Zimbabwe’s New Currency Collapses and Inflation Surges

by Steve H Hanke, Market Oracle:

The most important price in an economy is the exchange rate between the local currency and the world’s reserve currency — the U.S. dollar. As long as there is an active black‐market (read: free market) for currency and the data are available, changes in the black‐market exchange rate can be reliably transformed into accurate estimates of countrywide inflation rates—if the annual inflation rates exceed 25%. The economic principle of Purchasing Power Parity (PPP) allows for this transformation.

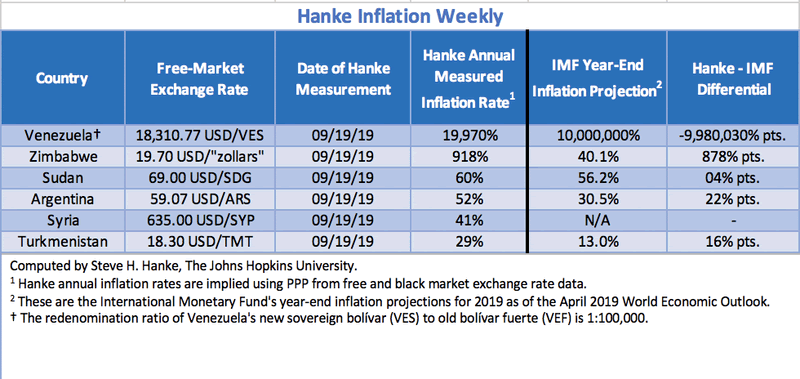

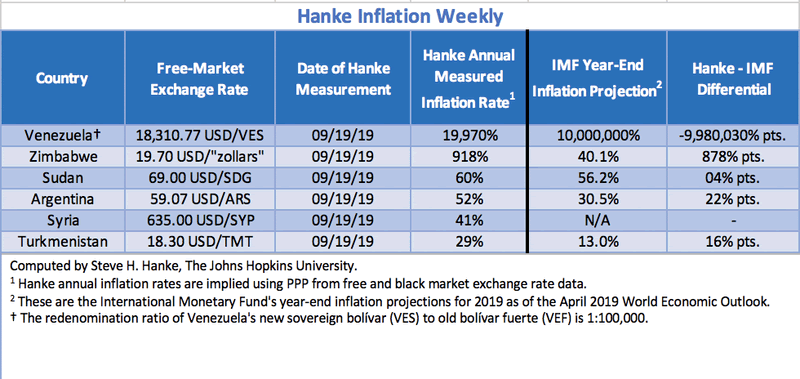

I compute the implied annual inflation rates with high‐frequency data and report them on a daily basis. PPP is used to translate changes in the black‐market exchange rates into annual inflation rates. For the countries that I follow each day, the table below shows the annual rates for the six countries with the highest inflation rates.

Zimbabwe’s annual inflation rate has surged passed the 900%/yr barrier. Yesterday’s annual inflation rate reached a whopping 918%. Since Zimbabwe’s government stopped reporting official annual inflation statistics for Zimbabwe, I am the only source for Zimbabwe’s annual inflation rate.

Since February, when Zimbabwe issued its new RTGS dollar currency as legal tender, inflation, by my calculation, has skyrocketed from 269%/yr to its current 918%/yr rate. Over this period, the RTGS has depreciated 81% in the black market. This makes Zimbabwe’s RTGS the second-worst performing currency in the world since February of this year, after Venezuela, which depreciated 84% over the same time period. Since February, Argentina’s peso has depreciated by 34% against the greenback, making its depreciation look pretty tame compared to Zimbabwe and Venezuela.

Venezuela continues to suffer from hyperinflation, which began in November 2016. Venezuela maintains the top spot on my list, with an annual inflation rate of 19,970%. Note that my MEASUREMENT of the implied inflation rate is accurate and much lower than the widely reported International Monetary Fund’s (IMF) end‐of‐year FORECAST of an absurd 10,000,000%. I write “absurd” because no one has ever been able to forecast the durations and magnitudes of hyperinflations. You can MEASURE hyperinflations with great accuracy, but you can’t FORECAST their durations or magnitudes.

A comparison of the IMF’s projections for the other five countries’ year‐end annual inflation rates are also way off. Given these large divergences and the IMF’s poor record of forecasting inflation in countries experiencing elevated inflation rates, one wonders why the financial press reports these forecasts, which have usually proved to be useless.

Read More @ MarketOracle.co.uk

Loading...