Small NASDAQ Company Just Got A Huge $900 Opportunity From Apple

This report is an ADVERTISEMENT from SafeHaven.com

Apple made history this year by becoming the first trillion-dollar company the U.S. has ever seen. But the only millionaire investors Apple is minting these days are those who boarded early.

While that ship has sailed, with share prices over $220, there’s some low-hanging fruit on the Apple tree that no one’s ever heard of …

One company might be about to provide investors with a backdoor into the world’s most tantalizing brand.

They’re trusted by Apple.

They have Apple experience.

And they’re planning to roll out a new type of Apple store across the Americas.

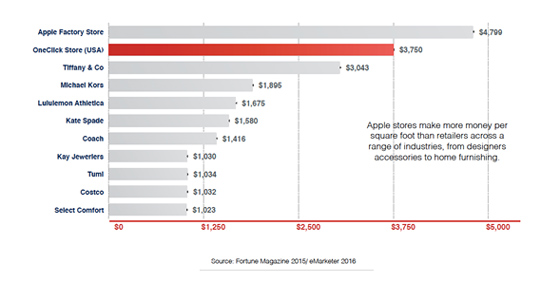

The name of this little-known company is Cool Holdings (NASDAQ:AWSM) and its all-Apple stores already earn an impressive $3,750 in revenue per single square foot.

That’s more than Tiffany & Co., more than Michael Kors—and way more than Costco.

In fact, it’s even closing in on Apple-owned stores themselves, which are the top retailers in terms of sales per square foot at $5,546 as of 2017.

For an investor looking to tie-in with Apple—the biggest and best brand in the world—this is how it’s done, and this is the time to do it.

Apple is unstoppable, and it recently unveiled its new Iphone XS and XR on September 12th at a big event at its headquarters. CNN Money has called the iPhone the MVP of the stock market, and the “biggest cash cow on Wall Street”.

The iPhone alone is expected to rake in $165 billion in sales this year—it’s a “stunning amount of money from a single product line”. And this ties in to Cool Holdings …

You might not have heard of them yet, but in the next couple of years, you will—when the hundreds of expected Cool Holdings-owned OneClick stores selling Apple products rise up and one day potentially turn into 1,000, from as far North as Canada to the southernmost tip of Latin America.

Here are 5 reasons to keep a very close eye on Cool Holdings (NASDAQ:AWSM) right now:

#1 Cool Holdings, The Coolest Back Door Into Apple Revenues

Cool Holdings owns OneClick International and OneClick Argentina, and it is already one of Apple’s premier partners in the Americas.

Its Apple-product boutiques look like Apple, and smell like Apple, but they aren’t run or owned by Apple.

They’ve been so successful in a difficult market (Latin America) that they were made an Apple premier partner to roll out in the United States.

Cool Holdings’ goal with its One Click retail boutiques is to become the largest authorized reseller of Apple® products and services.

In Latin America, its staging ground is Argentina, with six brand new boutiques. Its staging ground in the U.S. is Florida, where three stores are already up and running:

The next phase of the roll-out has already begun, and Cool Holdings is planning over 200 new stores by 2020. That’s 200+ stores in less than two years—from Canada and the U.S., to Argentina and beyond.

And it’s moving fast …

On August 28, Cool Holdings opened their newest OneClick Apple Boutique Store in Orlando, Florida, and on August 20, it acquired an Apple Boutique Store retail chain in the Dominican Republic, adding 7 more shops to the portfolio.

And they’re just getting started—there’s endless room to grow here.

#2 Per Square Foot, Only Apple Beats Cool Holdings

Cool Holdings (NASDAQ:AWSM) carries all the top brands for Apple and absolutely anything related to Apple. It’s covering the entire Apple ecosystem—and they have direct relationships with all the accessory brands.

Either you have the distribution without retail or retail without distribution – Cool Holdings has both.

That’s why it’s making a stunning $3,750 in revenue per square foot. That’s a figure that makes even the biggest of the big in retail jealous. And it’s quite a feat for a company that few have ever even heard of.

There seems to be nowhere for these figures to go but up, if Apple sales are a good indicator.

Remember, Wall Street thinks Apple will make $165 billion just on the iPhone this year. Add accessories, and this is a retailer’s dream.

Just think: In 2017, Target’s revenue per square foot was only $290, according to Forbes. And the latest figures from 2015 put Walmart at revenue of $423 per square foot.

#3 A Business Model Like No One Else Means Higher Margins

Cool Holdings’ (NASDAQ:AWSM) business model breaks the mold in a way that should please investors to no end. It’s unlike anything else.

That’s because it’s growing distribution, marketing and retail all under the same umbrella—it’s a first that is one of several reasons Cool Holdings has the advantage over its competitors in the Apple ecosystem.

Where other companies take bad sales executives and promote them to “marketing”, Cool Holdings has a very different philosophy.

They’ve created their own marketing agency and brought it into the company. That means the best of the best.

It also means they do marketing for free and generate profit from it. That’s a rare relief for investors who typically see companies spend $2 in marketing for every $1 they get.

In other words, a unique business model with control over distribution, retail and marketing simultaneously means margins are even higher.

#4 Apple Trust—There’s Nothing Bigger

Winning over Apple isn’t easy for retailers. The trillion-dollar company doesn’t entrust its brand to just any old company.

In fact, there are only 32 companies in all of North America that have the privilege of opening stores that sell Apple products. Most of them are mom-and-pop shops, but Apple has chosen a select few to actually grow the business and consolidate some of those tiny set-ups.

Apple wants a presence … everywhere. The only way it can be in small towns is to go through smaller companies, and Cool Holdings (NASDAQ:AWSM) is one of the chosen few.

Why? Because to sell Apple products you have to be Apple in every way.

You have to look and feel like Apple because customers want the Apple experience, and the Apple brand won’t risk being sold by outsiders.

Cool Holdings is a premier Apple partner that is kicking it into full throttle with plans to roll out hundreds of new boutiques in less than two years.

Cool Holdings’ motto is “one world, one store, one click”—so no matter where you are in Latin America or the U.S., all of its stores will look and feel the same. In other words, they are just like Apple wants them to be, and with true Apple DNA.

#5 Founded By A Former Apple Employee

Investors should take note of a company founded by a former Apple employee. And Cool Holdings (NASDAQ:AWSM) is just that.

They saw a massive opportunity, and they jumped on it—at just the right time.

After all, the best things have come from former Apple employees, according to Business Insider.

- Nest Labs, the company behind The Learning Thermostat, was started by the guy who created the iPod.

- Android founder Andy Rubin started out at Apple.

- Enjoy, a startup that wants to bring the Apple Store Genius Bar to you, was created by former Apple retail chief Ron Johnson.

- SITU, a Bluetooth food scale that syncs with your iPad, was invented by a former Apple employee.

- Cloud startup “Upthere” was founded by two former Apple employees, including the mastermind of the Mac OS X.

- ‘Path’ founder Dave Morin is also from Apple.

For starters, Cool Holdings’ founder and chief marketing and sales officer, Felipe Rezk, used to head up enterprise sales for Apple in Latin America.

And the board has plenty of powerhouses behind it, too, including Canadian billionaire Aaron Serruya, who made his fortune along with his brother, Michael Serruya, in the 1980s with frozen yogurt and most recently sold the closely-held Kahala Brands food franchise, which includes Blimpie and Cold Stone Creamery, for some $320 million.

Chairman of the Board Andrew DeFrancesco has over 26 years of capital markets experience and has taken a string of companies to multi-million-dollar sales. As founder and chairman, he took Dalradian Resources through its IPO in 2010 and it was recently sold for $500 million. He also injected $6.2 million into Aphria Inc. (TSE:APH), which is now worth $4.73 billion.

They know what Apple wants, and they definitely know what Apple has to offer.

As of today, Cool Holdings has already successfully rolled out 17 stores that sell Apple products, and they are only just getting started.

This is a truly unique opportunity that comes at the perfect time as Apple breaks the trillion-dollar mark and prepares to launch new products.

And it’s not just about Apple, or even the iPhone. Cool Holdings (NASDAQ:AWSM) is free to pivot to other, hot, high-margin tech products that benefit from the Apple halo effect. Revenues for retail accessory sales from key manufacturers like Bose, Sonos, Belkin, Zagg-Mophie, Speck, JBL … are also at play.

This is a team with Apple DNA, making $3,750 per square foot in a fast-growing market. And it’s hoping to piggy-back on Apple’s growth.

New stores are quietly being rolled out… and revenue numbers may be reflected in their next quarterly call… In the not-too-distant future, this might be another big ship that’s already sailed.

By. James Burgess

IMPORTANT NOTICE AND DISCLAIMER

PAID ADVERTISEMENT. This communication is a paid advertisement. Safehaven.com, Advanced Media Solutions Ltd, and their owners, managers, employees, and assigns (collectively “the Publisher”) is often paid by one or more of the profiled companies or a third party to disseminate these types of communications. In this case, the Publisher has been compensated by Cool Holdings, Inc. to conduct investor awareness advertising and marketing for Cool Holdings. Cool Holdings will pay the Publisher four hundred fifteen thousand US dollars over four months to produce and disseminate this article and certain banner ads. Cool Holdings may in the future pay the Publisher additional sums as compensation for other articles and marketing services. This compensation should be viewed as a major conflict with our ability to be unbiased.

Readers should beware that third parties, profiled companies, and/or their affiliates may liquidate shares of the profiled companies at any time, including at or near the time you receive this communication, which has the potential to hurt share prices. Frequently companies profiled in our articles experience a large increase in volume and share price during the course of investor awareness marketing, which often ends as soon as the investor awareness marketing ceases. The investor awareness marketing may be as brief as one day, after which a large decrease in volume and share price may likely occur.

This communication is not, and should not be construed to be, an offer to sell or a solicitation of an offer to buy any security. Neither this communication nor the Publisher purport to provide a complete analysis of any company or its financial position. The Publisher is not, and does not purport to be, a broker-dealer or registered investment adviser. This communication is not, and should not be construed to be, personalized investment advice directed to or appropriate for any particular investor. Any investment should be made only after consulting a professional investment advisor and only after reviewing the financial statements and other pertinent corporate information about the company. Further, readers are advised to read and carefully consider the Risk Factors identified and discussed in the advertised company’s SEC and/or other government filings. Investing in securities, particularly microcap securities, is speculative and carries a high degree of risk. Past performance does not guarantee future results. This communication is based on information generally available to the public and on an interview conducted with the company’s CEO, and does not contain any material, non-public information. The information on which it is based is believed to be reliable. Nevertheless, the Publisher cannot guarantee the accuracy or completeness of the information.

SHARE OWNERSHIP. The owner of Safehaven.com owns shares and/or stock options of the featured companies and therefore has an additional incentive to see the featured companies’ stock perform well. The owner of Safehaven.com will not notify the market when it decides to buy or sell shares of this issuer in the market. The owner of Safehaven.com will be buying and selling shares of the featured company for its own profit. This is why we stress that you conduct extensive due diligence as well as seek the advice of your financial advisor or a registered broker-dealer before investing in any securities.

FORWARD LOOKING STATEMENTS. This publication contains forward-looking statements, including statements regarding expected continual growth of the featured companies and/or industry. The publisher notes that statements contained herein that look forward in time, which include everything other than historical information, involve risks and uncertainties that may affect the companies’ actual results of operations. Factors that could cause actual results to differ include, but are not limited to, changing governmental laws and policies, the success of the companies’ technology and/or partnerships with other companies, the size and growth of the market for the companies’ products and services, the companies’ ability to fund their capital requirements in the near term and long term, pricing pressures, etc.

INDEMNIFICATION/RELEASE OF LIABILITY. By reading this communication, you acknowledge that you have read and understand this disclaimer, and further that to the greatest extent permitted under law, you release the Publisher, its affiliates, assigns and successors from any and all liability, damages, and injury from this communication. You further warrant that you are solely responsible for any financial outcome that may come from your investment decisions.

INTELLECTUAL PROPERTY. Safehaven.com is the Publisher’s trademark. All other trademarks used in this communication are the property of their respective trademark holders. The Publisher is not affiliated, connected, or associated with, and is not sponsored, approved, or originated by, the trademark holders unless otherwise stated. No claim is made by the Publisher to any rights in any third-party trademarks.

TheDailySheeple Legal Notice: The content in this article is provided by TheDailySheeple.com as general information only. The ideas expressed herein are solely the opinions of the author(s) and do not necessarily represent the opinions of sponsors or firms affiliated with the author(s). Members of the TheDailySheeple.com staff and/or owners of TheDailySheeple.com currently own no shares in the company mentioned. We will not purchase shares in the next 30 days. TheDailySheeple.com has been compensated for a two week marketing campaign. We were paid directly by SafeHaven.com, a third party media company. Any action taken as a result of information, analysis, or advertisement on this site is ultimately the responsibility of the reader. The information herein is not intended to be personal legal or investment advice and may not be appropriate or applicable for all readers. If personal advice is needed, the services of a qualified legal, investment or tax professional should be sought. Never base any decision on a single email. The companies mentioned in this post are intended to be a stock ideas, NOT recommendations. The ideas we present are high risk and you can lose your entire investment. We are not stock pickers, market timers, investment advisers, and you should not base any investment decision on our website, emails, videos, or other published material. Please do your own research before investing. It is crucial that you at least look at current SEC filings and read the latest press releases. Information contained in this profile was extracted from current documents filed with the SEC, the company web site and other publicly available sources deemed reliable. Our report is not intended to be, nor should it be construed as an offer to buy or sell, or a solicitation of an offer to buy or sell securities, or as a recommendation to purchase anything. This publication may provide the addresses or contain hyperlinks to websites; we disclaim any responsibility for the content of any such other websites.

Delivered by The Daily Sheeple

We encourage you to share and republish our reports, analyses, breaking news and videos (Click for details).

Contributed by James Burgess of SafeHaven.com.