DEUTSCHEBANK, DERIVATIVES, AND DOMINOS

by Joseph P. Farrell, Giza Death Star:

There’s an important article over at Zero Hedge that was shared by V.T., and I have to pass it along, because it highlights a problem that during the last few years has become lost in the shuffle: derivatives. These, as the article points out, are at the heart of the problem. Here’s the story:

A Bank With $49 Trillion In Derivatives Exposure Is Melting Down Before Our Eyes

What’s worth paying attention to here is the following:

Deutsche Bank is the most important bank in all of Europe, it has 49 trillion dollars in exposure to derivatives, and most of the largest “too big to fail banks” in the United States have very deep financial connections to the bank. In other words, the global financial system simply cannot afford for Deutsche Bank to fail, and right now it is literally melting down right in front of our eyes. For years I have been warning that this day would come, and even though it has been hit by scandal after scandal, somehow Deutsche Bank was able to survive until now. But after what we have witnessed in recent days, many now believe that the end is near for Deutsche Bank. On July 7th, they really shook up investors all over the globe when they laid off 18,000 employees and announced that they would be completely exiting their global equities trading business…

It takes a lot to rattle Wall Street.

But Deutsche Bank managed to. The beleaguered German giant announced on July 7 that it is laying off 18,000 employees—roughly one-fifth of its global workforce—and pursuing a vast restructuring plan that most notably includes shutting down its global equities trading business.

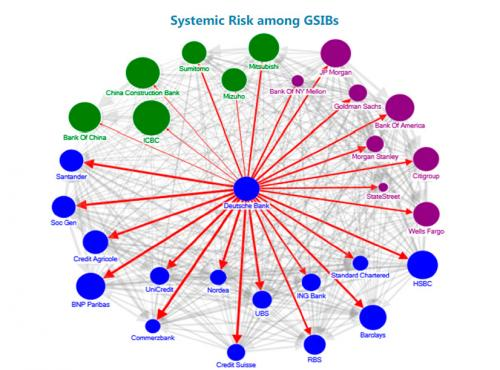

So that’s the first thing to note: Deutschebank’s derivatives book is intimately tied to those of other major banks. And to drive the point home, the article includes a helpful diagram:

ZBut the important fact to remember is that Deutsche Bank traded these derivatives with other financial firms. So, is this going to be another Lehman Brothers situation whereby one bank’s problems becomes other banks’ problems?

Pay close attention to this.

If the situation gets out of hand, the Federal Reserve and other central banks will have no choice but to cut interest rates even if it’s not the best thing for the world economies.

In particular, some of the largest “too big to fail banks” in the United States are “heavily interconnected financially” to Deutsche Bank. The following comes from Wall Street On Parade…

We know that Deutsche Bank’s derivative tentacles extend into most of the major Wall Street banks. According to a 2016 reportfrom the International Monetary Fund (IMF), Deutsche Bank is heavily interconnected financially to JPMorgan Chase, Citigroup, Goldman Sachs, Morgan Stanley and Bank of America as well as other mega banks in Europe. The IMF concluded that Deutsche Bank posed a greater threat to global financial stability than any other bank as a result of these interconnections – and that was when its market capitalization was tens of billions of dollars larger than it is today.

Until these mega banks are broken up, until the Fed is replaced by a competent and serious regulator of bank holding companies, and until derivatives are restricted to those that trade on a transparent exchange, the next epic financial crash is just one counterparty blowup away. (Italicized emphasis added)

You’ll note in this diagram the connection to BNP Paribas, the French banking giant. Recall that I blogged a few days ago about how BNP Paribas wanted to step into the “equities” (and we’re stretching that term here, which I’ll explain in a moment) trading that Deutschbank was exiting. In other words, the derivatives ball in this three card monte game is simply being shifted from one node in the diagram, to another. The source of all of this financial woe is something that dropped right out of the discussion after the 2008 bailouts: derivatives. Just exactly what are these, and why are they so important. To a certain extent, I detailed this problem in my book Babylon’s Banksters, but to put this phenomenon very simplistically, derivatives are tranches or bundles of securities which are then marketed and sold as bundles between major banks. These bundles include mortgages, stocks, bonds, and something called “credit defaults,” which is a security against a borrower defaulting on a loan. Think counterparty. Now here’s the game: as these bundles are bought and sold, they can be entered as assets on a bank’s balance sheet. They can then be bundled with other bundles, and bought and sold, and those can be entered on a balance sheet as assets, as these bundles are re-bundled, we get more and more derivatives of the original bundle. In other words, it’s a balloon full of a lot of hot air. The difficulty is that these bundles contain so many securities (many of them derivatives) of different types, that few people have focused on the actual contents of these instruments. That’s called a material omission, folks, and it’s such a gigantic one it’s literally stunning and shocking to understand that few banks, if any, ever fully scrutinized each bundle it was buying and selling. As the article points out, this has had the following effect:

A derivatives book of $49 trillion notional puts Deutsche Bank in the same league as the bank holding companies of U.S. juggernauts JPMorgan Chase, Citigroup and Goldman Sachs, which logged in at $48 trillion, $47 trillion and $42 trillion, respectively, at the end of December 2018 according to the Office of the Comptroller of the Currency (OCC).

In other words, using these figures, that’s $186,000,000,000,000 in derivatives, just among JP Morgan Chase, Citigroup, Deutschebank, and Goldman Sachs alone, or, to put a different point on it, that’s about 20% of $1,000,000,000,000,000, a quadrillion dollars. Factor in all the other banks in that diagram above, and you’re approaching that 14 to 17 quadrillion dollar figure for the amount of derivatives the banks ballooned prior to 2008. That’s several times the gross domestic product of the entire planet. And again, most of that is in derivatives, those bundles and bundles of bundles, whose actual contents are not well known. And remember something else very significant: most of the trading in these bundles is being conducted by algorithms and computers, not humans. Indeed, computers were used to create the bundles, and then to rate them.

Loading...