Federal Government Posts Largest Deficit in Seven Years

by Peter Schiff, Schiff Gold:

The federal debt spiral continues.

The 2018 fiscal year ended Sept. 30 and the US government closed out the year with its largest budget deficit since 2011. Uncle Sam ended 2018 $779 billion in the red, adding to the ballooning national debt.

A combination of new federal spending and shrinking revenue due to the tax cuts accounted for the large deficit.

Meanwhile, the national debt expanded by more than $1 trillion. According to data released by the Treasury Department, it was the sixth-largest fiscal-year debt increase in the history of the United States. (If you’re wondering how the debt can grow by a larger number than the annual deficit, economist Mark Brandly explains here.)

According to the Treasury Department, the 2018 fiscal deficit was $113 billion (17%) larger than the 2017 deficit. If you adjust for calendar effects (for instance, revenues come in higher during months when quarterly tax filings come due) the gap between fiscal 17 and fiscal 18 came in even larger.

According to Reuters, the Bipartisan Policy Center called the Treasury report a “wakeup call.”

The fact that our government is closing in on trillion-dollar deficits in the midst of an economic expansion should be a serious issue for voters and candidates.”

Although the economy is supposedly in the midst of a boom, US government borrowing looks more like we’re in the midst of a deep recession. Long-term US debt sales have risen to a level not seen since the height of the financial crisis.

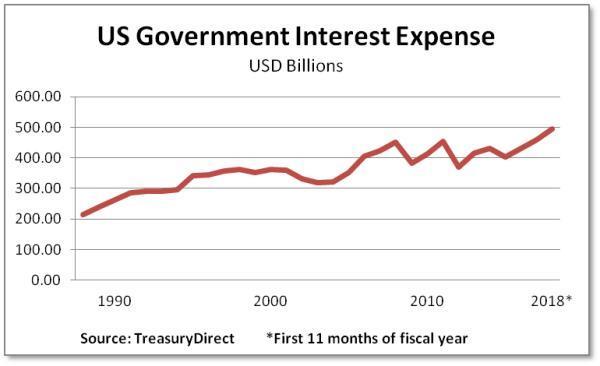

According to the report, the rising cost of servicing existing debt also contributes to the escalating deficits. Interest payments continue to rise as rates go up. This is partly a function of intentional Federal Reserve tightening and partly a function of normal supply and demand. Earlier this year, the US Treasury Department said it planned to auction off around $1.4 trillion in Treasuries in 2018 alone. And it won’t end there. The department expects that pace of borrowing to continue over the next several years.

Obviously, rising interest rates aren’t good news when you’re trying to finance increasing levels of debt. Growing debt coupled with soaring interest payments creates a vicious upwardly spiraling cycle. As debt grows, it costs more money to service it. That requires more borrowing, which adds to the debt, which increases the interest payments — and on and on it goes.

Annual interest payments already approach $500 billion. Every uptick in the interest rate increases that number. At the current trajectory, the cost of paying the annual interest on the US debt will equal the annual cost of Social Security within 30 years.

American consumers face a similar problem. Total consumer credit rose to a record $3.94 trillion in August, according to the latest numbers from the Federal Reserve.

Office of Management and Budget Director Mick Mulvaney said economic growth spurred by the tax cuts will close the budget gap.

America’s booming economy will create increased government revenues – an important step toward long-term fiscal sustainability.”

Loading...