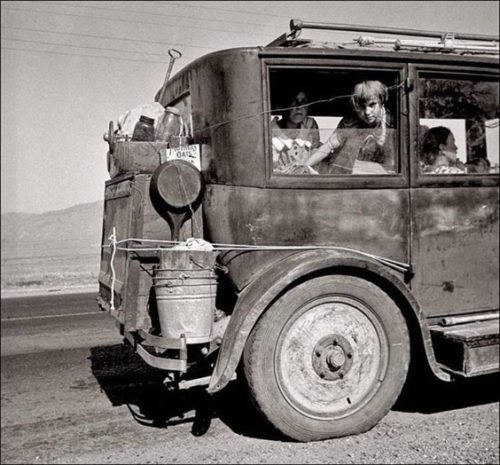

Death of the Great Recovery Part 2: The Second Coming of Carmageddon

by David Haggith, The Great Recession Blog:

Like the disintegration of the formerly charmed stock market, the return of Carmageddon is right on schedule. I had stated early last year that one of the first cracks in our economy to become evident would be the crash of the car industry.

Like the disintegration of the formerly charmed stock market, the return of Carmageddon is right on schedule. I had stated early last year that one of the first cracks in our economy to become evident would be the crash of the car industry.

That crack materialized as promised, but then Hurricanes Harvey and Irma showed up to flood a million automobiles. Before any statistics materialized to show the economic impacts of those storms, I wrote the following revision for the dates of Carmageddon:

There is nothing like a wartime economy to bring recovery from economic recession…. Wars (and hurricanes) create a flurry of economic activity, which may juice the economy … but you eventually have to pay for all of that so it doesn’t build wealth for a nation overall…. After Harvey, some articles I read stated that the auto industry, which was already starting down a major decline, would be harmed further. I thought that was ridiculous and that just the opposite is likely to be true. Sure, dealers are out of business for a few weeks as clean-up begins and until inventory gets replaced, so they are experiencing short-term losses right now; but most of their inventory was insured and will be replaced…. In a month or two, their businesses will boom as individuals who lost hundreds of thousands of cars seek to replace them. I am certain we will find that Harvey (and now Irma) actually did the declining auto industry a huge favor. By wiping out a million automobiles, these storms insure that a million more automobiles will be manufactured and sold. (“Hurricanes Harvey and Irma May Lend Helping Hand to Economy“)

And that’s what happened. The downhill auto market shot back up for a few months, causing those who think in shallow terms to proclaim, “Oh, the auto market has been saved!” But I didn’t. While things were picking up in auto sales and looking better, I wrote …

It was hurricanes to the rescue this year however, as Harvey and Irma wiped out something like a million automobiles. Those will for the most part be quickly replaced, effectively shifting the auto manufacturers’ problems for this year over to the insurance companies…. The hurricanes will not, however, solve any of the auto manufacturers’ troubles for next year. In fact, they likely make next year worse by moving purchases up. (“I Know What the Economy Did Last Summer Part 1 : Carmageddon and the Retail Apocalypse“)

And now here we are. Even though the auto industry got temporarily bailed out in 2017 by the collision of natural forces like hurricanes and wildfires, 2017 still ended as the first year of declining US auto sales since the Great Recession. My timeline for the fall of stocks and the resumption economic wreckage in the auto market was the start of this year. Now that first-quarter results are in, they show that is exactly what happened.

Ford’s new focus

While Ford Motor Company reported frontline news last week that earnings were up in the first quarter, that was entirely due to the tax savings it realized under the Trump Tax Plan. Earnings before interest and taxes were sharply down. In other words, Ford was saved from their poor performance by the new tax law, not by any expansion of its business.

And, as I said would be the case with those tax savings, none of it is going into capital improvements. Ford announced it is actually cutting its capital spending plans over the next few years by $5 billion. In typical euphemistic corporate style, Ford refers to these cuts as “efficiency gains.”

Whether the cuts are due to efficiency or not, one thing is clear: the tax savings are not going to capital improvements. Ford says the “efficient gains” will be attained by “moving capital” from areas of business that are declining toward more production in areas that are doing well. A little deeper in the report, we read their concession on how severe this retreat from failing areas of business really is (though, of course, they try to sprinkle it all with sugar):

Given declining consumer demand and product profitability, the company will not invest in next generations of traditional Ford sedans for North America. Over the next few years, the Ford car portfolio in North America will transition to two vehicles – the best-selling Mustang and the all-new Focus Active crossover coming out next year.

Wow! That’s huge … all in one sugar-coated bite. With as little commentary as possible, one of the big-three automakers has just announced it is practically going out of the car business! (While staying in the truck business.) It will no longer be developing new lines or cars or new generations of old lines, except for Mustangs and the Focus hybrid. Ford is essentially giving up on cars and going for the gold in the only area where it has remained profitable — trucks and SUVs — which it will begin converting to hybrid powertrains. (So, there is, at least some research and development that will continue within the final bastion of its profitability.) Thus, Ford will save $5 billion dollars through “efficiency” (cut $5 billion in capital spending) by ditching almost all development in new car production where its sales are dying and moving money spent in those departments to others. That is the new Ford focus. That is Ford efficiency.

And that’s how you parse a corporate report to take all the artificial gloss off of it. The death of Ford car production this year is practically just a footnote in the corporate report as Ford moves on to developing autonomous delivery vehicles and autonomous taxi services with its SUVs, vans and trucks. That’s the Ford of the future.

That may be good positioning with a future focus, but it is also Ford’s admission that its car sales are dead! The hundred-year manufacturer of touring cars and sedans is giving up on that market that it pioneered and doing so with as little eulogy as possible, while the profitability of its move toward autonomous vehicles and taxi services remains to be seen.

Bottom line: Ford stock is down 15% from its January peak and is approaching a five-year low of $10 per share. As for it’s real forward projections …

The company’s own CEO said that 2018 will be a “bad year.” Rising commodity prices and tariffs will take a toll on the company’s profit margins. Rising competition and a potential slump in American auto sales could also hurt. (InvestorPlace)

Like I said last year. While the company would love to blame tariffs for what will happen in 2018, those possible horizon issues do not explain the major failures of 2017 or of 2018 to present. They just make a convenient excuse for a decline that clearly was well underway last year, got a temporary reprieve and has been deepening throughout the first quarter of this year, well before Trump said a word about steel tariffs.

That’s why it’s called “Carmageddon.” Last year and this were the year auto sales died, and now we see the end result of what has been developing during the time frame in which I said the auto industry would experience major die-back.

Read More @ TheGreatRecession.info