European Alternate Payment System to Circumvent US Iran Sanctions Nearly Ready

by Peter Schiff, Schiff Gold:

A European payment system set up to circumvent US sanctions on Iran will be ready soon, according to German Foreign Minister Heiko Maas.

This is yet another move in a global effort to minimize dependence on the US dollar.

According to an Al Jazeera report, Maas recently met with Iranian President Hassan Rouhani and Foreign Minister Mohammad Javad Zarif in Tehran in an effort to salvage the nuclear arms deal negotiated in 2015. Pres. Trump withdrew the US from the agreement last year.

The new payment system called INSTEX (Instrument in Support of Trade Exchanges) will allow France, Britain and Germany, along with other EU nations, to continue trade with Iran outside of the dollar-based SWIFT payment system. When EU foreign policy chief Federica Mogherini announced the plan, she said the new payment channel would allow companies to preserve oil and other business deals with Iran despite US sanctions.

In practical terms, this will mean that EU member states will set up a legal entity to facilitate legitimate financial transactions with Iran and this will allow European companies to continue to trade with Iran in accordance with European Union law and could be open to other partners in the world.”

The “special purpose vehicle” will serve as a clearinghouse for transactions with Iran. An Al Jazeera reporter explained it this way:

If the Italians want to buy some Iranian oil, they will wire the money to this entity which will then handle the financial transactions from there and vice versa. There will be no involvement of commercial banks and central banks, both of whom are terrified at the prospect of US retribution if they are seen to be going against US sanctions.”

Maas said the new payment system would soon be ready after months of work.

This is an instrument of a new kind so it’s not straightforward to operationalize it. But all the formal requirements are in place now, and so I’m assuming we’ll be ready to use it in the foreseeable future.”

The Russians have already developed an alternative payment system that has reportedly surpassed SWIFT in popularity within that country. According to the Central Bank of Russia, 416 Russian companies and government organizations had joined the System for Transfer of Financial Messages (SPFS) as of September.

Weaponizing the Dollar

The United States has taken advantage of the fact that the dollar serves as the world reserve currency by using it as leverage to achieve its foreign policy goals.

In effect, the US has weaponized the dollar.

The fact that the global system facilitating financial transactions uses the dollar gives the US a great deal of economic and geopolitical leverage. The Society for Worldwide Interbank Financial Telecommunication (SWIFT) enables financial institutions to send and receive information about financial transactions in a secure, standardized environment. Since the dollar is the world reserve currency, SWIFT facilitates the international dollar system.

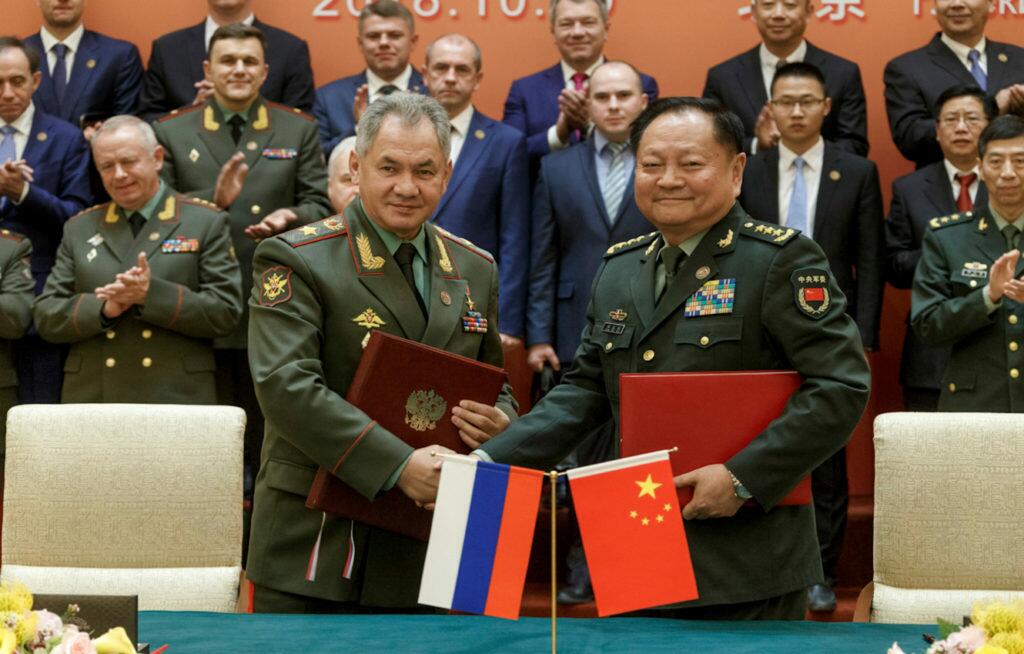

In 2014 and 2015, the US blocked several Russian banks from SWIFT as relations between the two countries deteriorated. Last fall, the US threatened to lock China out of the dollar system if it didn’t follow UN sanctions on North Korea.

In order to shake loose from US control, we’re seeing these efforts to limit exposure to the US dollar by setting up alternative payments systems and financial channels that don’t rely on the greenback.

In addition to the alternative payment system that they’ve already set up, the Russians are also considering a gold-backed cryptocurrency. And last year, China launched its much anticipated yuan-denominated oil futures contract.

Meanwhile, central banks have gone on a gold-buying spree. So far in 2019, central banks globally have added 207 tons of gold to their reserves. This continues a trend we saw through 2018. In total, the world’s central banks accumulated 651.5 tons of gold last year. The World Gold Council noted that 2018 marked the highest level of annual net central bank gold purchases since the suspension of dollar convertibility into gold in 1971, and the second highest annual total on record.

Loading...