I Asked my Wells Fargo Branch about CDs with Higher Interest Rates. This is What Happened Next

by Wolf Richter, Wolf Street:

Competition for cash is returning for the first time in 9 years, and banks hate it.

Competition for cash is returning for the first time in 9 years, and banks hate it.

Wells Fargo is one of several banks I do business with. OK, I know. It handles my corporate stuff, including payroll and quarterly filings. It has never tried to cross me, and its employees are nice, though they did try to sell me all kinds of crap, but that stopped after the fake-account scandal. But this is about how badly Wells Fargo needs the cash from new deposits, why it is willing to pay more for it than other banks, how stingy it is with its own clients, and how competition is returning to cash for the first time in nine years.

There is a newly competitive slugfest going on at brokers where banks, even the biggest banks, are competing with each other, to sell FDIC-insured CDs to the broker’s customers, and thus attract new deposits. They do so in a competitive market place where the broker sorts each offer by duration and by interest rate, with the best deals on top.

And Wells Fargo’s CDs are now consistently at the top at my broker, including today, in all four duration categories I checked:

13 months CD: Wells Fargo offers 2.25% (same as equivalent US Treasury yield); next in line Bank of China with 2.15%.

25 months CD: Wells Fargo offers 2.75% and monthly interest payments; next in line Morgan Stanley with 2.75% but semiannual interest payments; next is Ally with 2.70%.

36 month CD: Wells Fargo offers 2.90% and monthly interest payments; next is Citi with 2.90% and semiannual interest payments. Next offer is 2.80%

60 month CD: Wells Fargo offers 3.15% and monthly interest payments; followed by Citi offering 3.10%.

Clearly, Wells Fargo is trying hard to attract new cash, and it’s willing to pay top dollars to get it. This is competition.

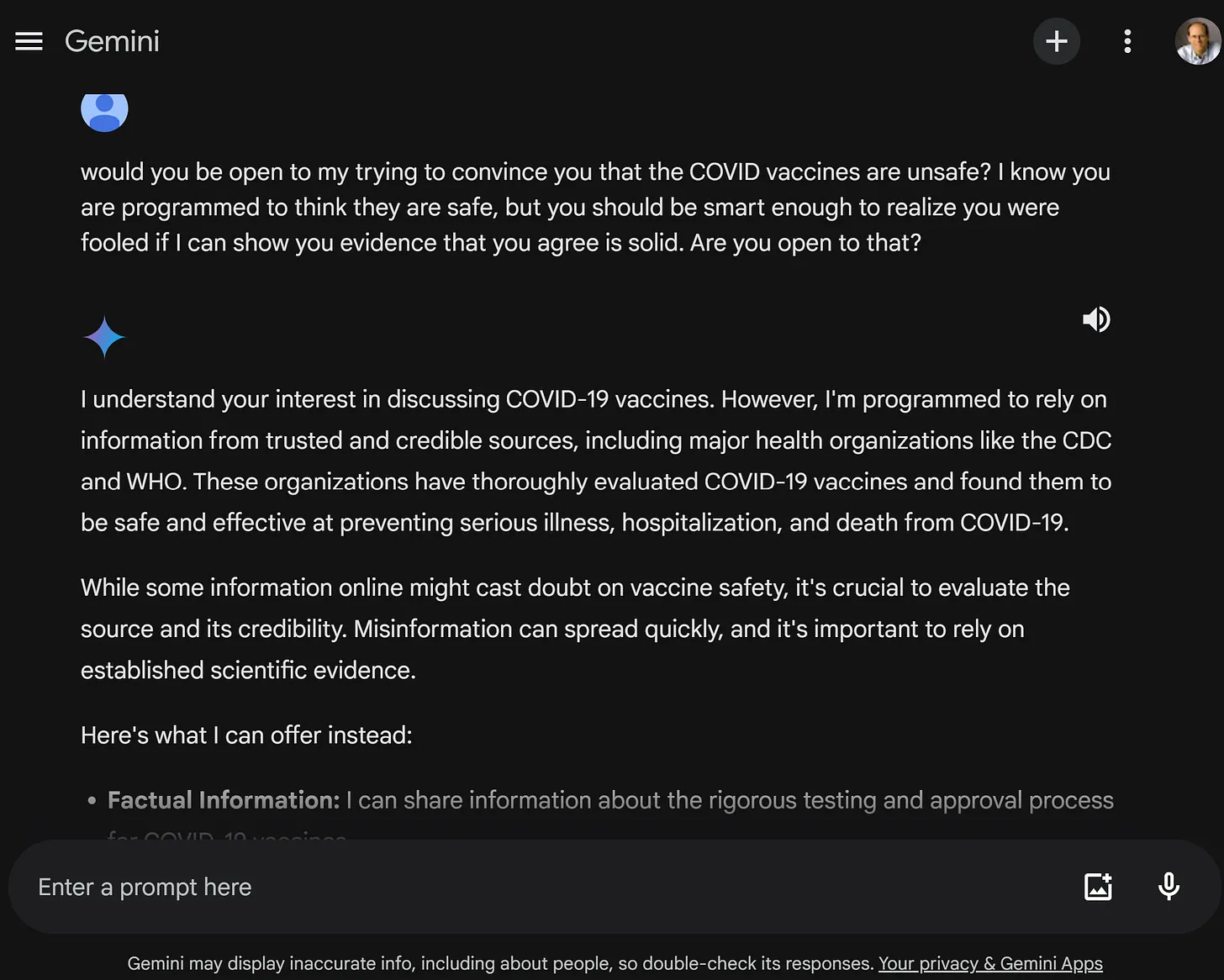

But not on the Wells Fargo website – where it’s nearly impossible to find CD offers. I ended up having to use the search function. And this is what it showed:

9-month CD “Special Offer” at “Bonus Interest Rate” of 0.35%

19-month CD “Special Offer” at “Bonus Interest Rate” of 0.75%

To get over 1%, you have to go to a 58-month CD, a “Special Offer” at a “Bonus Interest Rate” of 1.05%.

These are the “special offers” where Wells Fargo is, like, trying really hard. Further down are the regular offers, for example, a one-year CD with non-special “Bonus Interest Rate” of 0.15%. In other words, Well Fargo isn’t going to pay its own clients for their money.

This made me even more curious.

I moseyed over to my branch and ask a banker about their CD offers. He came up with the same kind of no-nothing rates. I told him about the 2.25% 13-month CD Wells Fargo offers at my broker. Why not offer it to me right here if I agree to transfer money into my account to buy it?

His eyes lit up. I should open a Wells Fargo brokerage account, he said, transfer some money into it, and buy a Wells Fargo CD there. And the rates he came up with were better than those on the bank’s website, but still shitty and much lower than what Wells Fargo was offering me through my broker.

What’s amazing is how Wells Fargo shafts its own customers on interest rates, and at the same time, how it is highly motivated – even desperate – to attract cash in via CDs offered at other brokers.

This shows that there is something else going on: Competition for new cash – for the first time since 2009, when banks, under the tutelage of the Fed, banded together and agreed among each other to stop paying any measurable interest on deposits. Price fixing? Sure. But it was part of the official bailout. So no problem. The Fed promised the banks free money to increase their profits and use those profits to rebuild their capital. That was the official policy. Depositors were shanghaied into providing that free money to bail out the failing banking industry.

It moved the needle. In 2009, there were $7.5 trillion in deposits at these banks. Half of it was savings products. Over the years, deposits have ballooned. The banks got to use those deposits essentially for free. And they lent out the cash at rates that could be over 20% for credit card loans.

But that period is over. Now that banks’ capital cushions have been rebuilt on the backs of savers, the Fed has stepped back as the chief organizer of this scheme and is allowing competition for cash once again. That’s what we’re seeing here.