Indian Gold-Loan Volume Explodes Amid Banking Sector Credit Crisis

from ZeroHedge:

India’s $42 billion shadow-banking system has been cracking since the country’s largest infrastructure lenders halted debt repayments in 2018.

Confidence in these banks has since tumbled, with the latest fears resurfacing in June when a primary mortgage lender delayed bond interest payments, indicting credit markets are freezing across the country.

The situation has led to a rapid rise in borrowing costs, forcing non-bank financial companies (NBFC) to tighten lending practices. This has stressed out Indian consumers, who are desperate for loans, now willing to pledge and or even sell their gold for lines of credit.

Reuters interviewed Indian farmer Babasaheb Mandlik, who was refused a farm loan from a major state-run lender; he was forced to pawn his wife’s gold jewelry as collateral so that he could use the funds to manage his 8-acre cotton farm in western India.

“Pawning the jewelry was a difficult decision as my wife likes to wear it at festivals and weddings,” 50-year-old Mandlik told Reuters.

“I convinced her that we didn’t have any other option.”

Mandlik isn’t the only one. Pawning or selling gold for bank loans has been an increasing trend amid a severe credit crunch and an economic slowdown that began last summer.

Several lenders told Reuters that demand for loans collateralized by gold is unprecedented at the moment, it’s the only way banks in some parts of the country will give out money to people.

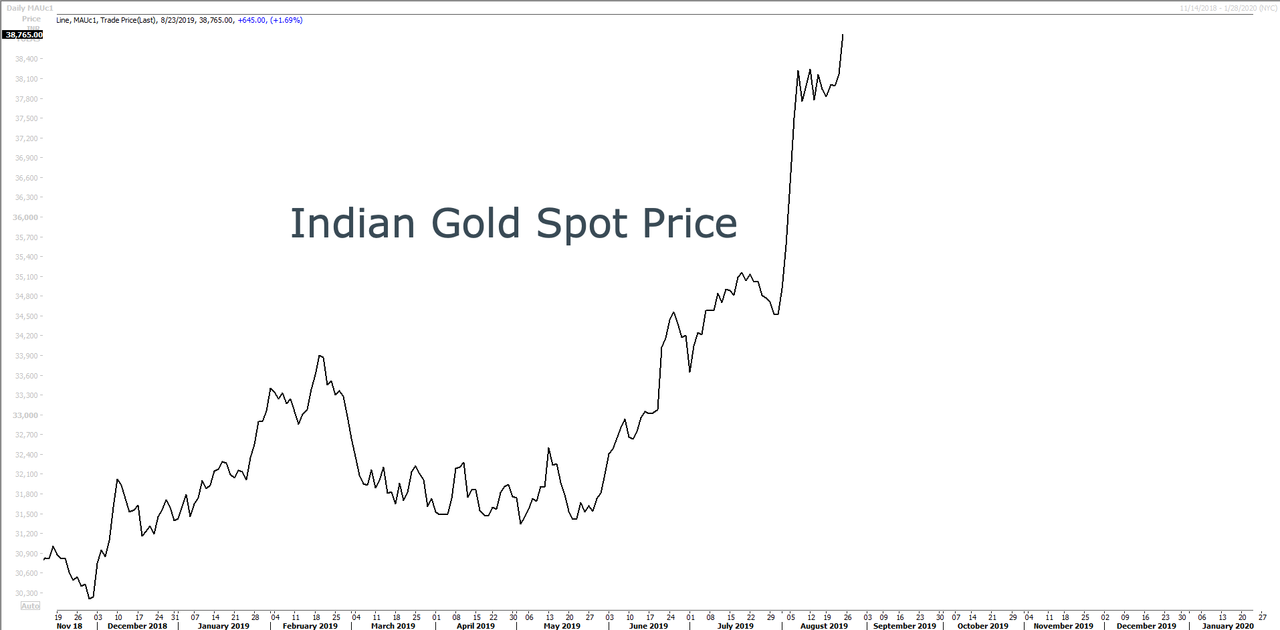

The credit crunch, which has prompted some lenders to impose restrictions as risks and borrowing costs rise, has been accelerated by record gold prices.

Domestic gold prices have jumped by 25% this calendar year, hitting a record high of 38,765 rupees ($543) per 10 grams earlier this month.

“As a lot of NBFCs have become cautious of giving unsecured or even secured loans, we are seeing more customers opting for gold loans instead,” said Sumit Bali, chief executive officer of IIFL Finance.

“One can obtain a gold loan and walk out of the branch in just thirty minutes.”

Loading...