The Great Recovery Rewind: How the Federal Reserve’s Balance-Sheet Unwind is Unwinding Recovery

by David Haggith, The Great Recession Blog:

We are in the end time of an unprecedented era of financial expansion — the greatest expansion of the world’s money supply ever attempted, expansion of the Federal Reserve’s vast and unchecked powers far beyond what the Fed could do before the financial crisis, and super-sizing expansion of banks that were already way too big to fail.

I am calling this time in which we are now unwinding this monetary expansion the Great Recovery Rewind because I believe this attempt by the Federal Reserve and other central banks of the world to move us away from crisis banking is taking us right back into economic crisis. That is why this was the top peril listed in my Premier Post, “2019 Economic Headwinds Look Like Storm of the Century.” It is more potent in possible perils than all the trade tariffs in the world.

Even the CEO of one of the Fed’s largest member banks says no one knows what devastating effects the Fed’s unwinding of its balance sheet will cause. JP Morgan Chase’s Jamie Dimon warned that the Fed’s unwind is a massive experiment as untried as the quantitative easing that is being unwound.

“QE has never been done on this scale,” he said. “We cannot possibly know all of the effects of its reversal.”

Jamie Dimon, the chairman and CEO of JPMorgan Chase, is one of many prominent figures in finance who warn that this reversal of direction could send stock prices plummeting and derail the U.S. economic expansion. “I don’t want to scare the public, but we’ve never had QE [before]. We’ve never had the reversal [before]. Regulations are different. Monetary transmission is different. Governments have borrowed too much debt, and people can panic when things change….”

Earlier this year, noted bond fund manager Bill Gross expressed his own concerns about the effect of this unwinding. Last year former Fed Chairman Alan Greenspan warned of a massive bond market bubble that will be deflated in the process….

Former U.S. Treasury Secretary Lawrence Summers says, “tightening involves real dangers and needs to be carried out with great care.”

According to Peter Bockvar, the chief investment officer (CIO) of … Bleakley Advisory Group, “I believe the market … is headed for a brick wall the deeper quantitative tightening gets.”

Ray Dalio, founder of hedge fund Bridgewater Associates, observes that quantitative tightening is bound to produce effects entirely opposite to those from quantitative easing, namely, “higher interest rates, wider credit spreads and very volatile market conditions.”

Sounds like now.

Even the Fed Prez, himself, uses language that casts the Great Recovery Rewind as experimentation:

“We are looking carefully at that [the unwind’s impact on interest rates], and the truth is, we don’t know with any precision,” Fed Chairman Jerome Powell told reporters on Wednesday…. “Really, no one does. You can’t run experiments with one effect and not the other. We’re just going to have to be watching and learning. And, frankly, we don’t have to know today.”

That’s reassuring.

However unprecedented the Great Recovery Rewind is, some outcomes can already be readily extrapolated; and they are playing out as I thought they would.

The withering economic effects of the Great Recovery Rewind

Rising reserve risks. You may recall the Fed pumped up its member bank reserves to make us all more secure in case of runs on banks as we almost saw during the financial crisis of 2007-2009. Now, as you’ll see below, the reserves in the accounts of member banks have been bleeding out faster than red ink in the last days of a failing Ponzi scheme.

For those banks to drain their reserves, the Fed has to reduce its reserve requirements; so the Fed has to be involved in this great reserve flush. It may be allowing this on the basis that it believes the world is more financially secure now, so it thinks the concern about runs on banks is long gone; but we all know from the last financial crisis that the world can become financially insecure in a small window of time, while the scars from an economic crash can endure a lifetime.

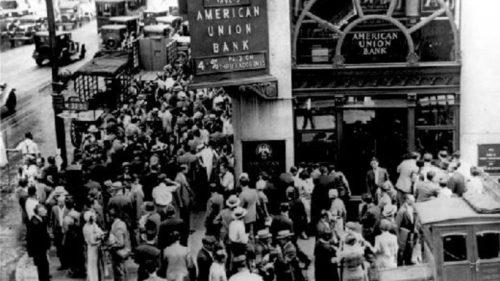

This photo dated October 24th, 1929, shows a view of people rushing to a saving bank in Millbury, Massachusetts as the stock market on Wall Street crashed, sparking a run on banks that spread across the country.

This photo dated October 24th, 1929, shows a view of people rushing to a saving bank in Millbury, Massachusetts as the stock market on Wall Street crashed, sparking a run on banks that spread across the country.Compounding US government debt. One of the side-effects of the Fed sucking money out of the global monetary system is that the Fed used to roll over its holdings in US treasuries by purchasing more at an incredibly low interest rate for the US government. The government is now forced to sell a lot more treasuries in auctions to its primary dealers (member banks in the Federal Reserve System) without the Fed backstopping that by sucking them all up.

That presses the government to either pay higher interest on its treasuries to attract new buyers or raise less money with each $1,000 bond it issues. (Say, sell a $1,000 bond for $945, instead of $950.) Either results in higher yields on government bonds. (See: “BOND PRIMER: What is the difference between bond yield, bond interest, and bond price?“) That accelerates the government debt vortex.

Interest impact. Here’s another side effect that justifies calling this time the Great Recovery Rewind: Because government bonds are foundational in the credit market, higher yields on government bonds result in higher interest on all kinds of things, including home mortgages and auto loans. On large items, people shop payments, so those items are now less affordable. Therefore …

Housing Collapse 2.0 and Carmageddon. Rising interest is already taking us into another housing crisis and Carmageddon. I’ve been writing about these as the first major industries that will get the impact of the Fed’s Great Recovery Rewind. (My next article will show how deeply into a new housing crisis we have already fallen, and we’ve all heard about the number of automobile factories closing in the US.)

I think there is an insidious way rising mortgage interest is taking down the housing market besides just making houses more expensive. While mortgage applications are down by almost half due to rising interest, an even more interesting development is that the percentage of applications that are getting approved is also down by about half.

With total applications being down, you’d think banks would be inclined toward approving a higher percentage of the apps they get. So, why are they approving a lower percentage from an already much smaller stack of applicants? Losing half of your applicants and then cutting the percentage of those that get accepted in half is a 75% drop in approved loans! (See Business Insider‘s “Americans stopped buying homes in 2018, mortgage lenders are getting crushed, and an economic storm could be brewing.“)

Here is what I think is happening: Banks don’t usually issue loans to carry them until they are paid off. They issue them to resell them to other banks and investors. In terms of the loan resale market, loans are somewhat like bonds. In the same way that the bond you hold falls in resale value (price) when bond interest on other bonds is rising, fixed-interest loans a bank issues today will be worth less when it resells them in a month if interest rates are rising quickly. (Who’ll want to buy that loan when they can buy one that pays higher interest?)

Even if a bank plans to carry the loan itself, it might think it makes more sense to wait another month or two to loan out its money at an eighth-of-a-percent more interest for the next thirty years than to loan it out now if it is certain rates will rise that much in a short time. (Or it might just want to use its money to buy and hold those risk-free government bonds now that interest is getting interesting again!)

A full rewind back into the housing market collapse that began in 2007 could be readily foreseen as an obvious effect of the Fed’s tightening because 1) tightening after a period of sloppy easing triggered the last collapse; and 2) one of the reasons the Fed gave for buying government treasuries was to reduce mortgage interest and other long-term interest specifically to prop the housing market back up and stimulate the economy.

This is why I’ve repeatedly maintained that, when the props are pulled, we’ll fall back into the same recession. It took total denial to believe doing the opposite would not have the opposite effect. We have seen the opposite effect happening with long-term interest ever since the Fed began its balance-sheet unwind. Falling back into the same pit by winding back what we did to get out of the pit is why I call this the Great Recovery Rewind.

Hence, my prediction a couple years ago of a major stock market upset last January (as began in the last week of January) with a much worse one in the fall of 2018 when the Fed would hit full Recovery Rewind speed. (O.K., I also said something big would happen in the summer with stocks, and not much did, except the deFAANGing of the high-tech market that drove the bull market for a decade.) That’s why I was so certain of the timing of these stock market’s major plunges turns and of the summer start of a repeat crisis in housing and automobiles that certainly materialized.

Stock drop. This brings us to another inevitable side effect of the Federal Reserve’s Great Recovery Rewind — loss of stock values. Think about it: Another one of the main reasons the Fed eventually admitted for hoovering up government bonds was to save us from the 50% crash in stock values that happened between 2007 and 2009. It did this by taking interest so low on bonds that it pushed investors into riskier assets in order to make money. In the process, this created money in bank reserve accounts that banks could use to buy those riskier assets. That worked.

Read More @ TheGreatRecession.info

Loading...