Merger Mania in the Military Industry

by Gareth Porter, Consortium News:

Lockheed Martin’s government contracts rival the operating budget of the State Department, writes William D. Hartung. And now it’s about to have company.

Lockheed Martin’s government contracts rival the operating budget of the State Department, writes William D. Hartung. And now it’s about to have company.

When, in his farewell address in 1961, President Dwight D. Eisenhower warned of the dangers of the “unwarranted influence” wielded by the “military-industrial complex,” he could never have dreamed of an arms-making corporation of the size and political clout of Lockheed Martin. In a good year, it now receives up to $50 billion in government contracts, a sum larger than the operating budget of the State Department. And now it’s about to have company.

Raytheon, already one of the top five U.S. defense contractors, is planning to merge with United Technologies. That company is a major contractor in its own right, producing, among other things, the engine for the F-35 combat aircraft, the most expensive Pentagon weapons program ever. The new firm will be second only to Lockheed Martin when it comes to consuming your tax dollars — and it may end up even more powerful politically, thanks to President Donald Trump’s fondness for hiring arms industry executives to run the national security state.

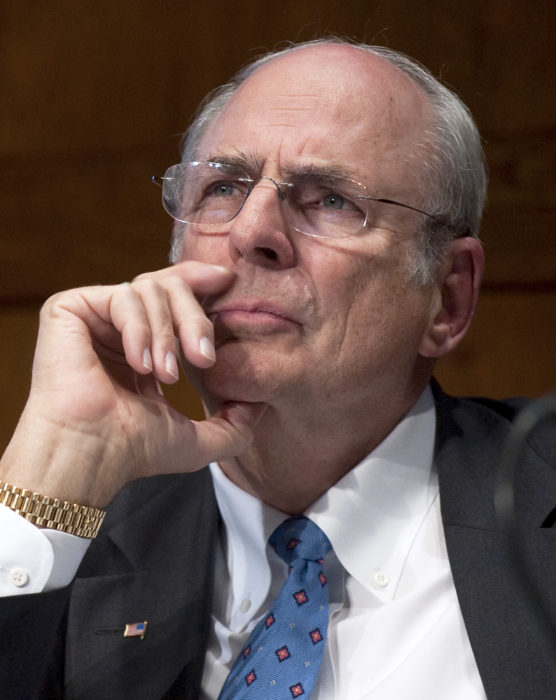

Esper: Raytheon’s former top lobbyist. (DoD/Edward Lopez)

Just as Boeing benefited from its former Senior Vice President Patrick Shanahan’s stint as acting secretary of defense, so Raytheon is likely to cash in on the nomination of its former top lobbyist, Mike Esper, as his successor. Esper’s elevation comes shortly after another former Raytheon lobbyist, Charles Faulkner, left the State Department amid charges that he had improperly influenced decisions to sell Raytheon-produced guided bombs to Saudi Arabia for its brutal air war in Yemen. John Rood, third-in-charge at the Pentagon, has worked for both Lockheed Martin and Raytheon, while Ryan McCarthy, Mike Esper’s replacement as secretary of the Army, worked for Lockheed on the F-35, which the Project on Government Oversight (POGO) has determined may never be ready for combat.

And so it goes. There was a time when Donald Trump was enamored of “his” generals — Secretary of Defense James Mattis (a former board member of the weapons-maker General Dynamics), National Security Advisor H.R. McMaster, and White House Chief of Staff John Kelly. Now, he seems to have a crush on personnel from the industrial side of the military-industrial complex.

As POGO’s research has demonstrated, the infamous “revolving door” that deposits defense executives like Esper in top national security posts swings both ways. The group estimates that, in 2018 alone, 645 senior government officials — mostly from the Pentagon, the uniformed military, and Capitol Hill — went to work as executives, consultants, or board members of one of the top 20 defense contractors.

Fifty years ago, Wisconsin Senator William Proxmire identified the problem when he noted that:

“the movement of high ranking military officers into jobs with defense contractors and the reverse movement of top executives in major defense contractors into high Pentagon jobs is solid evidence of the military-industrial complex in operation. It is a real threat to the public interest because it increases the chances of abuse… How hard a bargain will officers involved in procurement planning or specifications drive when they are one or two years away from retirement and have the example to look at of over 2,000 fellow officers doing well on the outside after retirement?”

In other words, that revolving door and the problems that go with it are anything but new. Right now, however, it seems to be spinning faster than ever — and mergers such as Raytheon-United Technologies are only likely to feed the phenomenon.

A Raytheon Tomahawk Block IV cruise missile during flight test at NAWS China Lake, California, 2002. (U.S. Navy via Wikimedia Commons)

The Last Supper

The merger of Raytheon and United Technologies should bring back memories of the merger boom of the 1990s, when Lockheed combined with Martin Marietta to form Lockheed Martin, Northrop and Grumman formed Northrop Grumman, and Boeing absorbed rival military aircraft manufacturer McDonnell Douglas. And it wasn’t just a matter of big firms pairing up either. Lockheed Martin itself was the product of mergers and acquisitions involving nearly two dozen companies — distinctly a tale of big fish chowing down on little fish. The consolidation of the arms industry in those years was strongly encouraged by Clinton administration Secretary of Defense William Perry, who held a dinner with defense executives that was later dubbed “the last supper.” There, he reportedly told the assembled corporate officials that a third of them would be out of business in five years if they didn’t merge with one of their cohorts.

The Clinton administration’s encouragement of defense industry mergers would prove anything but rhetorical. It would, for instance, provide tens of millions of dollars in merger subsidies to pay for the closing of plants, the moving of equipment, and other necessities. It even picked up part of the tab for the golden parachutes given defense executives and corporate board members ousted in those deals.

Norman Augustine in 2009. (NASA/Paul E. Alers)

The most egregious case was surely that of Norman Augustine. The CEO of Martin Marietta, he would actually take over at the helm of the even more powerful newly created Lockheed Martin. In the process, he received $8.2 million in payments, technically for leaving his post as head of Martin Marietta. U.S. taxpayers would cover more than a third of his windfall. Then, a congressman who has only gained stature in recent years, Representative Bernie Sanders (I-VT), began to fight back against those merger subsidies. He dubbed them“payoffs for layoffs” because executives got government-funded bailouts, while an estimated 19,000 workers were laid off in the Lockheed Martin merger alone with no particular taxpayer support. Sanders was actually able to shepherd through legislation that clawed back some, but not all, of those merger subsidies.

According to one argument in favor of the merger binge then, by closing half-empty factories, the new firms could charge less overhead and taxpayers would benefit. Well, dream on. This never came near happening, because the newly merged industrial behemoths turned out to have even greater bargaining power over the Pentagon and Congress than the unmerged companies that preceded them.

Draw your own conclusions about what’s likely to happen in this next round of mergers, since cost overruns and lucrative contracts continue apace. Despite this dismal record, Raytheon CEO Thomas Kennedy claims that the new corporate pairing will — you guessed it! — save the taxpayers money. Don’t hold your breath.

Read More @ ConsortiumNews.com

Loading...