How the Crybabies on Wall Street Try to Force the Fed into QE-4

by Wolf Richter, Wolf Street:

The repo blow-out — whoever instigated it — comes in real handy.

The repo blow-out — whoever instigated it — comes in real handy.

Fed Chair Jerome Powell’s explanation on Tuesday and the FOMC minutes released yesterday were a bitter disappointment for the Crybabies on Wall Street – the broker-dealers and banks: They’d expected a massive bout of QE, and perhaps some of the players had gleefully contributed to, or even instigated the turmoil in the repo market to make sure they would get that massive bout of QE as the Fed would be forced to calm the waters with QE, the theory went. This QE would include big purchases of long-term securities to push down long-term yields, and drive up the prices of those bonds these Crybabies are holding or have bet on with derivatives.

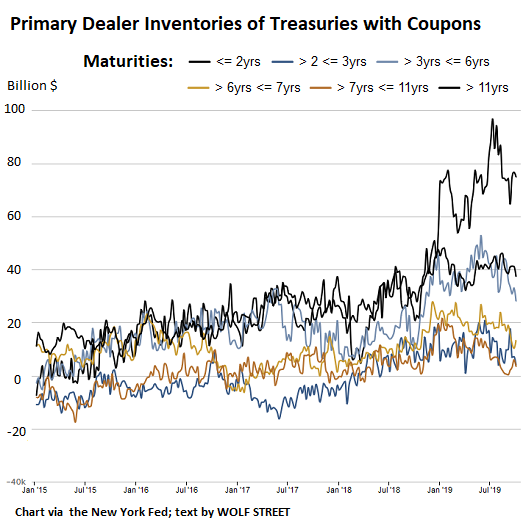

This is particularly crucial to the “primary dealers” – the 24 US and foreign broker-dealers and banks that are authorized to deal directly with the US Treasury and the New York Fed. They’ve been hoarding Treasury securities with longer maturities. As of October 2, according to the most recent data from the New York Fed, they hoarded $161 billion, double the $81 billion a year ago – though that has come down from the peak in July of $219 billion:

Note the top two lines (black): Less than two-year maturities amounting to $74 billion; and 11-year and over maturities amounting to $37 billion. Not included on this chart are the primary dealers’ holdings of Treasury bills, TIPS, Agency securities, and Floating Rate Notes.

Primary dealers are funding their hoard in the repo market. These funding needs were putting pressures on the repo market, the Fed already said in its minutes for the July meeting, before repo rates totally blew out in mid-September.

But primary dealers could have sold a large part of those securities, if they’d wanted to. Prices were high and yields were low, a sign that there was heavy demand. But the dealers were holding out for even higher prices and even lower yields. And any heavy selling could have pushed up those yields and steepened the yield curve, very unpalatable for folks clamoring for rate cuts.

So these dealers are sitting on a pile of Treasury notes and bonds whose prices they want to rise, and therefore their yields would have to fall. Massive QE, where the Fed buys these types of Treasury securities, would accomplish that.

But that’s exactly what the Fed said it wouldn’t do. Starting with Powell on Tuesday and with the minutes released on Wednesday, the Fed is outlining a plan to buy only Treasury bills.

T-bills are securities with maturities of one year or less, such as a 3-month T-bill. They do not have a coupon. Instead, they’re purchased at a discount from face value and are redeemed at face value. The difference is the yield for the investor.

Dealers have not been hoarding T-bills. As of October 2, they were holding less than $7 billion in T-bills, at the very low end of the three-year range.

So these Crybabies were hoping for real QE with long-term notes and bonds. And all they got was a plan focused on acquiring T-bills, on top of the new plan from a few months ago to replace longer-term Treasury securities and all MBS on the Fed’s balance sheet with a mix that includes T-bills.

Under these plans, any growth of the Fed’s balance sheet would free up longer term Treasury securities that the market would have to absorb. In turn, the Fed would absorb more T-bills.

The bond market was aghast. Treasuries with longer maturities have sold off across the board since Powell spoke on Tuesday, and yields rose. The 10-year yield closed on Thursday at 1.67%, the highest all month, up 15 basis point from about 1.52% on Tuesday at the time Powell was speaking.

This is not what the Crybabies on Wall Street had in mind. They’re now trying to forcefully push the Fed into restarting real QE. And they’re coming up with all kinds of hoary ideas of why the Fed must do it. MarketWatch has gathered up some of them.

The most hilarious idea is that there suddenly aren’t enough short-term T-bills out there for the Fed to buy, and that is why the Fed will have to buy longer-term notes and bonds. But there are $2.4 trillion in T-bills outstanding, and if the price is right, anyone can by them, even the Fed.

“Is that part of the market large enough to deliver the reserve growth [the Fed] wants?” Steve Johnson, senior portfolio manager at SVB Asset Management, told MarketWatch. “Where do they go besides banks for those bills? That’s a big question mark right now.”

Loading...