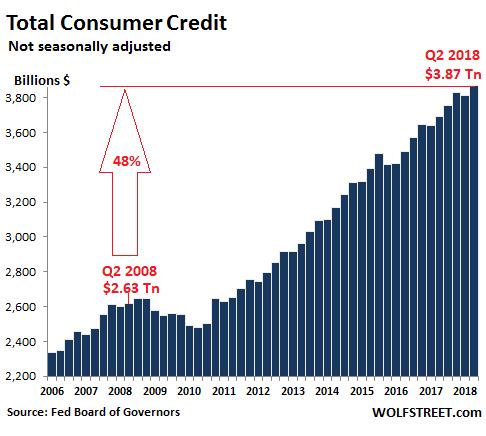

Consumer Debt Hits Record $3.87 Trillion; Could the Debt-Based House of Cards Be Close to Collapse?

by Peter Schiff, Schiff Gold:

Consumer debt hit another record in the first half of 2018, but the rate of borrowing seems to be slowing down. Could this be a sign that the debt-based house of cards economy is close to the point of collapse?

Total consumer debt rose by $176 billion in Q2, a 4.8% year-on-year increase. That pushed total debt to a record $3.87 trillion, according to numbers released by the Federal Reserve.

These figures include credit card debt, student loans and auto loans, but do not factor in mortgage debt.

Revolving credit and credit card debt increased at an annual rate of 4%, while nonrevolving credit increased at an annual rate of 5%.

WolfStreet added a little perspective to the numbers, making the same point Peter Schiff made in a recent podcast.

In Q2, the economy as measured by real GDP grew 2.8% year-over-year, and inflation as measured by CPI increased 2.7%. In other words, American consumers, among the hardiest creatures out there, have pulled through once again, holding up the economy with borrowed money. Over the 10 years since Q2 2008, consumer debt has surged 48%. Over the same period, the consumer price index has increased 15.1%, and the economy has grown 17.8%.”

In other words, America’s “recovery” is built on debt.

Outstanding credit card balances crossed the $1 trillion threshold. Meanwhile, auto loans and leases for new and used vehicles rose by $40 billion over the last year to a record of $1.13 trillion. Student loans jumped by 5.8% in Q2, increasing $84 billion, year-over-year to $1.53 trillion.

But there something else going on that should raise some concerns.

The rate of increase in some debt categories appears to be slowing. For instance, the increase in credit card debt was actually down in the first half of 2018 compared to the spectacular 5.6% to 6.8% increases we saw from Q4 2016 through Q4 2017. Auto financing has also fallen off since the euphoria of 2015.

So, is the American consumer close to being maxed out?

As Peter Schiff pointed out in his most recent podcast, June consumer debt numbers actually came in significantly below expectations. Analysts anticipated an increase of $16 billion. As it turns out, consumers only increased their debt loads by $10.2 billion. That’s still a lot of borrowing, but it pales in comparison to May, when Americans went gangbusters, borrowing $24.3 billion.

Peter said May borrowing was probably a big factor in the big Q2 GDP number.

You know, we got that 4.1% number Donald Trump has been bragging about, but the biggest driver, other than soybean exports to try to beat the tariffs, was a big jump in consumer spending. And the reason that consumers had all that extra money to spend was because they borrowed it.”

June borrowing factors into Q2 as GDP well as May’s. Peter said the lower than expected debt increase could result in the GDP number getting revised down.

If the consumer didn’t borrow as much money as we thought in June, then he probably didn’t spend as much money. Because all the borrowing is to finance spending. I mean, consumers are not borrowing money and then sticking it in a piggy bank. They’re borrowing money to spend it. So, if they didn’t borrow as much money as we thought in the month of June, then they probably didn’t spend as much money in the month of June either.”

Loading...