If You Could Design A Perfect World For Gold…

by John Rubino, Dollar Collapse:

Are you sick of your gold just sitting there when it was supposed to have long since made you rich? Have you been fantasizing about a world in which your gold really does make you rich?

If so you’re in good – or at least numerous – company.

So let’s sketch out such a world.

Start by envisioning an America in which a handful of oligopolies have captured banking, media, healthcare and several other important industries, while a tiny group of super-rich neo-aristocrats control as much wealth as the 200 million least-rich citizens.

Toss in a US president who goes out of his way to pick fights which he then proceeds to lose, leading to both falling poll numbers and derisive headlines around the world.

That’s a good start but probably not enough to take gold to its rightful price of $10,000. So let’s add a US opposition party – which, given the above president’s declining popularity, has at least a 50-50 shot at taking power in the next election – that is skewing madly, unprecedentedly to the left. For more on the three most popular Democrats:

Elizabeth Warren proposes ‘wealth tax’ on Americans with more than $50 million in assets

Ocasio-Cortez buzz hits Davos with talk of 70% tax-rate plan

[Socialist frontrunner] Bernie Sanders set to announce 2020 presidential run

Meanwhile, imagine that that same opposition party recently gained control of the branch of Congress that can investigate the President, leading to an escalating battle between legislature and executive that adds an element of legal chaos to what would already have been a presidential campaign of off-the-charts vitriol.

Now that’s a crazy country where gold should be in demand. But it’s just one place. There’s a whole big world out there where gold and silver can trade. For precious metals to truly go to the moon everyone, not just traumatized Americans, has to desperately crave sound money.

So let’s imagine France roiled by violent street protesters with numerous but nebulous aims, forcing a rattled government to ramp up deficit spending on pretty much everything that anyone seems to want. And let’s have misguided but at least emotionally stable German Chancellor Angela Merkel be pushed out of office in favor of no one knows what.

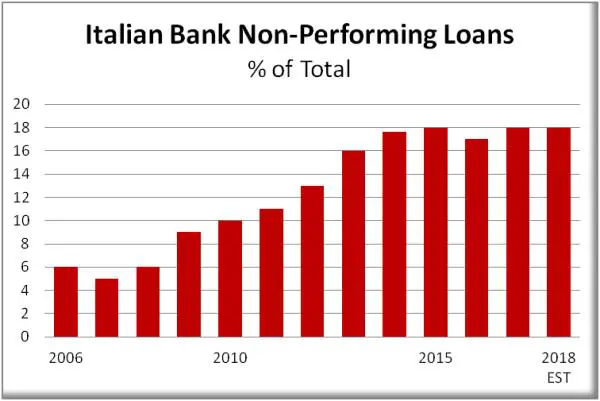

Italy has to be in there somewhere, of course. So let’s pretend its banking system has some insane amount of nonperforming loans. Maybe 18% of total loans – three times what would normally be considered extremely dangerous. We can’t even call that banking system a zombie. Instead let’s go with “persistent vegetative state.”

To sum up our hypothetical Europe, all its current problems require extremely easy money from both governments and the central bank for as far as the eye can see. Negative interest rates and an inflation target of 5% or more will soon be proposed by formerly-rational cabinet ministers and headline writers, and agreed-to by voters.

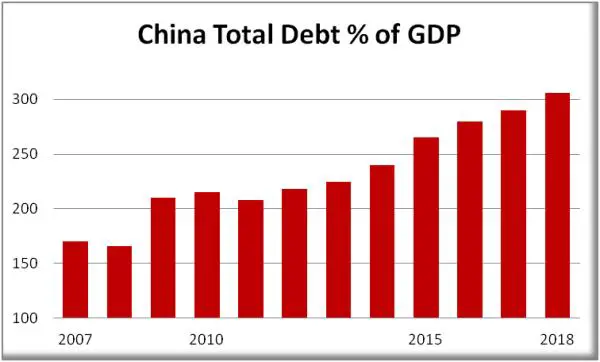

The required level of global chaos is getting close. We just need a dash of…China. Let’s pretend that it has quintupled its debt since 2008, in the course of which it recapitulated three generations of Western financial bubbles in one cycle, apparently without a sense of how those previous bubbles ended. And now it’s running out of new bubbles to inflate even as its growth slows to dangerously low levels.

That should just about do it. So let’s step back and consider our precious metals paradise:

• A US run by a trillion-dollar-deficit spender with an ever-lengthening list enemies at home and abroad, to be followed in 2020 by either more of the same or a bunch of literal, not-trying-to-hide-it socialists who institute wealth taxes, marginal income tax rates reminiscent of 1970s Great Britain and cradle-to-grave free entitlements with only “the rich” expected to cover all the bills — and who love the idea of Modern Monetary Theory, which states that governments should dispense with the whole taxing and borrowing thing and just create as much money as they need. (Can you spot this theory’s fatal flaw in the previous sentence?)

Read More @ DollarCollapse.com

Loading...