Drama in the Oil Markets, But This Isn’t 2007 Anymore

by Wolf Richter, Wolf Street:

How the US shale boom changed the equation. If the attack on Saudi oil facilities had occurred in 2007, it would have caused chaos in the US economy.

How the US shale boom changed the equation. If the attack on Saudi oil facilities had occurred in 2007, it would have caused chaos in the US economy.

The attacks on Saudi Arabia’s largest oil-processing plant at Abqaiq and its second-largest oil field in Khurais on Saturday knocked out about 5.7 million barrels a day of output – about half of Saudi production and about 5% of global production. Saudi military officials told reporters on Monday that the preliminary investigation of “debris and wreckage” shows “it belongs to the Iranian regime,” and that the long-range drones were not launched from Yemen, as Iran-backed Houthi rebels there had claimed.

The White House has pointed the finger directly at Iran. Trump tweeted on Sunday that the US government was “locked and loaded depending on verification,” but was “waiting to hear from the Kingdom as to who they believe was the cause of this attack, and under what terms we would proceed!”

On Monday, the Wall Street Journal reported that “people familiar with the discussions” said that US officials said that intelligence suggests that the attacks were staged in Iran. Retaliatory strikes are being weighed.

Some of the production could be restored in days. But Bloomberg reported, based on a source, that “Aramco officials are growing less optimistic that there will be a rapid recovery in production.” Saudi Arabia can use part of its stock of about 645 million barrels of crude and petroleum products to make up for lost production in the near term. But “Aramco could consider declaring itself unable to fulfill contracts on some international shipments – known as force majeure – if the resumption of full capacity at Abqaiq takes weeks.”

In 2007, this scenario would have caused unspeakable upheaval and chaos in the oil markets globally, but particularly in the US, which at that time had relied heavily on Saudi oil. Prices would have hit astronomical levels and causing all kinds of wreckage.

But this isn’t 2007 anymore.

The price reaction in the market was breath-taking of sorts, with the price of WTI spiking 13% to about $62 a barrel at the moment.

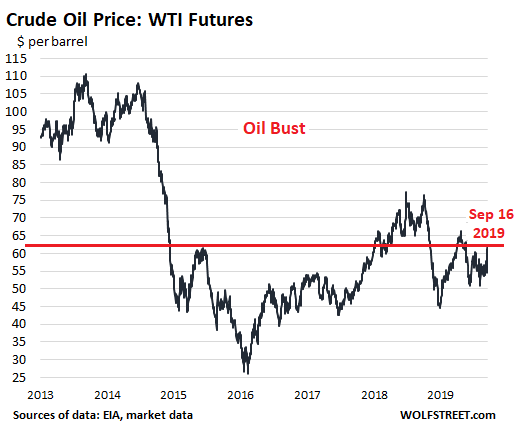

But wait: The US is stuck in an oil bust that started in mid-2014, after years when WTI traded between $90 to over $110 a barrel. By early 2016, the price of WTI had collapsed to $26 a barrel. The Fed pulled back from the four expected rate hikes in 2016 because the oil-and-gas sector was threatening to collapse, and credit was already freezing up for the sector, and bankruptcy filings occurred in rapid-fire sequence. The Fed was worried that the collapse of the industry and the freezing of credit could spread to other industries.

That was the opposite scenario of today. Today, US shale oil drillers are seeing a modicum of relief from the 13% price spike. But it’s not much of a relief. At $62 a barrel, WTI is still $6 (9%) below where it had been last year at this time. And it’s about $44 (43%) below where it had been in July 2014:

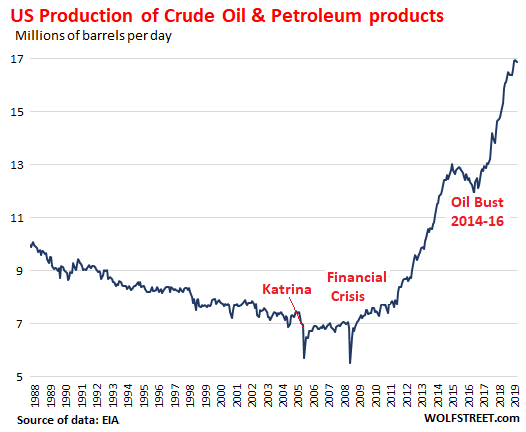

The most important factor that changed since 2007 is that US production of petroleum and petroleum products has skyrocketed by 142% from about 7 million barrels per day (bpd) in 2007 to about 17 million bpd:

In the process, the US has become the largest crude oil producer in the world, and imports from Saudi Arabia have shriveled to about 450,000 barrels per day. China, Japan, and South Korea are now large customers of Saudi Arabia.

The US has been involved in a lively trade – importing and exporting – with the rest of the world in crude oil and petroleum products such as gasoline. Among the reasons are pricing, demand by refineries in the US and around the world for various grades of crude, and geographical reasons.

California, for example. There is no pipeline connecting the state to the oil producing areas east of the Rockies. Since California’s own production is not nearly enough to meet demand, it has been importing crude oil from Alaska. As Alaskan and Californian production has been shrinking, California increased imports from other countries. At the same time, California’s refineries are refining imported crude oil into gasoline and are exporting it to other countries, mostly in Latin America.

Loading...