Wag the Dog – The new COMEX and SGE Gold Contracts

by Ronan Manly, BullionStar:

Last week, in a move which went largely unnoticed, the US and Chinese gold markets moved one step closer to lockstep, when the CME group, home of the COMEX gold derivatives market and the Shanghai Gold Exchange (SGE), the world’s largest physical gold exchange, simultaneously and jointly launched a series of gold futures products in what they pitched as cross-market cooperation.

On the US side, CME has launched two cash-settled ‘Shanghai Gold futures‘, based on the SGE’s daily Shanghai Gold Benchmark Price, one denominated in US dollars and the other denominated in offshore Chinese renminbi (CNH). Both of these contracts are listed on the COMEX. On the Chinese side, the SGE has launched a T + N (margin) 100 gram contract denominated in renmimbi (RMB) that’s based on the CME’s COMEX Gold Futures Asia Spot Price. The SGE calls this the NYAuTN contract.

Synchronizing Watches

For those unfamiliar with the Shanghai Gold Benchmark Price, this is a twice daily gold spot fixing auction operated by the SGE which was launched in April 2016. The auctions runs on SGE business days at 10:15 am and 2:15 pm Beijing Time and are for physically-delivered 1 kg lots of 99.99% purity gold or higher, quoted in RMB per gram. You can read all about the Shanghai Gold Benchmark Price in the BullionStar article here “Shanghai Gold Benchmark Price – New Kid on the Block”.

For those unfamiliar with the COMEX Gold Futures Asia Spot Price, which is probably nearly everyone, this is merely a CME Marker Price conjured up by CME based on the COMEX GC contract, the infamous 100 oz gold futures contract that dominates price discovery in the international gold market. The Gold Futures Asia Marker Price is calculated as a volume weighted average price of trades in the nearby active month of the GC contract taken during a snapshot 5 minute period between 3:25 pm and 3:30 pm China time (GMT + 8 hours). This then gives the Gold Futures Asia Marker dataset which the SGE contracts use after converting from US dollars to renminbi and after converting to the NYAuTN contract size of 100 grams.

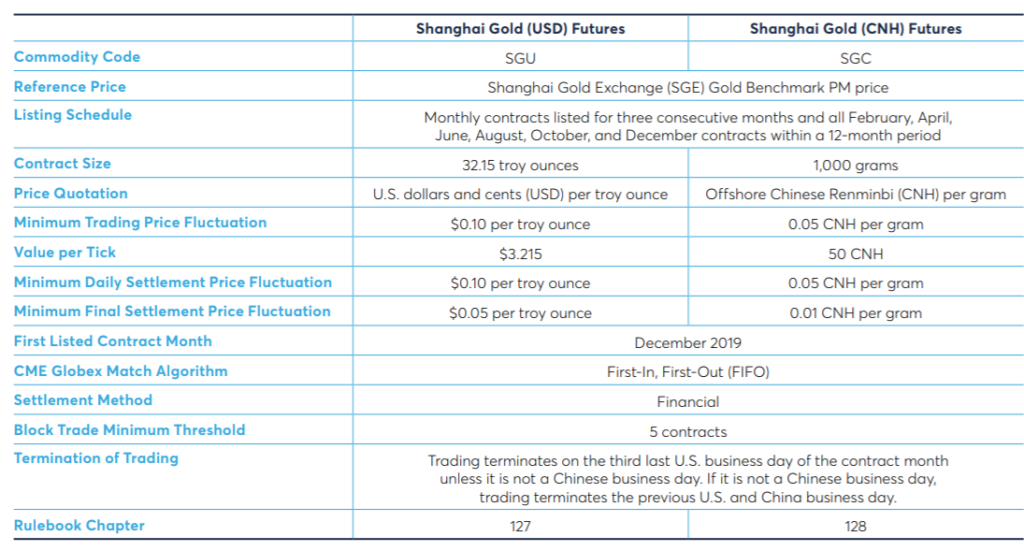

Contract Specs – CME Shanghai Gold futures

The CME’s renminbi Shanghai Gold futures contract, quoted in offshore Chinese renminbi (CNH) per gram, is a cash-settled future representing a contract size of 1000 grams (1 kilo of gold), and which settles using the PM (afternoon) Shanghai Gold Benchmark Price sourced from Bloomberg or Reuters price feeds. The CME commodity code for this USD Shanghai gold futures SGC.

The CME’s US dollar Shanghai Gold futures contract is quoted in US dollars per troy ounce, has a contract unit of 32.15 troy ozs (i.e. 1 kilo), and cash-settles using the same SGE afternoon Shanghai Gold Benchmark Price while converting the benchmark price from renminbi to US dollars using a 3 pm Beijing USDCNH exchange rate sourced from the ‘EBS CNH Benchmark‘ exchange rate published by NEX Data. As the Shanghai Gold Benchmark Price is quoted in grams, and CME’s USD version is quoted in troy ounces, the USD Shanghai gold futures contract also applies a conversion from grams to ozs using a conversion factor of 32.15 troy ounces per kilo. The CME commodity code for this USD Shanghai gold futures SGU.

Importantly, both of these new CME Shanghai Gold Futures have an identical listing schedule to the COMEX 100 oz gold futures contract (GC) out to the nearest 12 months, which means that traders (bullion banks and others) will be able to arbitrage between the 100 oz gold futures and the Shanghai gold futures. The listing schedule is “monthly contracts listed for 3 consecutive months and all February, April, June, August, October, and December contracts within a 12-month period”.

Both of these CME Shanghai gold futures contracts are listed on COMEX, and will trade on Globex, CME’s global electronic trading platform as well as on CME ClearPort, and will clear via CME Clearing House. Notes that the CME contracts can also be traded bilaterally as block trade cleared on CME ClearPort.

CME’s gold futures have a notoriously long trading week trading Sunday through Friday nearly 24 hours per day, and these new Shanghai gold futures are no exception, which means, according to CME that these new futures have “longer trading hours than any other Asian exchange.”

Further information on the new CME contracts can be read here in its product introduction sheet and FAQs sheet. But as the CME helpfully points out in its FAQ sheet: “Both the contracts are cash settled. Therefore, a gold account at the Shanghai Gold Exchange is not required to support these products.” The reason being that there is no gold, just derivatives.

And if anyone is still under the impression there is gold tied to these contracts, the CME clears up the confusion with a bizarre True-False test at the end of the its Shanghai Gold Futures product page just to remind everybody that these contracts are cash-settled and not physically delivered, because there is no gold at the COMEX, just paper. But not to worry, the new contracts are regulated by the CFTC.

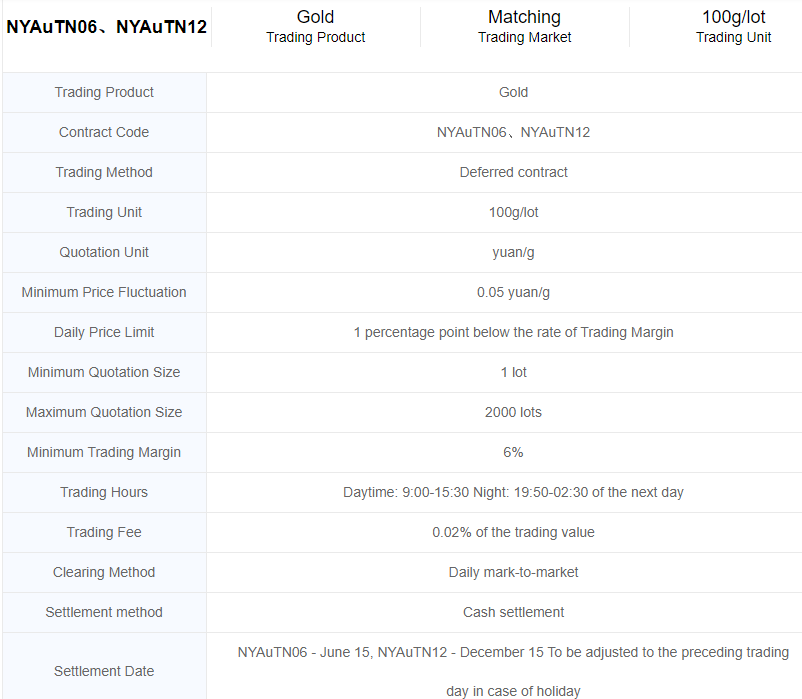

Contract Specs – SGE COMEX gold contracts

The SGE’s new contract, called NYAuTN, which was also launched on 14 October, trades on the SGE’s electronic trading platform and is also a cash-settled contract with deferred settlement. In general, the SGE uses the naming convention T + D to refer to deferred contracts and T + N for margin contracts, where T = Trade Date, and these new contracts are based on the SGE’s existing Au(T+ N1) and Au(T+ N2) contracts. Hence for this new contract, the SGE has chosen the somewhat logical name NYAuTN, to refer to the fact that the price comes from COMEX New York (NY), is gold (Au) and is a deferred margin contract (TN).

The contract’s settlement price is based on the COMEX Gold Futures Asia Spot Price, is denominated in renminbi (RMB aka CNY or yuan), and has a contract size of 100 grams. Since the contract price is quoted in yuan per gram, the settlement price is arrived at by converting the COMEX Gold Futures Asia Spot Price (which is in US dollars per troy ounce) to yuan per gram using a USDCNY exchange rate, and also applying a conversion factor of 31.10 grams per troy ounce. The exchange rate SGE has chosen to use is a 3 pm Beijing time snapshot of the CFETS USD/CNY exchange rate from the government owned China Foreign Exchange Trade System (CFETS).

There are actually two contract SGE NYAuTN contracts, a six month version called NYAuTN06 which settles on 15 June, and a 12 month version called NYAuTN12 which settles on 15 December. The SGE contracts trade in a daytime session between 9 am and 3.30 pm, and a nighttime session between 07.50 pm and 2.30 am the next day, and clear daily by marking to market.

Best of Buddies

Cooperation between the US CME and the Chinese SGE shouldn’t be all that surprising as the two parties signed a Memorandum of Understanding back in 2014 to do just that saying that they intended to ” explore possibilities of cooperation between the domestic and international markets” so as to “vigorously expand the ways to serve the investors from home and abroad” . At the time the SGE said that “establishing the partnership with the CME was one of the best ways for the SGE to implement its opening-up policy and internationalization strategy“.

In May this year, the SGE and CME signed a bilateral product licensing agreement whereby SGE granted CME a license to use the Shanghai Gold Benchmark Price to develop futures contracts, while CME granted SGE a license to launch new T+ N product based on the COMEX Gold Futures Asia Spot Price.

Behind the Curtain

So what are these new products really about? The CME marketing spiel talks about broadening market access for global investors, and on the surface this is true, since traders outside China can now access the SGE Benchmark price in listed products in a US venue in either USD or CNY, and there would be investment restrictions on many non-Chinese traders and funds if they tried accessing the SGE benchmark price directly.

CME also claims that cooperation will SGE will enhance “the global liquidity of COMEX gold futures”, not something anyone would have thought really needs a boost given that COMEX already trade already trades vast amounts of fictitious gold each and every day. As we wrote recently:

“COMEX gold futures contracts trade the equivalent of 27 million ounces per day. That’s equivalent to 260,000 tonnes of gold per year. That too is more gold than has been mined in history, and is a whopping 86 times annual gold mining supply.

In 2018, COMEX gold deliveries were just 1.6 million ounces (51 tonnes). This means that 99.98% of COMEX gold futures do not result in physical delivery, with only 0.02% of the trades leading to metal delivery. Currently, COMEX registered gold stocks (those which are available for delivery) are only 735,000 ozs (22.85 tonnes), a tiny foundation underpinning a giant paper pyramid.“

For its part, SGE says the link-up with CME is part of the SGE’s internationalization strategy to integrate domestic and foreign gold markets, internationalize the Shanghai Gold Benchmark Price, give a stronger voice to China’s gold market, boost the influence of the RMB gold price, and strengthen Shanghai’s image as an international financial center. The SGE also claims the joint products will help internationalize the renminbi by allowing access to China’s domestic financial market using CNH (offshore yean), while providing Chinese investors with an indirect link to international markets using CNY (onshore yuan).

Loading...

.jpg?itok=DfHMPIqZ)