Inflation Is Eating Up Your Wage Growth

by Peter Schiff, Schiff Gold:

When the August jobs report came out earlier this month, much was made over the “solid” wage growth. Average hourly wages increased by 2.9% on an annualized basis.

When the August jobs report came out earlier this month, much was made over the “solid” wage growth. Average hourly wages increased by 2.9% on an annualized basis.

Peter Schiff raised an important question when the report hit the news cycle. Is this wage growth indicative of a growing economy? Or is it simply a sign of inflation?

See, I think it’s the latter. I think it’s inflation that is the reason wages are going up. Remember, wages are prices. They’re the price that you pay to hire labor. So, the price of labor is wages … The price of goods and the price of labor are both affected by inflation. So, because we have all this inflation, prices are rising. They’re rising for goods and they’re rising for labor.”

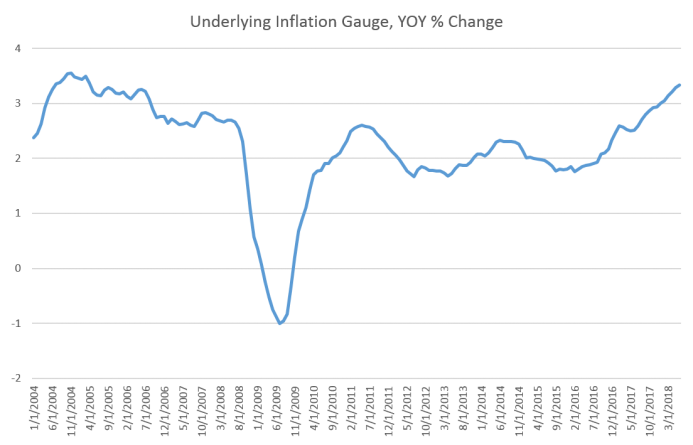

Well, we have pretty solid evidence that inflation is the real factor driving wage growth. As Ryan McMaken at the Mises Institute reported, according to the Federal Reserve, its underlying inflation gauge hit the highest rate in 158 months in June, coming in at 3.36%.

In other words, while wages are increasing, they aren’t even keeping pace with rising prices. In fact, according to Pew Research, your purchasing power is about the same as it was in 1978.

After adjusting for inflation, however, today’s average hourly wage has just about the same purchasing power it did in 1978, following a long slide in the 1980s and early 1990s and bumpy, inconsistent growth since then. In fact, in real terms average hourly earnings peaked more than 45 years ago: The $4.03-an-hour rate recorded in January 1973 had the same purchasing power that $23.68 would today.”

Economist Doug French raises an important question in a recent Mises Institute article: how is everyone, seemingly, buying all those new gadgets?

Answer: debt.

Consumer lending is at record levels. French quotes a Wall Street Journalarticle.

Lenders extended $81.9 billion in personal loans to US consumers in the first half of the year, up about 13% from a year prior, according to credit-reporting firm Experian PLC. That compares with a 9% rise in auto loans and leases and a 5% boost in spending limits issued on new general-purpose credit cards over the same period.”

As French points out, personal loans are unsecured and much riskier than lending on cars and homes. This is just one piece of the giant personal debt puzzle Americans have put together. Total household debt in the US hit a record $13 trillion in 2017, eclipsing levels seen on the eve of the Great Recession.

Loading...