Russia Dumping US Treasuries, Buying Gold

by Peter Schiff, Schiff Gold:

The Russians are dumping US Treasuries and buying gold.

As we reported earlier this week, the three largest holders of US Treasuries are not in a buying mood. In fact, they’re selling. The Japanese disposed of $12.3 billion in US debt. Meanwhile, Chinese Treasury holdings fell by $5.8 billion. The Federal Reserve has shed about $70 billion in US bonds since launching its tightening program last fall. So far, individual and institutional investors have picked up the slack.

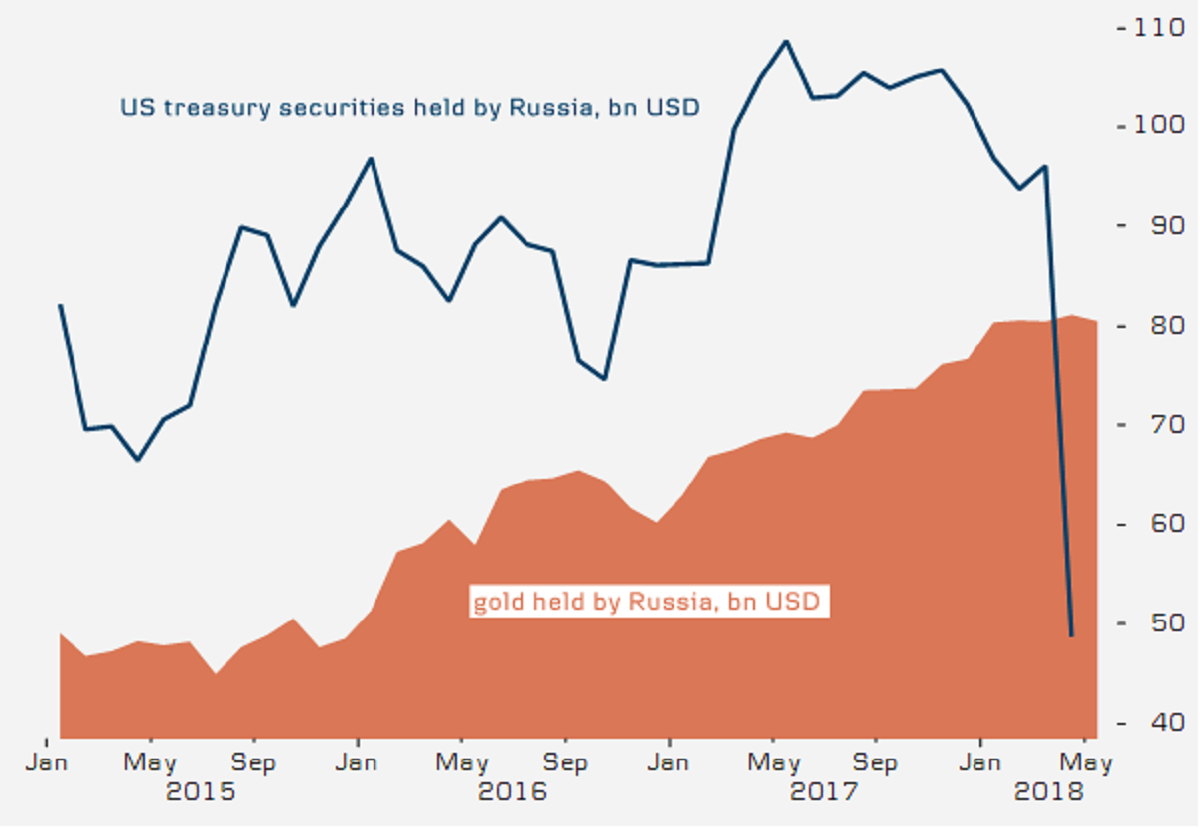

Lost in the latest data about Treasury holdings was the fact that Russia dumped nearly half of its US debt in April. But even as it divests itself from US bonds, Russia’s total reserves have grown as the country adds to its gold holdings.

In just one month, the Russians sold off $47.4 billion of its $96.1 billion in US Treasuries. The Russians don’t hold very much US debt compared to countries like China and Japan, so their sell-off isn’t particularly meaningful in the big scheme of things. But it is telling. The country is obviously trying to unshackle itself from the US economy.

As part of that strategy, the Russians have aggressively added to their gold hoard. The Bank of Russia said on Wednesday that its holdings of gold rose by 1% in May to 62 million ounces.

Russia has bought gold every month since March 2015 in an effort to diversify its foreign currency holdings and minimize its dependence on the US dollar. According to the World Gold Council, Russian gold reserves increased 224 tons in 2017, marking the third consecutive year of plus-200 ton growth. In February, Russia passed China to become the world’s fifth-largest gold-holding country.

As Bloomberg noted, Russian Pres. Vladimir Putin warned shortly after his inauguration for a fourth term as president that he wants to “break” from the dollar and diversify reserves to bolster “economic sovereignty.”

Russia is not alone. Jim Rickards described a number of countries using gold as an offensive counterweight to the dollar as an emerging “axis of gold.” These countries include Russia, China, Turkey and Iran. This axis could ultimately undermine dollar dominance. At the least, stockpiling gold makes these countries less vulnerable to US sanctions and economic pressures.

There are efforts underway to create alternative payment systems in gold that will enable countries to operate outside the dollar-dominated SWIFT international payment system. Rickards said, “This gold-based payments system will dilute and ultimately eliminate the impact of US dollar-based sanctions.”

While the US and other western countries can effectively lock out countries from the dollar system, they have very little control when countries start doing business in gold. Since gold is physical, not digital, there is no way for it to be hacked, frozen or electronically diverted. It cannot be interdicted through SWIFT. Gold is fungible and non-traceable, and the yellow metal is relatively easy to transport.

In April, Turkish President Recep Tayyip Erdoğan took things another step, publicly suggesting international loans should be made in gold instead of greenbacks in order to prevent exchange rate pressure on economies.

I made a suggestion at a G20 meeting. I asked, ‘Why do we make all loans in dollars? Let’s use another currency.’ I suggest that the loans should be made based on gold.”