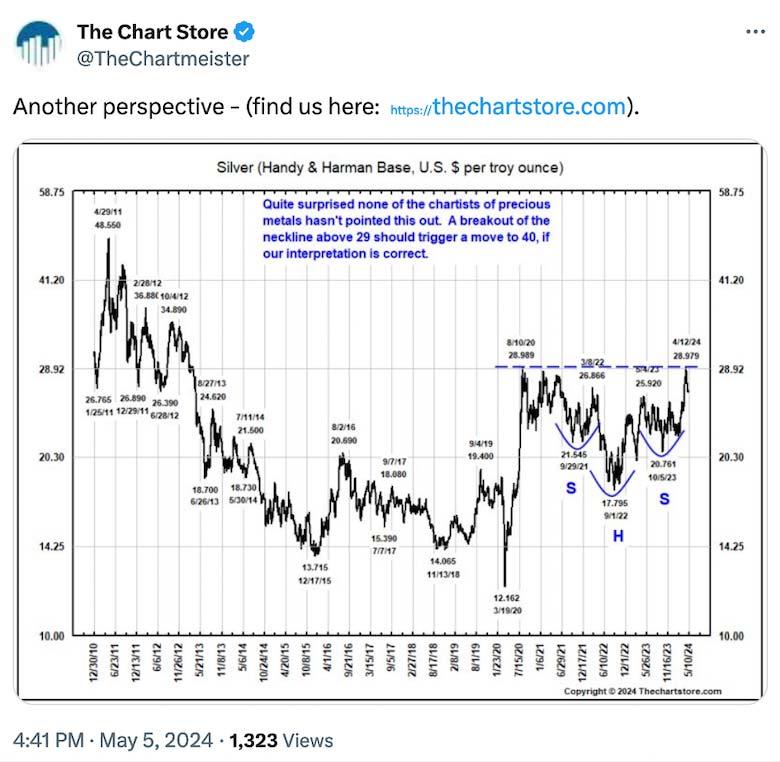

Silver Could Be on the Verge of a Massive Rally

by Doug Casey, Casey Research:

Imagine losing $4 million in the blink of an eye.

Imagine losing $4 million in the blink of an eye.

It’s painful to even think about. But that’s how much money one trader lost earlier this year by making an all-or-nothing bet against volatility.

He wasn’t alone. Countless traders made similar bets on low volatility, only to get smoked.

If you’re a regular reader, you know what I’m talking about. If not, here’s a rundown…

• Last year was the least volatile year ever for U.S. stocks…

The markets were so calm that many investors were lulled to sleep. They threw caution to the wind. Some people even shorted (bet against) volatility.

You can see why that was such a bad idea in the chart below. It shows the CBOE Volatility Index (VIX), or what most people call the “fear index.” This index measures how volatile investors expect the market to be over the next 30 days.

This chart shows what the VIX has done over the past three years. When this index is high, it means traders expect a lot volatility. When it’s low, it means they’re less fearful. An extremely low reading can even mean that traders are complacent.

You can see that the VIX was in a clear downtrend for years…

That’s a long time… but nothing lasts forever.

And as you can see, the VIX skyrocketed in January. This crushed traders who shorted volatility. At the same time, it rewarded traders who took the other side of this bet.

And that’s why I wrote this essay…

• A similar opportunity is staring us in the face right now…

Only this time, it’s in the silver market.

In a minute, I’ll show you how to set yourself up for major gains. But first, let me tell you why this is such a great speculative opportunity.

The chart below shows the CBOE Silver ETF Volatility Index, which you can think of as the VIX for silver. It measures how volatile traders expect the silver market to be going forward.

As you can see, the CBOE Silver ETF Volatility Index has been in steady decline since 2011. Last year was an especially calm year for the silver market.

This is important because, as I showed you earlier, markets are often calmest just before explosive moves.