2018 Year in Review

by David Collum, Peak Prosperity:

Every December, I write a Year in Reviewref 1 that’s first posted on Chris Martenson & Adam Taggart’s website Peak Prosperityref 2 and later at ZeroHedge.ref 3 This is my tenth, although informal versions go back further. It always presents a host of challenging questions like, “Why the hell do I do this?” Is it because I am deeply conflicted for being a misogynist with sexual contempt—both products of the systemic normalization of toxic masculinity perpetuated by an oppressively patriarchal societal structure? No. That’s just crazy talk. More likely, narcissism and need for e-permanence deeply buried in my lizard brain demands surges of dopamine, the neurotransmitter that drives kings to conquer new lands, Jeff Bezos to make even more money, and Harvey Weinstein to do whatever that perv does. The readership has held up so far. Larry Summers said he “finished the first half.” Even as a fib that’s a dopamine cha-ching.

“If you think you are too small to make an impact, try spending the night in a room with a mosquito.”

~African proverb

A non-pejorative justification for writing this beast is that life, with the aid of the digital world, hurls information at us so fast we cannot process it. Who could forget when Knight Capital Group launched an algorithm that sent them into bankruptcy within 45 minutes? What ever came of the Vegas shootings? Will David Hogg’s 10 minutes of fame as a world-class douche be forgotten? (If not, please euthanize me.) It seems a shame to simply let these fragments of life drift into the void without trying to find an underlying meaning to the human folly. I mostly ponder broken markets and the antics of bankers looking for signs of unintelligent life. The markets have been well over the historical fair value marks for 15 years. I have been a bear long enough to earn my permabear merit badge. The always-chipper Mark Dow called me a “bunker monkey.” John Hussman referred to some of my ideas as “bloodthirsty,” although I prefer the term “ghoulish.” The odds that I understand what has already happened are vanishingly small. I don’t know if markets are going up or down, only that they will move from left to right. None of what I say should be taken as investment advice; channel George Costanza and do the opposite.

“I would have written a shorter letter, but I did not have the time.”

~Blaise Pascal, French mathematician, 1656

What’s with the trite “matrix” metaphor? (I swear I will not refer to naked swimmers, rhyming history, or kicking cans.) I’m not even sure the puzzle pieces are real, fake, or as Ben Hunt calls them, “counterfeit.” It is deeper than that. I have like-minded friends sharing seemingly common interests who look at events—think Brett Kavanaugh, for example—and extract from them unrecognizably different messages because our perspectives are not similar; they are profoundly different. If you shuffle a deck of cards, the odds that the resulting order has ever before been created is zero (52! = 8 × 1067). What are the odds all of us share common websites, read the same articles or blogs, or have the same Twitter feed? Zero. It is preposterous to think that we are looking at the same world through similar lenses. The viral audio in which some hear “Yanny” and others hear “Laurel” is metaphorical.ref 4 This document is what I saw and heard described as fact-based hyperbole. It is the Year According to Dave.

“I want to thank everybody who made this day necessary.”

~Yogi Berra

Background: The Author

When reading Dave’s Year In Review

You’ll note one conclusion rings true

His odd observations

And strange contemplations

Have proven he’s missing a screw

@TheLimerickKing

By way of introduction—despite a knowledge and understanding of economics, finance, and politics that one would expect from a lifetime of studying organic chemistry—I am 1/1,024th economist. There is absolutely no substitute for a genuine lack of preparation. I’ve managed to get cameos in the most improbable of venues including the Wall Street Journal, Russia Today (RT), the Guardian, and even Rolling Stone (but not “on the cover”). With some regularity and little forethought, I routinely manage to risk career and what’s left of my tattered reputation by getting embroiled in international incidents, which included brawling publicly with the American Federation of Teachers in 2017ref 5 and locking arms with Nassim Taleb in defense of Nobel Prize winner Tim Hunt in 2015.ref 6 This year was no exception. I risked an international incident by being the only chemist in the world calling bullshit on the Sergei and Yulia Skripal Novichok poisoning story. That gets its own section.

Aristotle noted that an educated man can entertain an idea without endorsing it. I also have a penchant for entertaining any idea until it dies of SIDS or gets legs, and I have to chase it down. I am, in short, a conspiracy theorist. We all should be conspiracy theorists because men and women of wealth and power conspire. If some ideas make you uneasy, just shut up. Pejoratively denouncing the rest of us as “conspiracy theorists” is intentionally shutting down uncomfortable discussions. If you do this in the current political climate, I get to smack you to get you to agree with me. If you wish to discuss dicey topics, quit apologizing by saying, “I am not a conspiracy theorist but . . .” because you are one.

Figure 1. Jeff Macke (@JeffMacke) original. CNBC’s Fast Money and chartist-artist extraordinaire.

I can’t control what topics go on and off my radar; they just do it. Hardly a shot was fired this year in the War on Cash. Some issues are huge but change on geologic timescales. We’re all doomed to burn in eternal hell, but I can only say that so many years in a row before it starts getting old. I got the most email complaints for not discussing the opioid crisis. I still haven’t gone there, but I’m about to read Beth Macy’s Dopesick. Energy has been a hot topic and had moments of hilarity this year, but my bandwidth limitations and lack of investment exposure left me bored.

There is a tractor beam that pulls economic blogs into the political realm. I have saved more notes and links and destroyed more gray matter than I thought possible trying to understand Russian collusion, the politics of Trump and Trump haters, and criminal behavior inside the FBI and CIA. I could write a book, but I just can’t do these topics justice in this forum. I’m letting them go for now, concluding that we desperately need a wall . . . around the Beltway.

If I have offended you already—I guarantee that at least a few readers are—it’s time to stop reading. Although no puppies were killed writing this blog, trust me: I am just warming up.

Sources

I sit in front of a computer 16 hours a day gerrymandering my brain, at least three of which are dedicated to non-chemistry pursuits. I’m a huge fan of Adam Taggart and Chris Martenson (Peak Prosperity), Tony Greer (TG Macro), Doug Noland (Credit Bubble Bulletin), The Automatic Earth, Grant Williams (Real Vision and Things That Make You Go Hmmm), Raoul Pal (Real Vision), Bill Fleckenstein (Fleckenstein Capital), Mike Krieger (Liberty Blitzkrieg), Demetri Kofinas (Hidden Forces), James Grant (Grant’s Interest Rate Observer), Campus Reform, and any nonsense spewed by Twitter legend @RudyHavenstein. There are so many others, many of whom I consider friends that I am simply waiting to meet. ZeroHedge is by far my preferred consolidator of news; it’s an acquired taste and requires a filter, but I think those rogues are great. Twitter is a window to the world if managed correctly—especially for a chemist attempting to connect with the finance world. Warning: the Holy Grail of maximizing follower counts is an illusion; it produces a counterproductive hyperconnectivity that makes extracting signal from noise difficult. So much flow, so little time.

Contents

Footnotes appear as superscripts with hyperlinks in the Links section. The whole beast can be downloaded as a single PDF Here or viewed in parts via the hot-linked contents as follows:

Part 1

Part 2

My Personal Year

My emergent role as a Roosky apologist (pronounced “Roo-ski”) brought in a wave of interviews including two each with British provocateur George Galloway, RT,ref 7,8,9 Lee Stranahan and Garland Nixon on Fault Lines,ref 10 and Scott Horton.ref 12 Other interviews focusing on economics, markets, and the absurdity we call “college” included Crush the Street,ref 11 Jason Burack (Wall St. for Main Street),ref 13 Chris Martenson (Peak Prosperity),ref 14 several with Lance Roberts,ref 15,16 and several on local radio.ref 17 Last year’s write-up on pensions was reproduced verbatim in the Solari Report on pensions.ref 18

A three-hour dinner with Jonah Goldberg. I’ll remember vividly. I also played a role in coaxing one of my favorite economists, Stephen Roach, and one of my readers and friend, Tony Deden, to do RealVision interviews purely out of self-interest: I wanted to hear what they had to say. This much heralded two-part Deden interview was his first interview ever.ref 19 In return, I got to spend 10 hours sitting on my deck chatting with Tony about the meaning of everything. Y’all are now free to eat your hearts out.

On the chemistry front. Somebody recorded a chemistry lecture I gave in Portugal in which you can hear my Yankee-dog jokes bomb.ref 20 Halfway through dinner that night, I remembered that one of my three compatriots had won the Nobel Prize in chemistry six months earlier. Another was six months shy of winning this year’s prize. (Congrats, Frances) In 2017 I had two NIH grants hit the same study section. Any academic will tell you that was guaranteed to be a “Sophie’s choice” moment at best. I only needed a few stitches—I got one of them funded—and it looks like the other is coming back in the spring. (Phew!)

Investing

My investing acumen has been pretty lucky, with one notable bad streak. From 1980 to 1987, I was all long-dated bonds. Those suffering acute equityphilia may not realize that bonds were great. The ’87 dip prompted me to switch to equities, which I held until mid-1999. Here’s a dark secret that I’ve never told anybody: I had tech stocks on leverage. Ding! Ding! Ding! They ring bells at the top! I woke up in time, sold everything, and held only cash, gold, and a token short position from late 1999 forward, dumping the short position during the ’02–’03 recession. From around 2003 through 2010 it was gold, cash, and energy-based equities with a pinch of tobacco. That was my best decade, relatively speaking, cranking out >10% annually compounded returns like a boss in an otherwise brutal environment. Yahtzee! Then we get to 2010 through the present, and Mr. Smarty Pants got a ’tude adjustment. Energy, gold, and cash hoisted me by my own petard and put me headfirst through a wood chipper. As explained last year, my employer booted me out of my entire (15%) energy position after the beatings. Thanks. I’ve been sitting on gold and cash witnessing an epic equity ’roid rage accumulating skid marks in my boxers.

Precious metals, etc.: 28%

Energy: 0%

Cash equivalent (short term): 63%

Standard equities: 9%

For me, however, investing is all about valuations. The section on “Valuations” will explain why I didn’t buy equities when they were dirt cheap—hint: they were never dirt cheap—and where I think it all goes from here. I have one overarching goal: don’t fuck up. If I hit this goal, I will retire in comfort. The one variable I have no control over, however, is time, and that is why the chronostrictesis of sitting on the sidelines for nearly a decade caused me to start cutting myself again. Let me show you a foreshadowing chart that should give you pause (Figure 2):

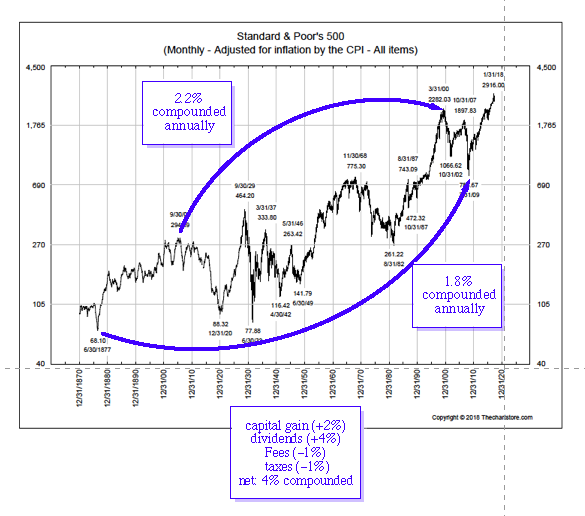

Figure 2. Peak-to-peak or trough-to-trough (full cycle) inflation-adjusted capital gains of 1.8–2.2% per annum since 1870.

If you negate timing—if you measure peak-to-peak or trough-to-trough—your inflation-adjusted capital gains will average about 2%. If you get caught holding your life savings in equities at the wrong time, you will not recover in your lifetime. Hold that thought until “Valuations.”

“But there is one course of action – one classic mistake – that I most strongly feel is wrong: reaching for return.”

– Howard Marks, founder of Oaktree Capital

How’d I do in 2018? Large physical gold and much smaller silver investments went moderately down (–5% and –15%, respectively). Fixed income finally offered returns without a zero preceding the decimal point, but they’re still pyrrhic gains at best. My TIAA retirement account returns 3.6% per year guaranteed (unless the zombie apocalypse arrives). I am also laddering 2-year treasuries and CDs; reaching any further for yield makes sense only if you’re a diehard deflationist because the yield curve is dangerously flat. To my joy, my former energy position would have cost me another –10% loss had it not been liquidated by my employer. I will get it back when I’m ready—when the next recession is making headlines. All this compares with a –10% return on an S&P index fund.

Here is my maxim: Save to retire, and invest to combat inflation. I have prided myself on saving 20–30% of my gross salary per year, but for the first time ever (including the college tuition years!), my spending exceeded earnings. Adult children are expensive as hell, especially when the youngest spawn is trying to be a non-starving musician and starting a new venture—buying and selling violins.ref 21 (You wanna buy a violin?) You could call the money loans, but that means you’ve never loaned money to your children. Also, being married to a grandmother of three who is armed to the teeth with credit cards and digitally linked to point-and-click purchases of toys and kid’s clothing (Amazon) is quite the experience. I bought her a Jacuzzi for our deck overlooking Cayuga Lake (Figure 3) knowing that she can’t order toys and clothes while while in the tub. I plunged into the antique furniture bear market after a multi-decade hiatus by buying some nice pieces at seriously low prices; those in Figure 4 are emblematic. They will be in my estate, but I’m still hoping they don’t get seriously cheaper. Did I mention the dental implant, which seems almost metaphorical? To top it all off, I got an altogether unexpected 30% hit on annual gross income, which appears to be a one-off event. I see a return to profitability in Q1 2019—the ol’ first-half recovery story.

Read More @ PeakProsperity.com

Loading...