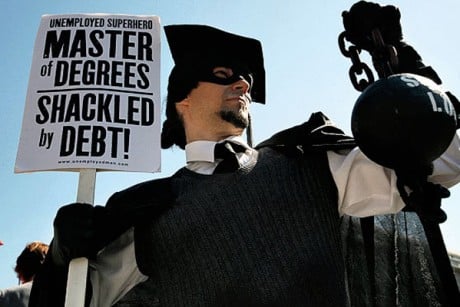

U.S. TEEN FLEES TO AVOID STUDENT LOAN REPAYMENT: “I HAD TO ESCAPE THIS DEBTORS’ PRISON!”

by Mac Slavo, SHTF Plan:

An American teenager fled the country in 2011 to avoid repaying student loans he took out to complete a college education. This isn’t the first time this has happened, and it certainly won’t be the last.

Stories of crippling student loan debt are not new, however, the idea that one can escape their obligation to repay the money they’ve borrowed is a symptom of the massive irresponsibility running rampant in our culture and propagated on a daily basis.According to the New York Post, a Pennsylvania man bought a one-way ticket to China to leave his financial woes behind after four years of job searching has gotten him nowhere in the United States.

Of course, no one held a gun to this man’s head and forced him to take out loans.

The Hill recently reported that Trump’s “regulatory rollbacks” would boost the chances of another recession. Trump’s administration has been wiping out measures designed to prevent consumers from being ensnared in unsustainable debt and, at the same time, eliminating borrowers’ ability to seek court-ordered relief when they are.

Just because Trump removes some regulations doesn’t mean people will go out and overburden themselves with debt, and if they do, they should have to face the consequences. Personal responsibility would go far in ensuring we have a free society, however, it certainly seems like most Americans would simply rather have their decisions made for them and then blame others when they make a bad choice. –SHTFPlan

“I had to escape this debtors’ prison. It felt like there was no other choice,” Chad Albright told the York Daily Record. “That’s what America became to me, a prison. So I left.” But it was a prison of Albright’s own making. “I wanted that diploma, and I was willing to work for it,” Albright told the newspaper. “Everyone always told me it would be worth it.” But no one apparently explained that if you take someone else’s money and sign a contract saying you’ll repay it that eventually, they will come for their money. This really isn’t rocket science, but supposedly needs to still be explained.

After graduating with a degree in public relations in 2007, at the start of the Great Recession, Albright found to his dismay that job offers were not exactly pouring in.

During interviews, he said he heard the same line from prospective employers: “Sorry, there’s someone who’s been doing this for 10 years and just lost their job. I have to go with someone who has 10 years’ experience.”

He recalled: “But the last thing they would say to me, ‘Don’t worry, your day will come.’”

The despondent man moved back to parents’ place in Lancaster, where he said he fell into a deep depression.

“I was expected to make a $400 loan payment every month, but I had no money, no sustainable income. College ruined my life,” he said.

“Two years of nonstop interviews and nothing. I was so done.” –The New York Post

If he could do things over, he said he would have skipped the degree and taken a course online to learn about computer programming. “I’ve accepted that this is my life now,” Albright said. “College ruined my life to the fullest extent, and my life is a constant reminder of that.”

Albright is now a permanent resident in Ukraine working in sales and hasn’t checked his student loan balance in over eight years. “I’m happy to be away from my debt, but I’m lonely most of the time,” Albright said. “I don’t really have other options at this point, though,” the 39-year-old said.

It’s unfortunate that our society is doing a great disservice to those who chose to go to college. The government’s entrance into the student loan business exaggerated the prices to attend school and the constant bombardment of the sentiment that “you can’t get by without a college degree” is failing far too many.

Loading...