Federal Government Runs Up Sixth-Largest Single-Year Debt Increase in US History

by Peter Schiff, Schiff Gold:

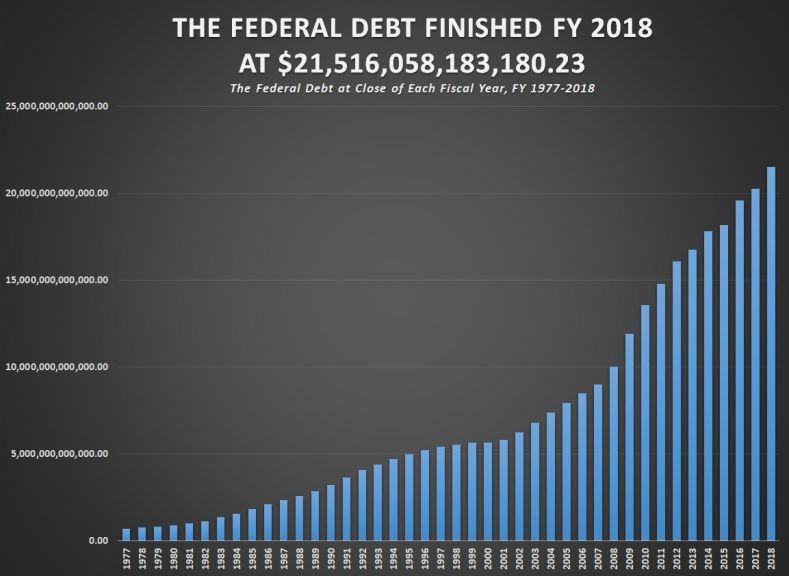

Sept. 30 marked the end of the federal government’s 2018 budget year. According to data released by the US Treasury Department, the federal debt grew by nearly $1.3 trillion in fiscal 2018 – $1,271,158,167,126.72 to be exact. It was the sixth-largest fiscal-year debt increase in the history of the United States.

So much for that Republican Party fiscal responsibility.

The total federal debt currently stands at $21.5 trillion.

For the eighth time in the last 11 years, the federal debt has grown by more than $1 trillion. As you can see from the chart, the debt continues to spiral upward, no matter which political party controls Congress and the White House.

The largest increase in the federal debt occurred in fiscal 2009 (Oct. 2008-Sept. 2009) at the height of the financial crisis. Debt tends to accumulate faster during economic downturns. The fact that the Trump administration managed to run up near-record debt during what is supposed to be an economic boom should cause a great deal of concern.

Republican tax cuts without any corresponding spending cuts exacerbated the debt problem. It’s not that tax cuts in and of themselves are bad. But without any accompanying cuts in spending, they are exacerbating the debt problem. As Peter Schiff has put it, we got tax relief without any government relief.

In August, the US government set a single month spending record, burning through $433.3 billion and running up a monthly deficit of $214 billion. Federal government spending came in 30% higher than August 2017 and ranked as the highest monthly outlay on record.

The spending pace looks to continue. Pres. Trump recently signed an $853 billion spending bill. The Republicans still haven’t passed an actual budget. The most recent spending bill funds the departments of Defense, Education, Labor and Health and Human Services for one year. It also provides money for agencies not covered by this legislation or by a previous spending bill through Dec. 7. The piecemeal approach to spending makes it difficult to track exactly how much the federal government is spending.

CNS news calculated that the federal government ran up a debt equaling approximately $8,172 per American worker. The total federal debt comes to about $138,330 for every person in this country who works.

It’s easy to read all of these numbers and think, ‘ho-hum who cares.’ After all, we’ve been talking about runaway spending, budget deficits and federal debt for years. Nothing has happened. But remember, we’ve also been in an artificially low interest rate environment for years. The federal government continues to pile up debt and interest rates are climbing. The interest payment on the debt hit an all-time high of $538 billion in Q2 2018.

Politicians in Washington have created a vicious cycle of skyrocketing debt and borrowing that is only likely to accelerate, and seem completely unwilling to do anything about it.

Loading...