Ron Paul: The Market Is Destined to Go Down – Perhaps As Much as 50% (Video)

by Peter Schiff, Schiff Gold:

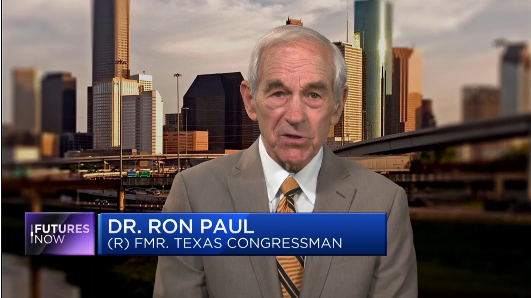

Ron Paul recently appeared on CNBC Futures Now and said the stock market is destined to go down – perhaps as much as 50%.

Ron Paul recently appeared on CNBC Futures Now and said the stock market is destined to go down – perhaps as much as 50%.

Why?

Because of the enormous amount of debt and monetary manipulation foisted upon the economy by the government and the Federal Reserve.

Paul started out the conversation talking about the US dollar. The greenback has undergone something of a revival in recent weeks, gaining strength against other currencies. Paul conceded that dollar may continue to go up over the short-term, but he doesn’t see that as the long-term trend.

I think long-term, the dollar is going to always be weaker. But it depends on what you measure it against. Because, you can measure it against the other currencies, and that’s important. You can measure it against gold. But it’s what you get for when you spend it. Prices are starting to go up now. The manufacturing index went up. So, prices are going up and people have thrown out the term stagflation. The economy is weakening and prices are still going up. I think we’re going to see a lot more of that.”

Most analysts focus on the strength of the dollar in relation to other world currencies. Paul said the best way to measure the dollar is against gold. When you do that, the fundamental problems in our economic system come into focus.

Long-term, of course, what I think measures the value of a currency is gold. You look at what has happened to gold since the Fed came into existence. It went from $20 up to $1,300. That means they’re printing too much money. So I think long-term, the fundamentals show that the spenders are in Washington. They’re alive and well. The deficit is skyrocketing like never before. I don’t know how you can keep monetizing that debt without the weakening of the dollar one way or another. And prices are going up, and eventually it will go up faster even than against the other currencies. But the dollar definitely will be weaker.”

The conversation then pivoted to the stock market. Stephanie Landsman asked the former Congressman what he thinks the stock market is going to do in the future.

I think the market is destined to go down.”

Paul said you can always find some economic or political event to blame a stock market drop on, but there is a more basic reason for his pessimism.

The fundamental reason is that we’ve had too much printing of money, especially since 1971, especially with the QE. So, everything is artificial. There are big bubbles … The real reason is overspending, debt, monetizing debt and most recently, the QEs that distorted things. So, there has to be adjustments. And that requires unwinding a lot of this.”