We Finally Understand How Destructive Negative Interest Rates Actually Are

from ZeroHedge:

Submitted by Tuomas Malinen is a Chief Economist of GnS Economics and an Adjunct Professor of Economics at the University of Helsinki.

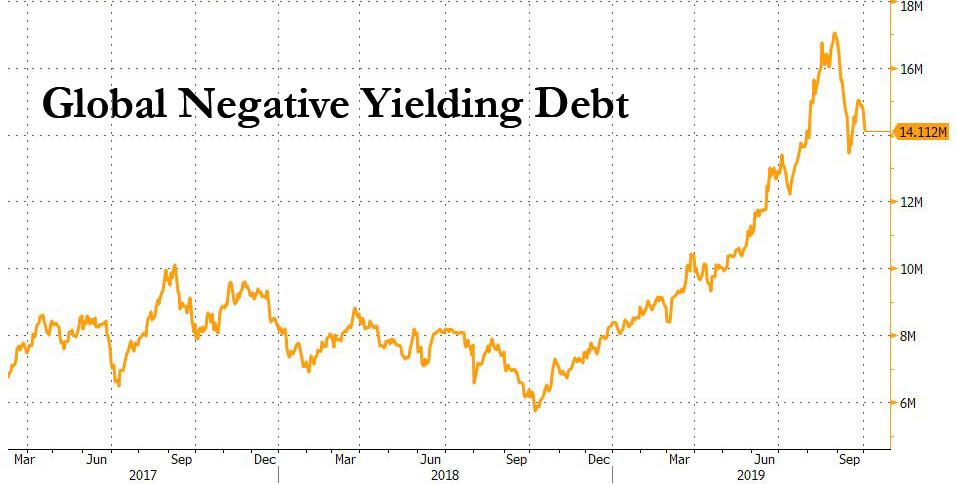

We are in the midst of a strange economic experiment. Vast quantities of negative-yielding debt are currently sloshing around the global economy. While the amount of negative-yielding bonds has dropped recently from a mind-boggling number in excess of $17 trillion, reinvigorated central bank easing across the globe ensures that this reduction is only temporary.

We are slowly starting to understand how destructive negative interest rates actually are. Central banks control short-term interest rates in an economy by setting the rate banks receive on their deposits, that is, on the reserves they hold at the central bank. A new development is the control central banks now exert over long-term rates through their asset purchase, or “QE” programs.

Banks profit from the interest rate differential between “lending long” but “borrowing short”. Essentially, the difference between lending and deposit rates determine a bank’s profitability. However, with today’s very low interest rates, this difference becomes almost non-existent, and with negative rates, inverts completely.

When a central bank pushes rates to negative, banks need to pay interest on the reserves they hold there. But they are not relieved of the obligation they have to pay interest on customer deposits, who are understandably reluctant to pay interest on money they place at a bank. Consequently, the whole earnings logic of banking goes haywire if banks are required to pay interest on loans and receive interest on deposits. As profit margins of banks are squeezed, profitability falls and lending activities suffer.

However, the problems created by negative interest rates do not stop there. In 2008, an influential article describing the economic malaise in Japan after the financial crash of the early 1990s found that instead of calling-in or refusing to refinance existing debts, large Japanese banks kept loans flowing to otherwise insolvent borrowers. That is, banks supported firms that, according to standard economic logic, should have perished. They were creating zombie corporations.

Negative interest rates foster the phenomenon of zombie corporations in two ways. First, credit is extremely cheap and in some cases you are even paid to take it (if banks acquiesce to the negative interest rates set by the central bank). Second, because negative interest rates weaken banks by destroying operating margins, they will try to avoid capital losses by extending credit to ailing or even insolvent borrowers.

Moreover, negative interest rates kill the incentives to invest in productivity-enhancing technologies by supporting industry leaders, which usually pay lower premiums for loans. As very low or negative rates naturally favour dominant firms, competition is strangled, leading to a fall in overall investment. As a result, productivity growth starts to stall leading to stagnation in the overall economy. This crucial but perverse mechanism has yet to be broadly understood.

The backward economic logic of negative interest rates also corrupts the role of time-preference. Normally, time depreciates physical products and introduces risk to financial transactions. When you have money and lend it to someone, you tend to demand a premium which represents compensation for the fact that you have to postpone your own current consumption and the very real risk of not getting your money back should the borrower become insolvent. This discounting is at the heart of every economic transaction.

Why would anyone want to lend if they need to pay the borrower? This is the absurdity already observed in global bond markets, but it is likely to be much more damaging in the economic interactions of everyday life. This is because negative interest rates fly in the face of both economic logic and our innate human sense of rightness. If we must pay to deposit money and to lend, but receive money if we borrow, our economic thinking corrupts. If such perversion continues long enough, it is likely to have far-reaching social and economic ramifications, which we can only guess at the moment.

Loading...