CENTRAL BANKS HAVE NOT LOST CONTROL – THEY NEVER HAD IT

by Egon Von Greyerz, Gold Switzerland:

The next explosive phase in the precious metals market has just started. As always is the case, the beginning is so slow that only the wealth preservationists and the gold bugs are seeing it. But since these are less than 1/2% of world financial assets, it means that virtually no one is aware of what is happening.

The masses will be alerted when gold reaches $2,000 which won’t take very long. That’s when lazy journalists and MSM (Main Stream Media) will start writing about gold and at that point it will even reach the front pages. These reporters who can be from any country do not realise that gold in 2019 has reached new highs in most currencies except for in US dollars and Swiss Francs. But it is only a matter of time before gold will hit new highs also in these two currencies.

Gold should be measured in your home currency, for example in Euros, Pounds or Swedish Kronor, and not just in Dollars. Any journalist in the UK or Sweden will always quote gold in Dollars, not being aware that in this century gold has gone up almost 7X in both Pounds and Kronor and made substantial new highs.

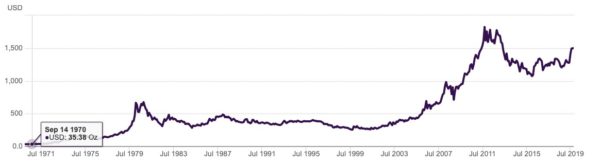

GOLD’S 48 YEAR BULL MARKET HAS A LONG WAY TO GO

Gold has been in a strong bull market since 1971 when Nixon closed the gold window. Gold went from $35 in August 1971 to $850 in January 1980. A remarkable 24X increase in less than 9 years. Since 1980 gold was correcting that major move up and bottomed at $250 in 1999. And over the 48 years since Nixon’s fatal decision, gold is up 43X measured in paper money. But if we turn the chart upside down, it means that since 1971, the dollar has lost 98% in real terms, which is gold of course.

GOLD IN US $ 1971 – 2019 – FROM $35 TO $1,515 – UP 43X

WE DECIDED TO ENTER GOLD MARKET AT TURN OF THE CENTURY

As a business we decided in the late 1990s that we would enter the gold market for ourselves and the investors we advised. The reasons were simple, risk in the financial system was getting out of hand and we identified physical gold as the best investment to preserve or insure our wealth. Also, after a 20 year correction since 1980 gold was both severely undervalued and unloved at $250. So we watched the gold chart closely for a couple of years and decided when it reached $300 or £200 per ounce in 2002 that the market had turned and it was a good time to pounce.

We were so convinced at the time that we didn’t ease in to the market but went in in a major way. As the dollar weakened, gold went up more quickly in the beginning but from 2005 gold accelerated in all currencies and reached an interim top in 2011 at $1,920 and in Euros at €1,380 in 2012.

As I already mentioned, gold has recently reached a new high in Euros at €1,410 and in virtually all other currencies and we won’t have to wait very long before gold goes past the $1,920 high from 2011.

GOLD QUARTERLY CHARTS CONFIRM EXPLOSIVE BULL MARKET

At the end of the article I show quarterly gold charts in a number of different currencies. These charts clearly indicate that gold is in a long term bull market since the turn of the century. The charts show that the correction from 2011 has ended and the next leg of the bull market has started. This leg will last at least 5 years and probably longer and will be explosive.

The principal reason there will be an explosive gold market is that we will have implosive asset markets and unlimited money printing. Debts, stocks, property as well as paper money which are all massive bubbles are going to implode in real terms in the next few years and lose 75% to 95%+ against gold.

Virtually nobody in the world expects this whether they are so called financial experts, journalists or just ordinary people. This is because most people don’t understand that the asset explosion that the world has experienced in the last few decades is based on debt and money printing and has very little to do with real growth.

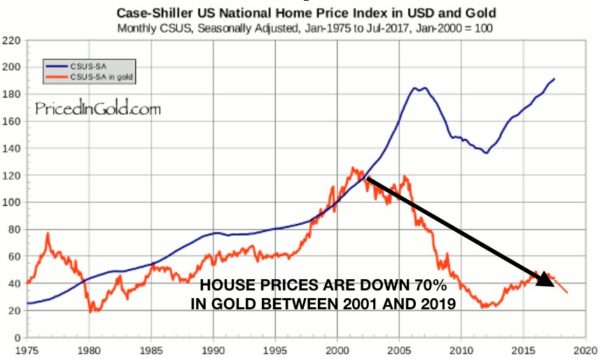

HOW CAN A HOUSE LOSE 95% IN VALUE

So what does it actually mean that a house will lose 95% in value, measured in gold?

The answer is very simple:

Property is a bubble asset and gold is undervalued.

In addition governments will in the next few years destroy paper money by printing unlimited amounts.

The consequence of all this is that property values will fall sharply and gold surge.

A $1 million house today costs approximately 20 kilos of gold

Within the next 4-8 years, you will buy the same house for 1 kilo of gold thus 95% less than today.

What this actually means in paper money terms is harder to project today. That will depend on how much money that the US government/Fed prints and if $100s of trillions of US bank derivatives have imploded.

If you take the example of no hyperinflation and gold just going up 10x from today that would mean a value of $15,000 per ounce or $466,000 per kilo. So the $1 million house would in this example decline in value from $1M to $466,000 – a 53% decline. That certainly doesn’t seem such a big fall in relation to the enormous growth in property prices in recent years. But the key is of course that gold has gone up in value by 10x, leading to the house just costing 1 kilo of gold instead of 20 kilos today – thus a 95% decline in gold terms.

If we measure US Home prices in gold from 2001 to 2019, they have declined 70% in dollar terms during that period. So the 53% decline in the example above is probably too conservative. Thus, a 95% decline in gold terms in the next few years clearly doesn’t look unrealistic.

I PAID 21% MORTGAGE INTEREST IN 1974 – TODAY THE BANK PAYS YOU

But virtually nobody today could believe that this scenario is possible but in my view, it is not just possible but very probable. The booming global housing market is based on massive credit expansion and rates at levels that borrowers see as free money. In 1974, I paid 21% interest on my first mortgage in the UK. Today borrowers in Switzerland can get a 15 year mortgage well below 1% and a 10 year one at 0.5%. In Denmark you get paid 0.1% by the bank to borrow money for a house purchase. What a mad world!

NO SAVINGS MEANS NO INVESTMENTS

Anyone who has studied economics knows that, in a sound economy, savings equals investments. But who is going to save when they get at best zero percent interest and more likely a negative rate. Savings will totally dry out since anyone who has spare cash would rather buy risky stocks, or other investments.

Read More @ GoldSwitzerland.com

Loading...