The End Of Money

by Chris Martenson, Peak Prosperity:

Prepare for the coming wealth transfer

Prepare for the coming wealth transfer

Today we live in a bifurcated economy: it is boom times for some and bust times for others.

Your personal situation depends largely on how close you fall on the socioeconomic spectrum to the protected elite class, towards which the central banks are directing their money-printing firehoses.

Why should we care about this bifurcation? History.

2,000 years ago, in Plutarch’s time, it was already ‘old wisdom’ that unhealthy wealth imbalances ended badly for society:

Even those near the top of the wealth pyramid don’t aspire to live surrounded by an impoverished underclass, forced to live hiding behind their fortifications and guards, hoping the unrest of the masses doesn’t get any worse.

But sadly, the US is not far off from this fate…this is Los Angeles:

The streets of San Francisco, Seattle, and a growing number of other once-proud American cities look very similar.

I care about our social stability which is why I believe in having a strong and vibrant middle class – something the US Federal Reserve is working to destroy with every intervention. It has been a shameless champion of the entrenched ultra-rich and powerful; at the expense of everyone else. Because of this, I’ve been a fierce critic of the Fed and its policies.

Money vs Real Wealth

I happen to know a good deal about our current system of money; how it is created, how it functions, its benefits and its darker aspects. I find it critical to remember that it isn’t actually “real”. Rather, it is a concept. Specifically, it’s a social contract. An agreement. Albeit one enforced at the end of a gun – or, as seen here, an eviction sheriff enforcing the local tax codes:

So while money isn’t “real” in itself, we value it because it is a claim on real things.

Having a lot of it currently entitles you to a great deal of privileges and power, which are a direct outcome of the spending of that money.

Money can be converted into houses. And cars. And massages. Also groceries, electricity, cell phone services and prescription drugs. These and ten billion other things are what money allows you to buy — the things you actually need or want.

So money is the means, but it is not the real wealth. ‘Real wealth’ is the things that money enables you to acquire.

The Three Types Of Wealth

Going further, we can break real wealth into two discrete forms. Primary wealth is the wealth of the land and its functioning ecosystems. It is clear air, fresh water, thick ore bodies, and rich soils:

Secondary wealth is a finished form produced from raw materials. It is primary wealth brought to market. It is fresh produce on the grocery shelf, cut lumber (or even a fully-constructed building), and rolled steel in giant coils:

Tertiary wealth, on the other hand, is not actually “real”. But most people mistake it as a comprehensive representation of “wealth”.

Similar to money, tertiary wealth is merely a claim on primary and/or secondary wealth. A share of General Electic a stock-based claim on the company’s means of production.

And debt (and bonds) is a future claim on money. And money, as we know, is a claim on real things.

It’s All About The Amount Of Claims

Why is it relevant to parse these distinctions so carefully?

Because there has to be a balance between the claims and the wealth.

Too many claims and we call that inflation. Each individual claim is reduced and diluted by every additional new claim brought into being. Beyond a certain amount, each claim becomes increasingly worthless.

Deflation is when there’s overproduction, or too much ‘real stuff’ relative to money. Prices fall, which is a perilous condition for a debt-based money system. There needs to be ever more money to pay off both the principal and interest components of past loans, or else defaults start cascading through the system.

Do you get now why we need to be very concerned with the balance between the claims and the real stuff?

History is full of examples when people first forgot and then violently remembered these truths. Through history, the balance has swung recklessly — almost chaotically — between inflation and deflation.

Another such phase transition approaches. These moments are billed as periods of wealth destruction, but they actually aren’t. Instead, they are periods of wealth transfers from the unaware to the observant.

We’re facing this approaching crisis for two main reasons. One, we’re repeating the forgetfulness and hubris of previous societies. And two, the complexities of our current situation are more challenging than ever before.

Man of our actions are driven by the strong human preference to push our current problems into the future. When problems and predicaments are compounding/exponential in nature like those we’re currently facing, every can-kicking deferment only makes the pain much greater when it finally arrives.

And as for the increased complexities, for the first time in our history as a global species, we are waking up to the fact that the world is no longer our infinite treasure basket with an unlimited ability to absorb our waste streams.

Instead, it is finite. And its already groaning under the weight of one unit of global GDP extraction and waste. The central banks are tirelessly seeking to double the size of the economy, and then double it again.

One can easily make the argument that 1x GDP is already ‘too much’ for the planet. Disappearing fishes, soil, insects, birds, amphibians, reptiles and large animals all indicate that ‘too much’ was a while ago.

But even for those who believe we haven’t exceed the Earth’s carrying capacity yet, it’s certainly true that there’s some sort of a limit somewhere. Is it when there’s 1.5 times as much consumption and waste as today? 2 times as much? 3 times?

When is the right time to act as if these limits matter to our future welfare? Not now! is the rally cry of the Federal Reserve and other central banks. Their remit begins and ends with fostering more credit growth as fast as possible. Full stop.

It’s all they care about. And if they have to continue to throw a couple of younger generations and the entire middle-upper, middle, and lower classes under their inequality-bus to achieve more growth in credit markets, then you’d better believe that’s what they’ll do.

The Wealth Transfer

With the near-inevitability of MMT (a.k.a “free money for everybody”) the wealth transfer will kick into a higher and more obvious gear when MMT arrives (as Charles Hugh Smith brilliantly summarized for us recently).

The basic problem is that money is not real wealth. But newly printed money has real purchasing power. What happens when purchasing power is increased but more real wealth is not auto-magically created at the same time?

Easy: the claims on real stuff become diluted. Every unit of money in circulation has a tiny fragment of purchasing power removed from it when a new unit of purchasing power is created ‘out of nothing.’

You might think “what a flawed plan!,” but that’s exactly wrong. That’s precisely the plan. Coin clipping was the ancient Roman practice of diluting the currency by recalling every coin in circulation (or as many as possible), shaving off a tiny bit from each of them, and then reissuing a larger quantity of coins that each weighed a tiny bit less than before.

Today it’s far easier to achieve the same outcome. New electronic digits are spewed out into the world and perhaps 0.1% of the population could even tell you that it’s happening. Perhaps only 0.001% could tell you exactly how.

But the effect is the same as coin clipping. Each new currency digit launched ‘from nothing’ into circulation has immediate purchasing power. By definition, all of the pre-existing currency in circulation loses a ‘unit-share’ as a consequence.

With trillions upon trillions in circulation, nobody really notices. Again, that’s both the point and by design.

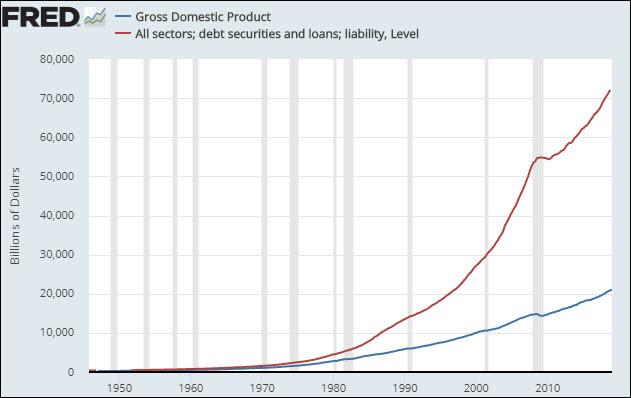

For the US, this chart explains what’s coming in grotesque detail:

This is the total debts of the US, which represent future claims on money — which, remember, itself is a future claim on real wealth.

GDP represents, imperfectly, the ‘real stuff’ in this story. As you can plainly see, the claims (red line) are compunding at a far faster pace than GDP (blue line).

Read More @ PeakProsperity.com

Loading...