Trump Is Pushing the U.S. Toward Negative Interest Rates

by E.B. Tucker, Casey Research:

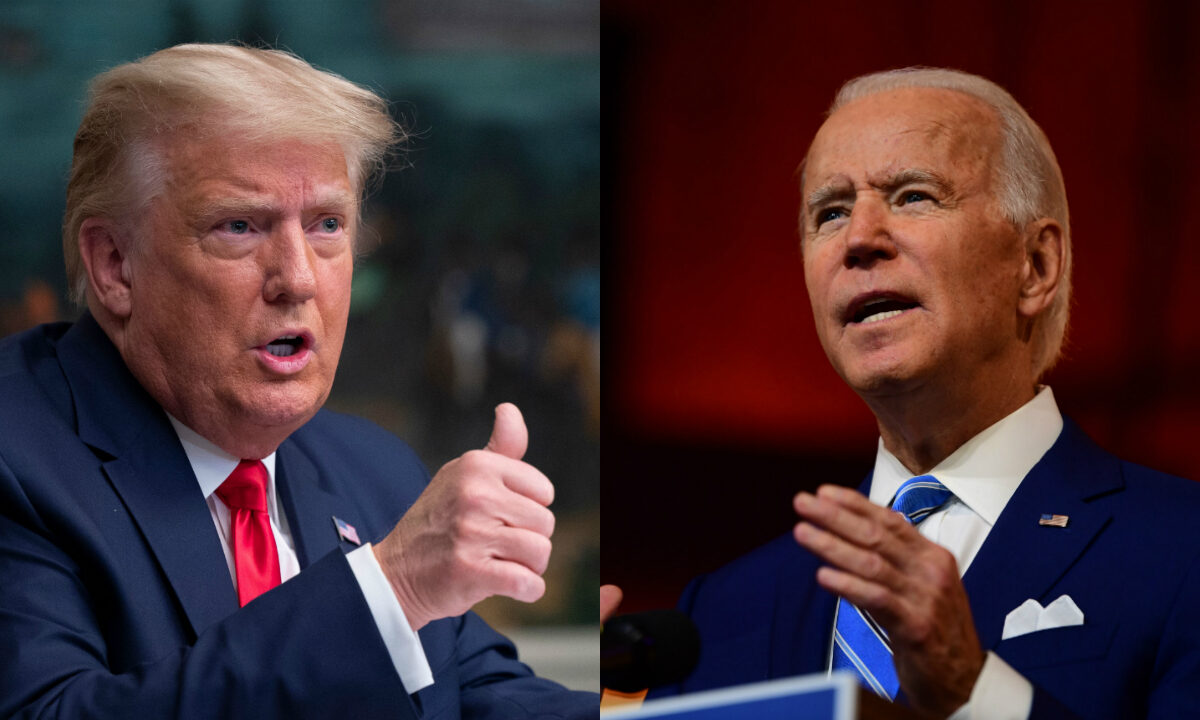

Chris’ note: President Trump wants the Federal Reserve to cut interest rates to zero – or less.

Here’s what he tweeted yesterday:

Trump went on to call the Fed “boneheads,” saying that by not slashing rates, we’re missing out on a “once in a lifetime opportunity”…

This is big news. After all, what Trump is suggesting – that the Fed should set negative interest rates – has never been done in the U.S.

I wanted to know how realistic this actually was… how it would affect the everyday American… and most importantly, what type of investing implications it would have.

So I called up my good friend E.B. Tucker – editor of Strategic Investor and one of the best big-picture thinkers in our business – for his take…

Chris Reilly, managing editor, Casey Daily Dispatch: Hi, E.B. So big news yesterday… Trump tweeted that the Fed should slash interest rates to zero. Or less. I’m sure a lot of our readers are wondering what negative interest rates here in the U.S. would actually look like…

E.B. Tucker, editor, Strategic Investor: Okay, so there are two huge things going on here. There’s a big difference between just lowering rates… and setting them below zero, which has never been done before in the U.S.

Let’s get into what happens in general when the Fed lowers rates first.

Remember, Trump sees things through his business history, which is in real estate. So let’s look at it like this: Say you have 5% debt on an apartment building, and you refinance with 4% debt. You free up more cash flow, so on paper you feel wealthier.

And if you can continue doing that to 3%… then 2%… and then 1%, the value of your apartment complex could effectively stay the same. But the cost for you to borrow the money keeps getting lower. So you feel wealthy.

And this happens in people’s lives, too. You see it all the time with your house. An 8% mortgage goes down to 7%, 6%, and so on. The lower it goes, the more monthly cash you have in your pocket. And so even though you’re not any wealthier (in fact, you might be further indebted), you feel wealthier because you free up more cash flow.

So what Trump is saying is, “Boneheads, lower the interest rates down to zero so that we can refinance the United States’ debt and feel wealthier. In fact, lower the rate down to negative.” So that’s his whole purpose first of all. Treasury debt under Trump has grown by around $2.6 trillion already.

You might know that I have an opinion that under every eight-year president in the United States, the national debt doubles. It’s been that way roughly back to Reagan. So we’ll see if that holds true with Trump. He’s well on his way. As the economy slows and spending goes up, and he keeps pressing for refinancing the debt, I think I’ll be right about that again.

So that’s why he’s talking to the Fed this way because what he’s saying is, “Look, refinance the apartment complex at lower rates.” It’s kind of like intimidating your banker. “Give me a lower mortgage or else.”

Chris: Got it. So what happens next?

E.B.: Treasury Secretary Steven Mnuchin has already come out and said we want to have a 50- or 100-year U.S. bond. Argentina has a 100-year bond. Austria has a 100-year bond. So there’s precedent for this.

Imagine if the U.S. could borrow trillions of dollars for, say, 1% or something for 100 years. And then you could pay that back over 100 years, which means effectively you would never really pay it back. Because the debt would be washed away with inflation. So that’s one thing we’ve got going on.

Now, where Trump takes it to the next level is when he says, “Take them even lower than zero.”

Chris: Yep. You said negative rates would be a whole other ballgame. Can you explain what that would potentially look like?

E.B.: If the Fed took rates below zero, the Treasury would actually make money by selling bonds.

What that means is, you would pay more than the value of the bond for the privilege of owning a bond. So that’s an incredible scenario for the Treasury, because the more it borrows, the more it would make. You’d pay $1,000 to get $995 back later. That’s how it works. You’d pay a premium to buy Treasury bonds in that case.

Chris: So do you think this could actually happen?

E.B.: Well, let’s look at it like this. There’s about $66 trillion of sovereign debt in the world. Sovereign debt meaning debt issued by a sovereign nation. $66 trillion. Around $15 trillion of that already trades at negative rates. What that means is that roughly a quarter of all that sovereign debt already trades at negative rates, and the U.S. is not even part of that.

So if you think about it, there’s absolutely precedent for this.

In fact, just this morning, the outgoing president of the European Central Bank [ECB], Mario Draghi, pushed European rates further negative. He lowered ECB rates to negative-0.5% and promised not to raise them until the ECB sees inflation reach its target of around 2%.

Look through the headlines and look what Draghi is really saying. Bankers will pay you negative-0.5% on your money until inflation reaches 2%. That means your money evaporates at a rate of 2.5% per year.

This next chapter in the central bank’s radical money experiment also helps irresponsible countries. Some of the world’s riskiest debt now trades with very low rates of return.

Loading...