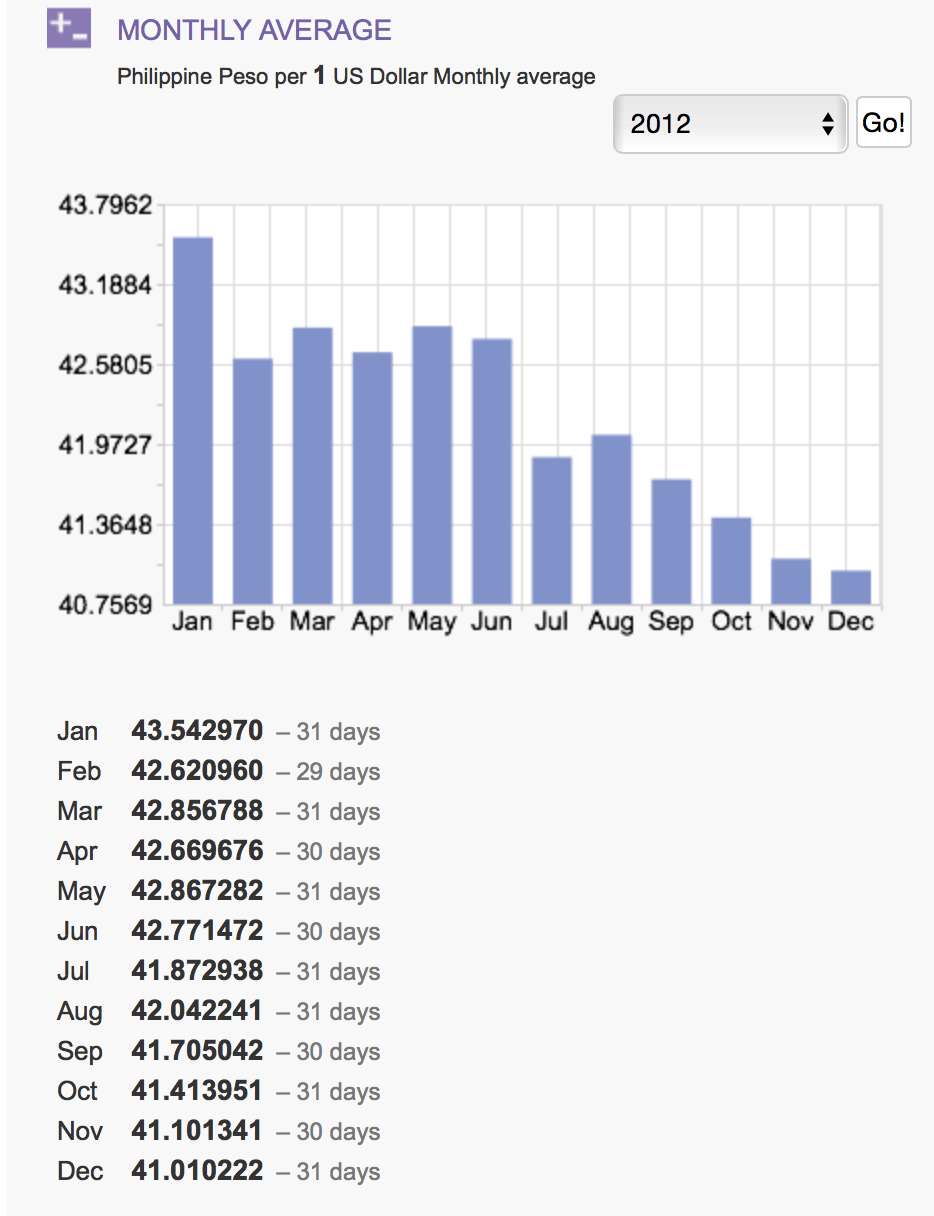

During the first semester of 2015, a family of five needed at least PhP 6,365 on the average every month to meet the family’s basic food needs and at least PhP 9,140 on the average every month to meet both basic food and non-food needs. These amounts represent the monthly food threshold and monthly poverty threshold, respectively. They indicate increases of about 17 percent in food threshold and poverty thresholds from the first semester of 2012 to the first semester of 2015 4.

Poverty among Filipino families

PSA also releases statistics on poverty among families – a crucial social indicator that guides policy makers in their efforts to alleviate poverty.

The poverty incidence among Filipino families based on the first visit of 2015 FIES was estimated at 21.1 percent during the first semester of 2015. In the first semester of 2012, the poverty incidence among Filipino families was estimated at 22.3 percent 5.

The subsistence incidence among Filipino families, or the proportion of Filipino families in extreme poverty, was estimated at 9.2 percent during the first semester of 2015. In the same period in 2012, the proportion of families in extreme poverty was recorded at 10.0 percent 6.

In addition to the thresholds and incidences, the PSA also releases other poverty-related statistics in the report such as the income gap, poverty gap and severity of poverty. The income gap measures the average income required by the poor in order to get out of poverty, expressed relative to the poverty threshold. The poverty gap refers to the income shortfall (expressed in proportion to the poverty threshold) of families with income below the poverty threshold, divided by the total number of families. The severity of poverty is the total of the squared income shortfall (expressed in proportion to the poverty threshold) of families with income below the poverty threshold, divided by the total number of families. This is a poverty measure that is sensitive to income distribution among the poor.

In the first semester of 2015, on the average, incomes of poor families were short by 29.0 percent of the poverty threshold. This means that on the average, an additional monthly income of Php 2,649 is needed by a poor family with five members in order to move out of poverty in the first semester of 2015.

https://en.wikipedia.org/wiki/Poverty_in_the_Philippines#Poverty_and_food_threshold