Did Everything Just Change?

by Adam Taggart, Peak Prosperity:

How material are this week’s QE & China deal announcements?

How material are this week’s QE & China deal announcements?

It’s hard to imagine a more euphoric end to the week for bulls.

Two weeks ago I issued a report titled Realistically, What’s Left To Power Asset Prices Higher? which claimed the bulls only hope was for a near-term resumption of QE (quantitative easing, aka “money printing”) or a China trade deal.

Well, this week they got both.

Jerome Powell announced Wednesday that the U.S. Federal Reserve will resume expanding its balance sheet to the tune of $60 billion per month. And just a few hours ago, the Trump administration announced it had reached a partial trade agreement with its Chinese counterparts.

And to put a cherry on top of things, word from across the Pond is that somehow a Brexit deal just might happen by the end of the month.

When I began typing this article earlier today, the markets were fiercely building towards an orgiastic climax. They ended with a slight post-coital breather, closing modestly off the day’s highs.

In short, the bulls are suddenly having the time of their lives.

So, does this mean happy days have returned? Have we been rescued from the rising tide of data warning of an economic slowdown and lower asset prices? Does the Fed — and now China, too — have our back again?

Is it time for investors to become optimistic once more?

“”Markets”” No More

Before we answer that, though, let’s address the elephant in the room. We no longer have functioning financial markets.

The central banking cartel has killed price discovery. The $15+ TRILLION in liquidity injected by the Fed, EBC, BoJ, BoE and PBoC over the past decade has ‘risen all boats’ when it comes to asset prices.

Whether great, mediocre, or horrible, the price of nearly every company/property/investment has been on a one-way 45-degree ramp upwards since global co-ordinated quantitative easing began in 2009.

And Wednesday’s announcement by the Fed simply shows that this game will continue, despite years of broken promises that it would instead ‘normalize’ (i.e., undo much of its past QE).

As a result, we live in a world where traditional price signals have become meaningless. Management turmoil? Missed earnings expectations? Regulators cracking down on your industry? None of it matters in a world of perpetual QE. As long as stimulus keeps flowing, everything heads in the same direction: UP.

All that matters is guessing what the small coterie of central bankers plan to do next. Will they tighten from here? Or ease? By how much? And for how long?

As a result, ‘investing’ is a dead science. Instead, we’ve all been forced to become speculators.

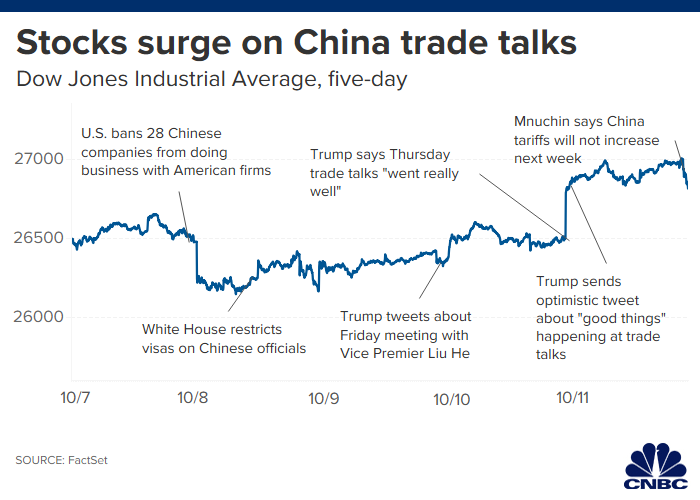

Meanwhile, extremely manipulable high frequency trading (HFT) algorithms dominate the daily price action. Stock prices now hyper-react instantly to every tweet and leak, which the media and the Trump administration now exploit to maximum advantage.

Seriously — and this is a topic deserving future lengthy exploration — those in favor of removing President Trump may have a better case to make for market manipulation as his impeachable offense. He’s been shoving market prices around on a daily basis for years now. And how are his tweets this week — one of which instantly sent the Dow skyrocketing 300 points on Thursday — not considered in flagrante delicto examples of painting the tape? (a prohibited form of manipulation in which the criminal ‘creates activity or rumors to drive up the price of a stock’):

Time To Pile Back Into The Market?

But making the (safe) assumption no one in power cares about our broken markets as long as they benefit from the status quo, where are prices more likely to go from here?

Two weeks ago, I argued that the only things that would save the bulls in the near term was new QE and a China deal. Now that the past 48 hours delivered on both counts, the outlook for the rest of 2019 is now substantially more complex to forecast.

Nearly all of the negative indicators we’ve been warning about still remain. The macro outlook still screams recession risk, corporate earnings are still forecast to disappoint, geopolitical strains remain unresolved, and the world’s oil supply chain looks even more vulnerable given today’s news that an Iranian oil tanker was struck by missiles in the Red Sea.

That said, Powell’s new $60 billion per month QE program (which he swears isn’t really QE) will surely have a stimulative impact on the system. Even if those funds don’t make it out into the economy directly, they will keep both good and bad banks solvent and thus keep credit flowing. That will help in keeping today’s zombie companies/jobs/buyback programs alive for the foreseeable future.

Read More @ PeakProsperity.com

Loading...