LBMA needs reform to serve the physical precious metals market

by Ronan Manly, BullionStar:

Among the wider precious metals community, it would be fair to say that the London Bullion Market Association (LBMA) has always been looked upon with a degree of suspicion. The reasons for the suspicion include:

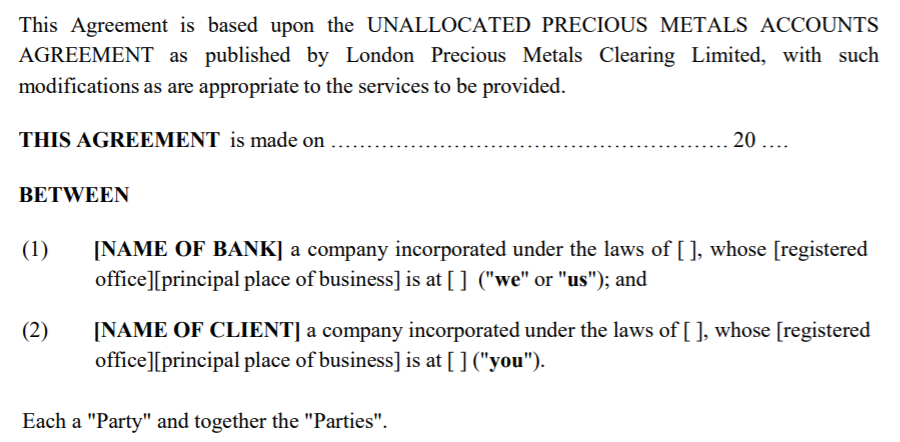

- That the LBMA banks created and unleashed on to the world the concept of fractional-reserve bullion banking, unallocated precious metal accounts, and synthetic cash-settled paper gold products unbacked or fractionally-backed by physical metal.

- That the founding members of the LBMA were a group of powerful bullion banks and brokers.

- That the LBMA was founded “at the behest” of the Bank of England.

- That the LBMA operates at the nexus of secretive central bank gold lending transactions where transparency is, to say the least, non-existent.

All of these reasons would be valid concerns, but they are not getting to the heart of the issue. The heart of the issue is that the LBMA does not represent the physical gold and silver markets nor does it champion the interests of physical precious metals savers and investors.

Rather, the LBMA promotes and protects and paper gold and silver markets and works on behalf of the bullion banks which operate and control these derivative paper markets through OTC precious metals trading, the London daily price fixings, and COMEX precious metals futures trading. All the while the LBMA with a straight face claims to be the “global authority for precious metals” and “the fulcrum for the global OTC precious metals markets“. A global authority appointed by who you might ask? Well, the banks of course!

It’s a Bullion Bank Club and You Ain’t in It!

The LBMA is an association so dominated by bullion banks that it might be more correctly called the London Bullion Bank Market Association. These banks position themselves as intermediaries in the flow of everything in the precious metal markets from trading to clearing, and from securitizing to lending and borrowing, all within a fractional reserve system which creates derivative paper gold and paper silver out of thin air using a leveraged system of unallocated precious metal accounts unconnected to the physical delivery of real gold or real silver.

Bullion banks and their trading of synthetic gold and silver are so integral and entrenched to the LBMA system that the LBMA even has a special category of membership for its ‘top tier’ bullion banks which are known as the LBMA ‘Market Making Members’. These market making members are so important to the LBMA that they are entitled to 50% of the electable seats on the LBMA board, and a LBMA Annual General Meeting (AGM) cannot even be convened without a quorum of eight members at least five of which need to be Market Making Members, i.e. banks.

Including these privileged ‘Market Making Members’, there are an astounding 41 banks that are ‘Full Members’ of the LBMA and a few additional banks in the dealer category. Contrast this to precious metals refiners, where there are only 9 precious metals refiners worldwide which are full members of the LBMA. And shockingly, not even one mining company is a full LBMA member.

LBMA Market Making Members include such familiar bullion banking names as HSBC, Goldman Sachs, JP Morgan Chase, UBS, Citibank, Bank of Nova Scotia (Scotiabank), Toronto Dominion Bank, and ICBC Standard Bank. Many of these same bullion bank names also dominant the LBMA Gold Price and LBMA Silver Price auctions as “Accredited Price Participants” for the daily benchmark prices of gold and silver, reference prices which are also based on unallocated positions but which perversely are used by the bullion industry worldwide as a reference point for pricing physical precious metals. It is also the LBMA which acts as gatekeeper and authorizes these bullion banks to directly participate in the auctions, i.e. LBMA-authorized bullion banks and market makers.

As many readers will know, the LBMA Gold Price and LBMA Silver Price auctions supersede the previous London Gold Fixing and London Silver Fixing which were exclusively, until they imploded in 2014, the playground of, you guessed it, bullion banks.

For the gold fix – these banks most recently were HSBC, Deutsche Bank, Barclays, Scotia, and SocGen operating under a company called The London Gold Market Fixing Limited, a company which was established at Rothschild’s offices in New Court, St Swithin’s Lane, London. For the silver fix, HSBC, Deutsche and Scotia operating using a company called The London Silver Market Fixing Limited.

Do you see the trend? Another spoke in the LBMA wheel is the paper precious metals clearing company, London Precious Metals Clearing Limited (LPMCL), a shadowy but critical company whose corporate secretary is the LBMA, and whose registered office is the LBMA’s offices in London at 1-2 Royal Exchange Buildings, Royal Exchange, across the road from the bank of England and Rothschild’s offices in the City of London. The original registered office of LPMCL when it was established in 2001 was yet again, Rothschilds offices in New Court, St Swithin’s Lane. London.

LPMCL uses an electronic clearing platform known as AURUM to net and clear the paper trades of gold, silver, platinum and palladium churned out in London by the staggeringly large unallocated paper positions generated by the bullion banks, with HSBC and JP Morgan clearing the majority of LPMCL trades. For all about AURUM see here.

As the LMPCL website explains:

“Initial exploratory work on the LPMCL [electronic matching system] was undertaken by The London Bullion Market Association (“LBMA”) Physical Committee, which comprised the clearing members.”

The clearing members of the LBMA (at the time Rothschild, JP Morgan, UBS, HSBC, Scotia, Deutsche, and Credit Suisse) then formed the LMPCL company in April 2001. LPMCL is currently operated by 5 of the largest bullion banks in the LBMA system, namely HSBC, JP Morgan, Scotia Bank, UBS and ICBC Standard Bank, all of which are Market Making Members of the LBMA. The Board of Directors of LMPCL (i.e. the LPMCL directors from HSBC, JP Morgan, Scotia, UBS and ICBC Standard) even holds its board meetings at the offices of the LBMA in the Royal Exchange. While LPMCL is a paper clearing platform, it interfaces into the twilight world between paper gold and real bullion with three of the LMPCL members operating precious metals vaults in London, JP Morgan, HSBC, and ICBC Standard Bank, and all five LPMCL members having gold accounts at the Bank of England. But with no transparency between LPMCL clearing transactions, London gold vaults stocks, and gold lending transactions out of the Bank of England, and no independent physical audits of any bullion bank gold holdings, LPMCL is a game of musical chairs keeping London’s unallocated precious metals pyramid spinning.

Loading...