Nearly Half of S&P 500 Stocks in Bear Market

by Peter Schiff, Schiff Gold:

US stock markets took another nosedive last week. Analysts blame the selloff on fears that the arrest of a Chinese businesswoman could derail apparent progress in resolving the trade war between the US and China. But during an interview on RT America, Peter Schiff said that while the arrest of Meng Wanzhou might have sparked the selloff, it wasn’t the underlying reason.

This is a bear market. That’s why the market went down. If it wasn’t that, they would have found another excuse. If we were in a bull market, I think the market would have shrugged it off. So, we’re going lower.”

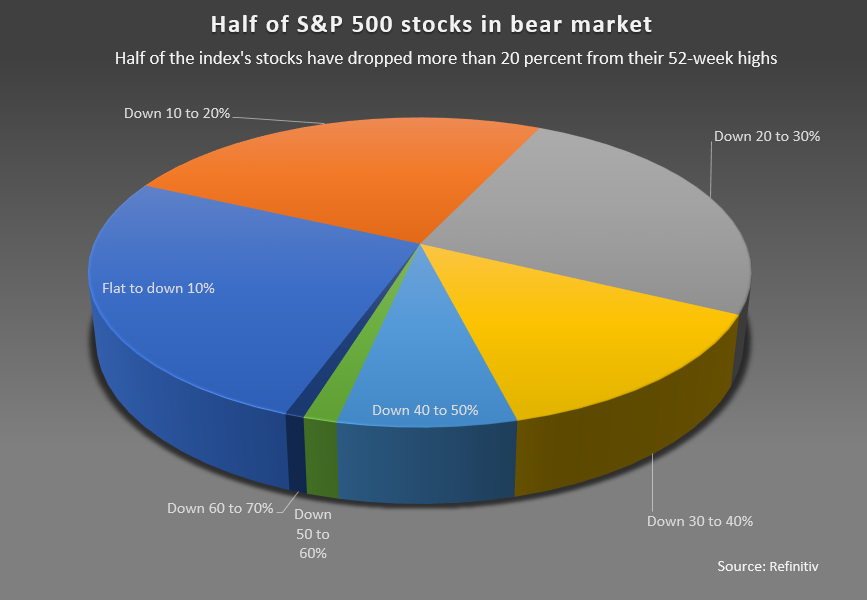

Peter has been saying we’re in a bear market for weeks. Technically, the broader markets are not in bear territory. But when you look at individual stocks, the picture isn’t so bright. Nearly half of the stocks on the S&P 500 are, in fact, in a bear market.

The S&P 500 has been officially in a correction since October. Analysts generally define a correction as a 10% drop from the high. Once that number hits 20%, the correction turns into a bear.

The S&P 500 hit its all-time high of 2930.75 on Sept. 20. As of its close on Tuesday, Dec. 12, the S&P 500 was at 2,636.78. That represents slightly more than a 10% drop.

However, according to a Reuters report, 245 stocks on the index had fallen 20% or more from their 52-week highs as of Monday, Dec. 10. Another 127 S&P 500 stocks were between 10 and 20 percent lower than their 52-week highs.

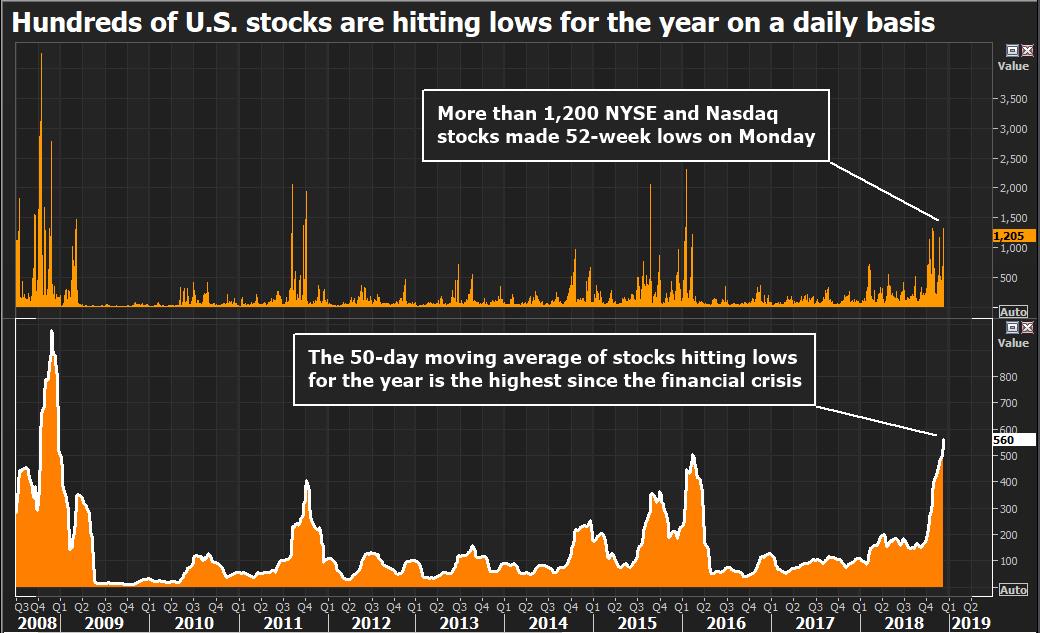

According to Reuters, “Pessimism has spread beyond the S&P 500 to smaller companies across the US stock market, with hundreds of stocks hitting lows for the year on a daily basis in recent sessions.”

This undercuts the mainstream narrative that the recent selloff is nothing more than a minor correction.

Peter recently said what we’re actually seeing is a deflating bubble.

I’ve been calling for a bear market, and I think this is a bear market. And if we get a rally that will be the correction because the primary trend is now down. This is early in this bear market. It’s very young and unfortunately, it’s going to be very long-lived. I think this is going to be similar, if not worse, than the bear market that went from 1966 to 1982. It took 16 years for the Dow to make a new high, and during that time period, inflation took about 70% away from the Dow’s value. This time I think it’s going to be worse.”

It appears the Federal Reserve is trying to blow some air back into the bubble. Fed chair Jerome Powell recently floated a trial balloon, hinting that the central bank may slow the pace of interest rate increases, saying that rates are “close to neutral.” Peter said he doesn’t think hints will be enough to reverse course. Ultimately we will see real rate cuts and more quantitative easing as the central bank tries to reinflate the popping bubbles.

Loading...