How’s That Recession Coming, Dave?

by David Haggith, The Great Recession Blog:

Pretty good if you ask me. Most economic indicators this year have moved relentlessly in the direction of recession, and now the Cass Freight Index is saying a US recession may start in the 3rd quarter, fitting up nicely to my prediction that we would be entering recession this summer.

Cass comes on board

The Cass Freight Index is one of the most robust proxies for the US and global economies there is. If freight isn’t moving, the economy is dying. As Cass says, their’s is a simple, fundamental approach to encapsulating the economy:

As we try to navigate the ebb and flow of the economy, we don’t pretend to have any ‘secret sauce’ or incredibly complex models that have exhaustively analyzed every data point available. Instead, we place our trust in the simple notion that the movement of tangible goods is the heartbeat of the economy, and that tracking the volume and velocity of those goods has proven to be one of the most reliable methods of predicting change because of the adequate amount of forewarning that exists.

The Cass Freight Index has now been negative for eight months, marking 2019 as a year of recessionary decline. Cass Information Systems notes they have been highly reserved in stating the index reveals a recession is now because the index periodically goes negative without the US going into recession, but they also note the weakness has rarely gone as deep as this time or spanned so many modes of transportation.

We are concerned about the severe declines in international airfreight volumes (especially in Asia) and the ongoing swoon in railroad volumes, especially in auto and building materials.

Are not Carmageddon and a new housing crisis two areas I have been saying for the last 2-3 years would be helping take us into recession, along with the Retail Apocalypse (also hugely reflected in freight)? Have I not been saying all year the trade with Asia due to the Trump Trade War is going exacerbate the problem?

While it is rare for Cass to come right out and say they believe we may now already be in the first quarter of a recession; here they do:

Bottom line, more and more data are indicating that this is the beginning of an economic contraction. If a contraction occurs, then the Cass Shipments Index will have been one of the first early indicators once again.

As “economic contraction” is synonymous with “economic recession,” Cass is now fully on board with my view (not that they know my view). As they consider their index one of the first indicators to come in with a “recession is now” view, I consider myself one of the first to have placed recession starting as early as this summer as well — a prediction over which many people on other websites still stridently argue with me. They are welcome to their view, but I am holding unwaveringly to mine, even as summer is now half over.

Now I have Cass on my side of the table.

Yield curve inversion moves solidly to recession indicator

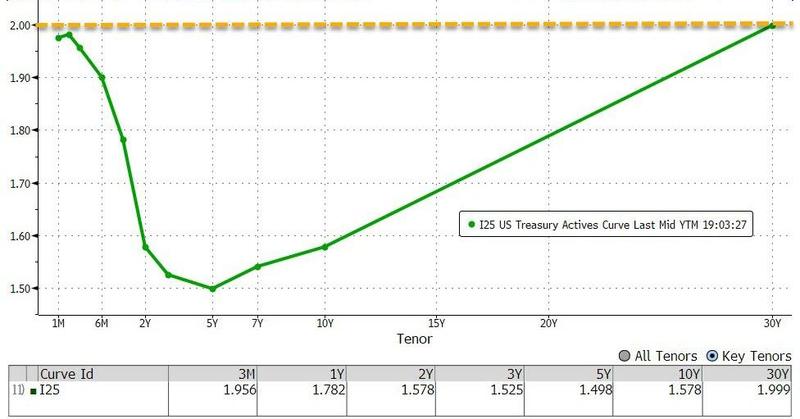

I’ve written a lot about how reliably the yield curve indicates a recession, so I won’t go into explaining here how that works. The curve typically inverts months ahead of a recession, and the curve first inverted last fall. For those hoping this time might be different, I’ll note that this time isexceptional in that the 30-year yield has now reached all-time lows and is lower than the 3-month yield and even lower than the Fed Funds Rate.

My, how the mighty have fallen! Only ten months ago, the 30-year was trading at 3.46%. Now it’s below the Fed’s bottom target interest rate, scraping along at 1.97%? What is exceptional, then, is how extreme the inversion is because the 3-month-over-30-year curve has inverted at the lowest interest rates ever. Ten months ago, the Fed was trying to raise interest rates. Since then rates fell off a cliff with the Fed doing nothing to lower them. It merely stopped trying to raise them. This is where the market has taken them on its own. Does that sound like the Fed is in control of anything?

One more thing that is different this time? For the first time ever, the entire US treasury yield curve is inverted!

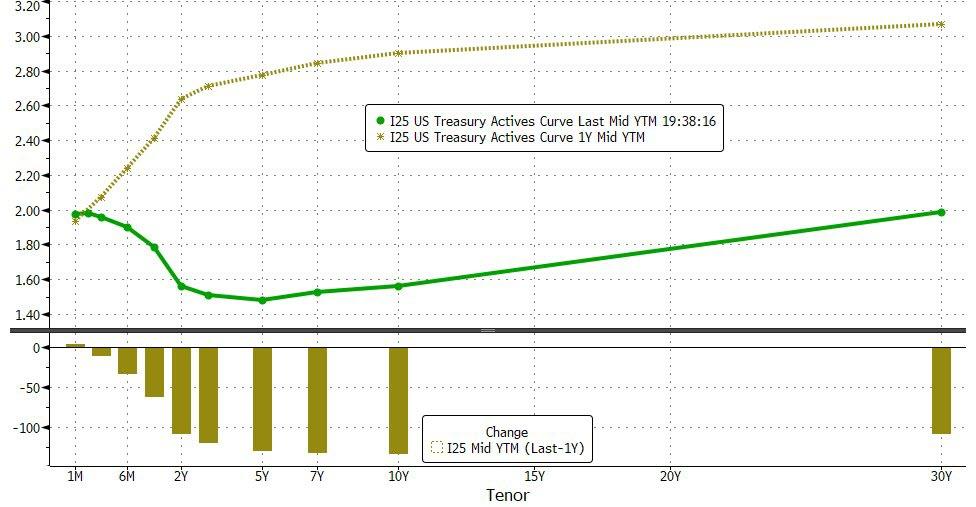

As ZH noted, “What a difference a year makes”:

I’m just going to take a bold stab at this and say, I don’t think this exception is likely a positive! The exceptional low yield on 30s could indicate a lot of money is running a long way out to find safe haven for a long time to come. If the size of the inversion means anything, it will match up to the size of the recession that is coming with it. If you have swum in the ocean, you know how, when you feel a huge trough around you, you’re going to turn around and see a huge wave coming right behind it. This is that.

The extent of this mammoth yield-curve inversion and the low level at which it is happening also indicates the economy is so fundamentally weak it cannot function, except at extreme low interest all across the board!

According to Donald Trump, however, the economy is thriving, and you should be ignoring this sign. The graph above is where a year of Trumponomics gets you OR where the Fed’s attempt to unwind its recovery efforts gets you. Or, as I think, it is where the Fed gets you and where Trumponomics leaves you because the Trump Tax Cuts were unable to push up the trough the Fed created when it started its Great Recovery Rewind.

Read More @ TheGreatRecession.info

Loading...