Plane Crash Sparks Stock Buying-Panic That Ends Transports Longest Losing Streak In 47 Years

Was the appearance of Powell, Yellen, and Bernanke the reason why the markets went panic-bid today? Seems like it should be the opposite signal?

After a brief dip on Friday, China went full bulltard once again - despite a dramatic slowdown in total social financing growth - with CHINEXT up a stunning 4.4%!!

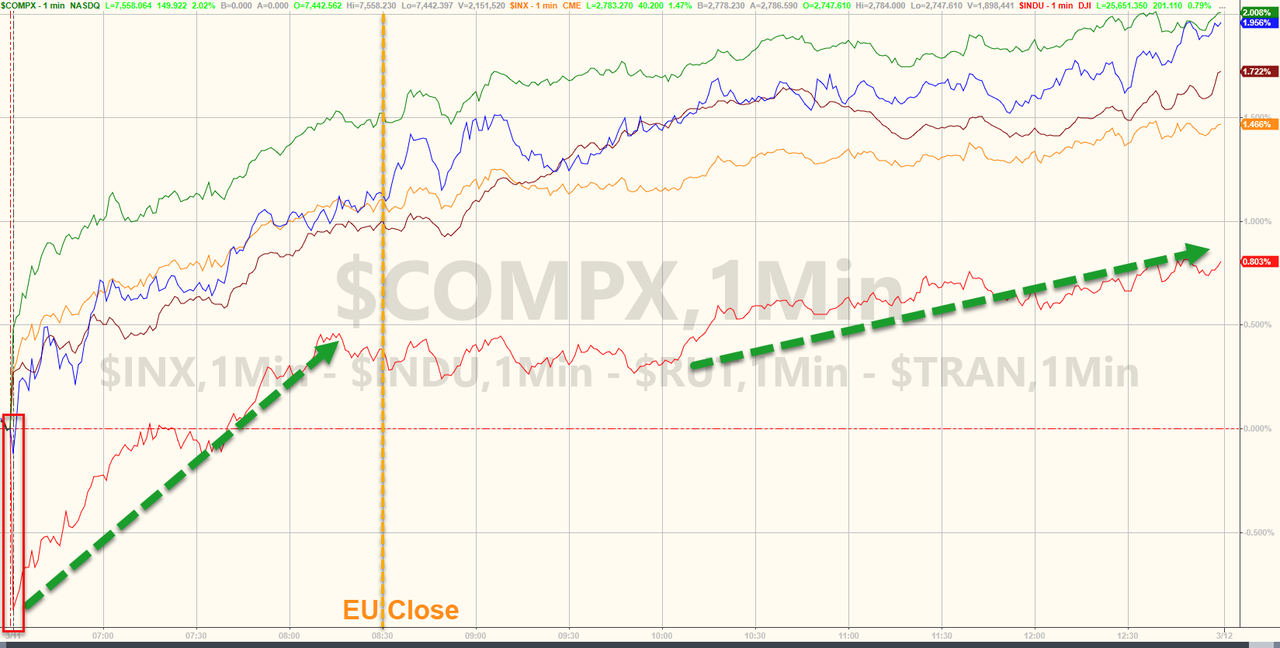

European markets refused to follow China's lead BUT went bid after US cash markets opened...

US Markets are best visualized from the futures market as the divergence between The Dow (down on Boeing) and the S&P/Nasdaq was clear overnight until the cash open when everything went panic bid until the EU close...

Nasdaq was the day's big winner on the cash side... Trannies surged on the day - the first rally day in the last 12 days and breaking the longest losing streak since 1972...

Boeing's plunge (737 max crash) was offset somewhat by Apple's surge (BofA updgrade) to rescue the Dow (best gain of the day)...AAPL added 40 points to the Dow, BA cut 175pts.

Dow futures pushed around 450 points off its intraday lows!!!

S&P broke back above its 200DMA (but remains well below the 2800ish level) and Nasdaq also broke back above its 200DMA

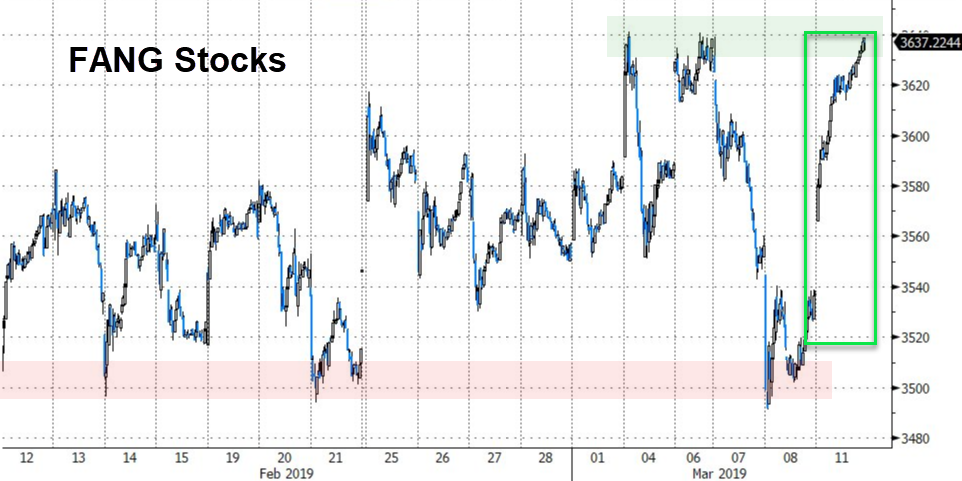

FANG Stocks drove the surge in Nasdaq (and AAPL)...

Buyback-related stocks soared today - erasing Friday's losses...

And yet another short-squeeze...

There has been a lot of hand-wringing over the underperformance of transports and semis in the last few weeks. Today that was all dismissed as both industries soared (despite another Boeing crash and no semi-related catalysts)...

However, not all is awesome. As Bloomberg notes, if today's U.S. stock rebound -- after the worst week of 2019 -- is to continue, it has to overcome a roadblock of negative momentum, not to mention the wall of resistance from 2,800-2,815.

And just like that, VIX was crushed and credit spreads collapsed...

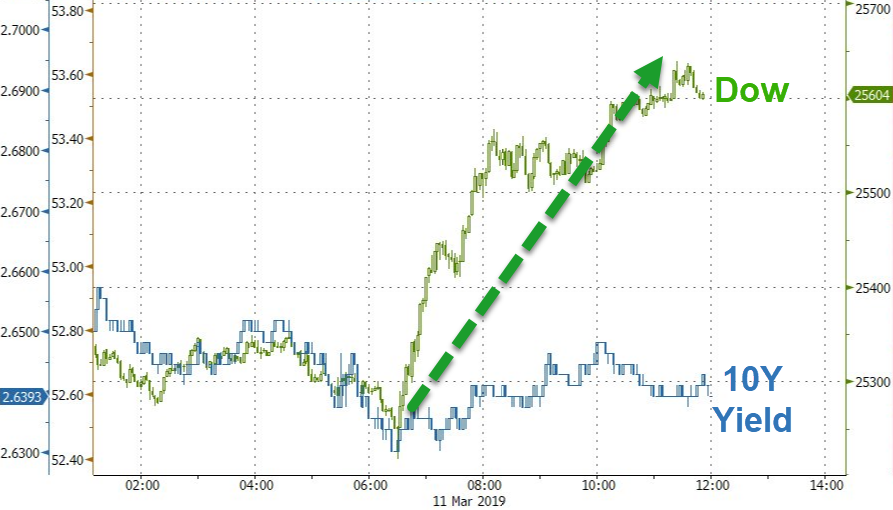

Stocks and bonds completely decoupled at the cash open...

Treasury yields rose very modestly...

30Y remains above 3.00% but is coiling...

The Dollar Index (DXY) faded for the second day in a row but held above the key 97.00 handle...

Cable rebounded - on no good news (lawmakers in the U.K. will vote Tuesday on PM May’s Brexit deal for a second time in two months before the Mar 29 deadline for exiting the EU) - after its worst losing streak since May...

While the dollar has dropped the last two days, yuan has been flat...

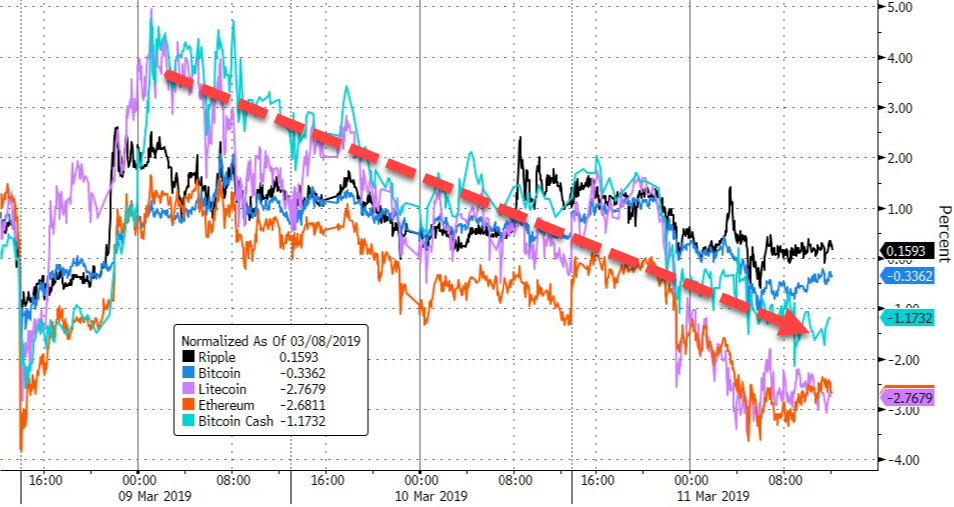

Cryptos slid from Saturday highs...

Despite dollar weakness, PMs were sold as copper and crude were bid...

WTI tagged $57.00 0twice and failed and Gold broke below $1300 early and never looked back...

Finally, spot the difference...

(hint: it's not the economic outlook or bonds!!)

The official narrative for today's gains is as follows: "U.S. stocks rebounded from the worst week of the year as chipmakers rallied on deal news and the latest retail-sales data boosted confidence that the economy isn’t headed for a downturn.."

To which we respond via David Rosenberg (and note that this was still the biggest 2mo drop in retail sales in a decade)...

What a retail sales report! 4 months in a row of decline in furniture/home furnishings; 5 months of decline in electronics/appliance sales; clothing at a 10-month low; gas sales at a 15-month low; electronics at an 18-month low; furniture at a 20-month low. All shutdown related?

— David Rosenberg (@EconguyRosie) March 11, 2019