Fed Injects $134BN In Liquidity, Term Repo Obersubscribed Amid Month-End Liquidity Panic

from ZeroHedge:

With stocks threatening to close in the red, late on Wednesday the Fed sparked a furious last hour rally…

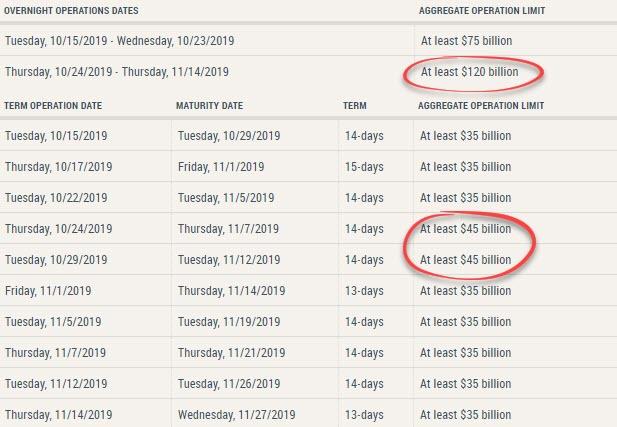

… when in a a statement published at 1515ET, precisely when the S&P ramp started, the New York Fed confirmed it would dramatically increase both its overnight and term liquidity provisions beginning tomorrow through November 14th.

The Desk has released an update to the schedule of repurchase agreement (repo) operations for the current monthly period. Consistent with the most recent FOMC directive, to ensure that the supply of reserves remains ample even during periods of sharp increases in non-reserve liabilities, and to mitigate the risk of money market pressures that could adversely affect policy implementation…

As we noted yesterday, that was a massive 60% increase in the overnight repo liquidity availability (from $75 billion to $120 billion) and a 28% jump in the term repo provision (from $35 billion to $45 billion).

“It’s just more evidence the Fed will not back off as year-end gets closer,” said Wells Fargo’s rates strategist, Mike Schumacher. “The Fed wants to take out more insurance. You had repo pick up last week. That might not have gone over too well.”

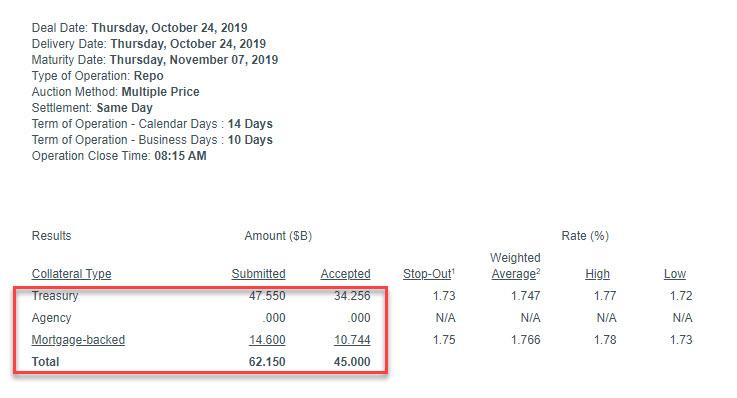

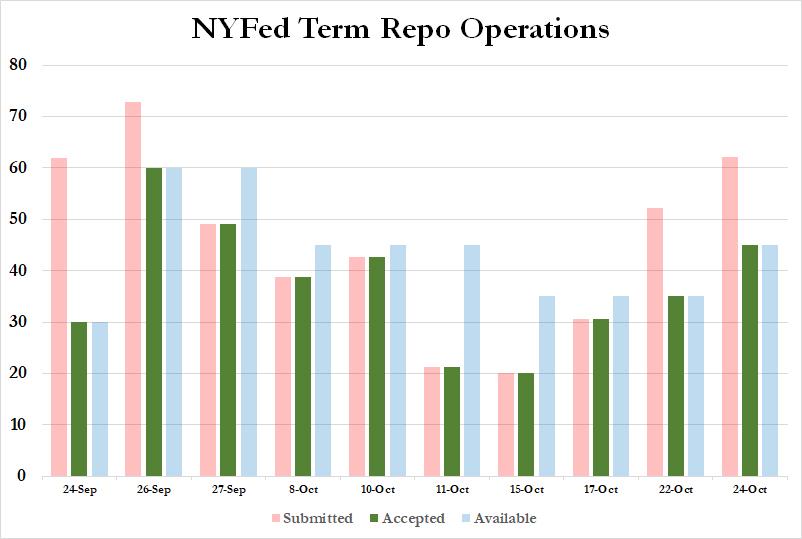

And now we know that there was good reason for that, because according to the latest, just concluded Term Repo operation, a whopping $62.15BN in securities were submitted to the Fed’s 14-day operation, ($47.55BN in TSYs, $14.6BN in MBS), resulting in a 1.38x oversubscribed term operation, the second consecutive oversubscription following Tuesday’s Term Repo, when $52.2BN in securities were submitted into the Fed’s then-$35BN operation.

This was the highest uptake of the Fed’s term repo operation since Sept 26.

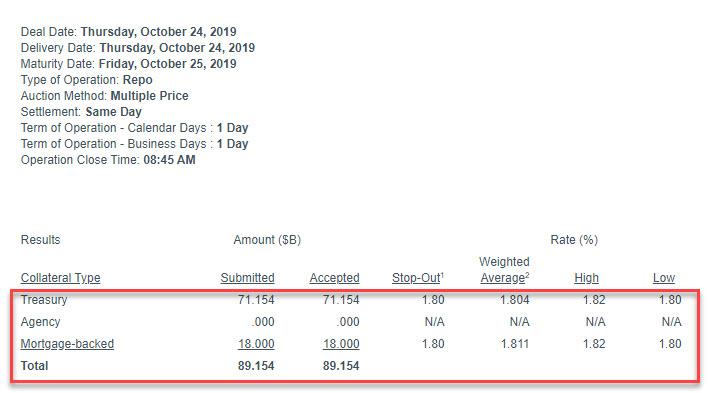

But wait there’s more, because while the upsized term-repo saw the biggest (oversubscribed) uptake in one month, demand for the Fed’s overnight repo also soared, with dealers submitting 89.2BN in securities for the newly upsized, $120BN operation.

This was the biggest overnight repo yet!

In total, between the $45BN term repo and the $89.2BN overnight repo, the Fed just injected a whopping $134.2BN in liquidity just to make sure the US banking system is stable. That, as the Fed’s balance sheet soared by $200BN in the past month rising to just shy of $4 trillion.

Loading...