Interest Payments on Federal Debt on Pace to Eclipse Social Security Outlays

by Peter Schiff, Schiff Gold:

At the current trajectory, the cost of paying the annual interest on the US debt will equal the annual cost of Social Security within 30 years, according to a recent report released by the Congressional Budget Office.

By 2048, as interest rates rise from their currently low levels and as debt accumulates, the federal government’s net interest costs are projected to more than double as a percentage of GDP and to reach record levels. Those costs would equal spending for Social Security, currently the largest federal program, by 2048.”

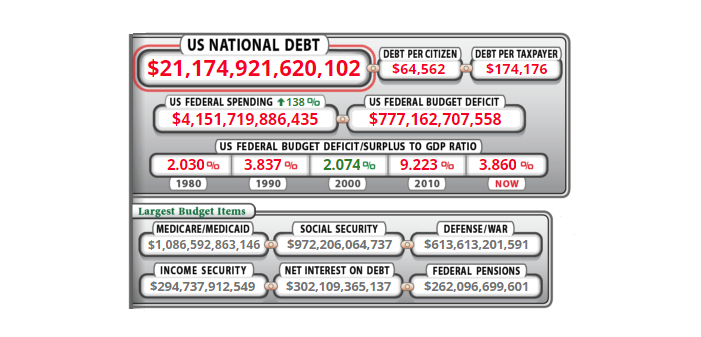

According to the CBO, federal debt will double in the next 30 years to a record 148% of GDP. And the agency currently uses a low estimate for its debt-to-GDP ratio. It calculates the US debt is currently about 78% of GDP. Many mainstream economists say that number ranges closer to 105% GDP.

We have previously warned that the rising debt coupled with a higher interest rate environment could crush the federal budget under interest payments. Last fall, Pres. Trump signed a budget bill adding about $318 billion to the federal debt. That increase alone will require an extra $7 billion interest payment annually. Analysts have calculated that if the interest rate on Treasury debt stood at 6.2% – their level in 2000 – the annual interest payment on the current debt would nearly triple to $1.3 trillion annually.

Now, the government itself admits it’s on an unsustainable trajectory. And the CBO generally uses relatively conservative assumptions to generate its forecasts. The reality could turn out much worse.

So what, you might ask?

In the first place, growing debt coupled with soaring interest payments creates a vicious upwardly spiraling cycle. As debt grows, it costs more money to service. That requires more borrowing, adding to the pile of debt.

In the second place, debt stifles economic growth. Multiple studies have shown GDP growth decreases by an average of about 30% when government debt exceeds 90% of an economy.

Peter Schiff has said the massive debt could also spur on the dollar collapse.

But Congress seems unwilling or incapable of doing anything about the debt. D.C. has a spending habit it just can’t break. The GOP-controlled Congress recently had an opportunity to slash a modest $15 billion in federal spending authority.

It didn’t.

To put that in perspective, that’s just 0.08 percent of the federal budget.