US Public Debt and Interest Payments Hit New Record

by Peter Schiff, Schiff Gold:

The US debt continues to skyrocket and it’s costing Uncle Same more and more money just to make the interest payments.

The US debt continues to skyrocket and it’s costing Uncle Same more and more money just to make the interest payments.

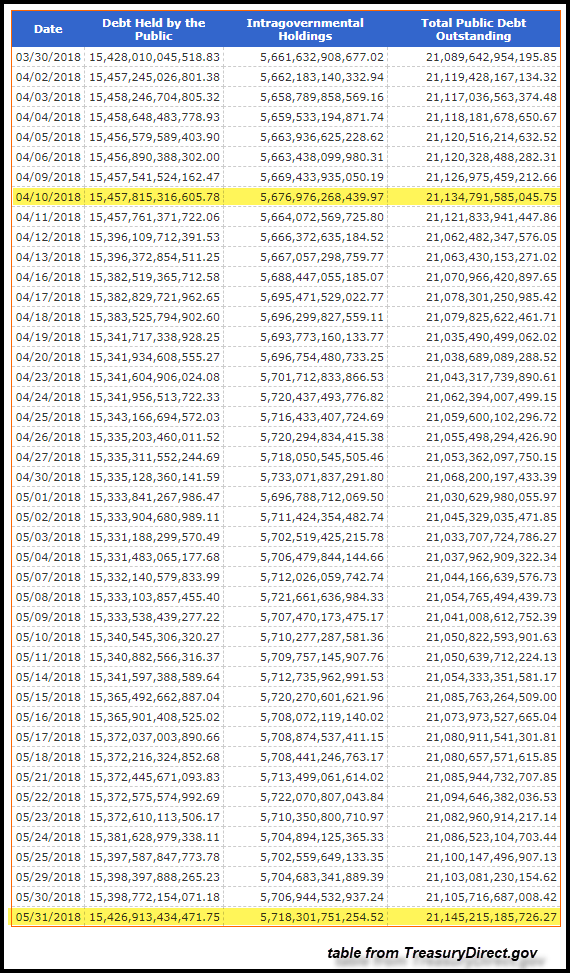

The US public debt hit a record high of $21.145 trillion on the last day of May. Meanwhile, the cost of servicing all that debt also spiked, increasing by $26 billion through the first seven months of the fiscal year (October-April) compared with the same period last year.

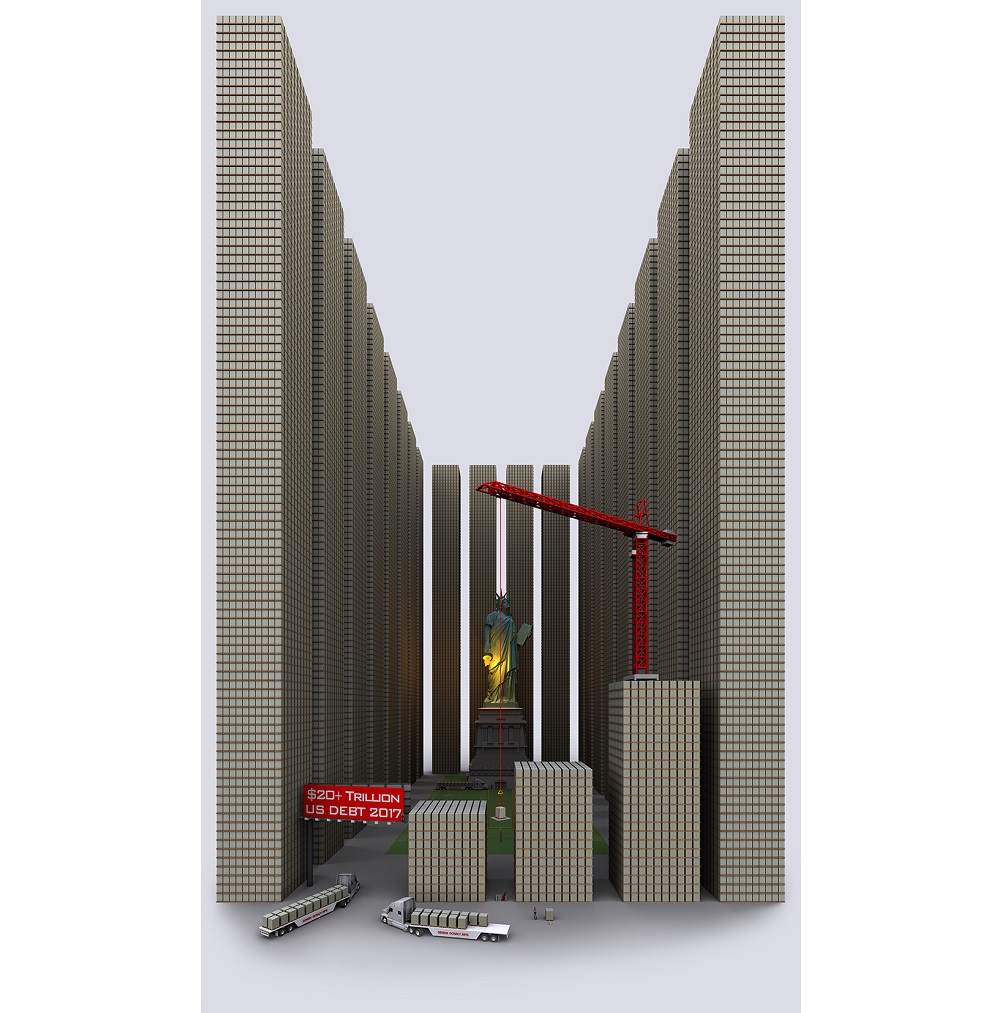

This is a staggering amount of money. Here’s a visualization of $20 trillion courtesy of VisualCapitalist.

Yet despite this staggering amount of debt, a lot of people continue to shrug and yawn. In fact, some people argue that the debt doesn’t even matter. But of course, it matters. As we’ve talked about before, skyrocketing debt suppresses economic growth.

There was actually a pause in the growth of the debt in the spring. The US government hit the previous high in early April. An influx of revenue into the Treasury during tax season put a pause on the debt climb. As SRSrocco noted, the debt doesn’t climb in a straight line. It actually falls some days and weeks. But the overall trend continues steadily upward.

That trend will only accelerate as interest rates climb. As we’ve discussed previously, rising rates will eventually crush the US budget under interest payments. Analysts have calculated that if the interest rate on Treasury debt stood at 6.2% – its level in 2000 – the annual interest payment on the current debt would nearly triple to $1.3 trillion annually.

So – do you really think the Fed is going to be able to “normalize” rates?

Even at a relatively modest 3%, we’re seeing the impact of rising rates with the interest expense growing from $257.3 billion in the first seven months of fiscal 2017 to $283.6 billion in the same period this year. When we’re talking about trillions of dollars in debt, a $26 billion increase in interest expense might start to sound like small potatoes. Of course, it’s a significant amount of money. SRSrocco calculated that it could buy the total global registered silver inventory: