The Federal Reserve Is Directly Monetizing US Debt

by Chris Martenson, Peak Prosperity:

In a very real way, MMT is already here

In a very real way, MMT is already here

The Federal Reserve is now directly monetizing US federal debt.

Sure, it’s not admitting to this. And it’s using several technical jinks and jives to offer a pretense that things are otherwise.

But it’s not terribly difficult to predict what’s going to happen next: the Federal Reserve will drop the secrecy and start buying US debt openly.

At a time, mind you, when US fiscal deficits are exploding and foreign buyers are heading for the exits.

How It’s Supposed to Work

Here’s how it’s supposed to work when the US government issues new debt:

- If the US Treasury needs to raise new funds, it announces an upcoming auction of US Treasury bills/notes/bonds.

- A date for the auction is set.

- Various participants bid for those bills/notes/bonds (including ‘regular folks’ like you and me if we’re using the government’s Treasury Direct program).

- At a later date, the Fed can buy those US Treasury bills/notes/bonds. The various holders of that debt submit offers to sell, and the Fed (presumably) selects the best offers on the best terms.

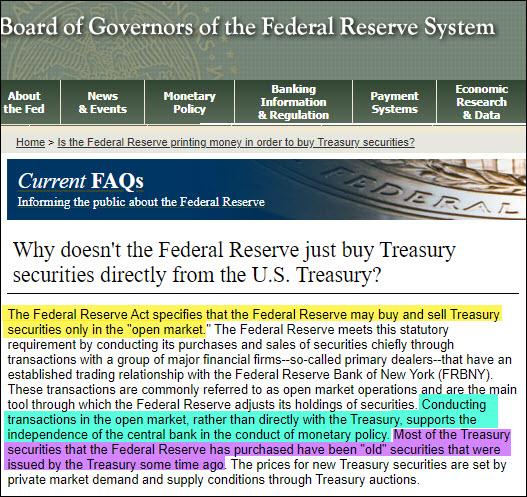

The Federal Reserve, under no conditions, buys Treasury paper directly. The Federal Reserve’s own website still maintains that this is the case:

(Source)

There are two important claims plus one assertion I’ve highlighted in there, each in a different color:

- Yellow: Treasury securities may “only be bought and sold in the open market.”

- Blue: doing otherwise might compromise the independence of the Fed.

- Purple: the Fed mostly buys “old” securities.

So according to the Fed: it’s independent, it follows the rules set forth in the Federal Reserve Act of 1913, and it mostly buys “old” Treasury paper that the market has already properly priced in a free and fair system.

But that’s not really what’s going on…

What’s Actually Happening

It’s now clear that something spooked the Fed badly in September.

We still don’t know what exactly went on, but the Repo market blew up. While this was a clear sign that something big was amiss, the Fed has not yet explained what the cause was, who needed to be bailed out, or why.

And it’s not going to anytime soon. It recently announced that its records on the matter are going to be sealed for at least two years.

While the Fed is ostensibly a public institution, and yes transparency should be extremely important — at least to maintain the appearance that it’s being careful with public monies — the Fed is prioritizing secrecy here.

Whatever’s going on has been serious enough for the Fed to openly lie. And not just in regards to the repo market.

“It’s not QE!” Fed chair Jerome Powell recently declared upon relaunching an asset purchase program that has already expanded the Fed’s balance sheet by hundreds of billion of dollars.

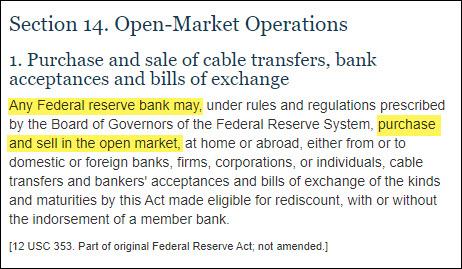

Given all the secrecy, obfuscation and lies, the Fed is now in clear violation of the spirit of the Federal Reserve Act of 1913.

Recall from above that the Fed “only buys Treasury securities in the open market”, meaning from other banks and financial institutions. That’s how the Federal Reserve Act of 1913 is written:

Let’s walk through an example that connects the dots here.

Just know that this is but a single example out of many.

Data point #1

Each and every Treasury offering comes with an identifying number called a “CUSIP” number (referring to the Committee on Uniform Securities Identification Procedures).

On October 31st, 2019 the Treasury Department held an auction for a series of 8-week T-bills with the CUSIP number 912796WL9.

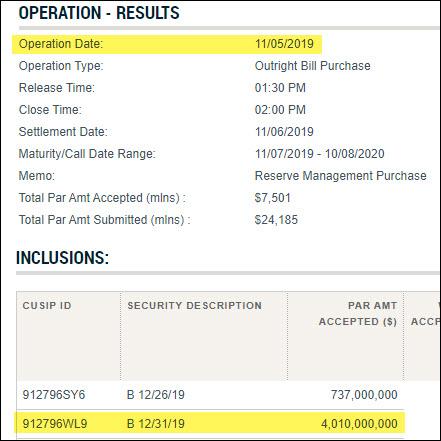

November 5th, 2019 those T-bills were “issued”, meaning that was the actual date that they were to become active. Before that date, nobody had possession of them and nobody was earning interest on them:

From the Treasury Offering Announcement above, on November 5, 2019, $40 billion of CUSIP number 912796WL9 were issued to the market.

It’s worth pointing out that no money changes hands on auction day (Oct 31 in this instance). It only does when the bills are issued (Nov 5 in this case).

Data point #2

Looking at the Federal Reserve’s website, we can see what they bought and when (but not for how much).

There we find that very same T-bill with the CUSIP 912796WL9 showing up as having been purchased by the Fed Nov 5, 2019 — the very date of its issuance:

(Source)

The Fed bought more than $4 billion of this CUSIP. If these T-bills were out in the “open market” they weren’t there for long. At most, less than a day before the Fed scooped them up.

Does it really matter if a big bank sits ever-so-briefly between the Fed and the Treasury debt it buys?

Maybe to a trial lawyer seeking to get a guilty client off on a technicality. But this certainly doesn’t qualify as “old” paper.

This is the Fed buying huge amounts of very freshly minted – not even a day old! – government paper using the power of its electronic printing press.

What the practical difference between the Fed buying this directly from the US government and buying it same day it issues from a big bank?

Virtually nothing — except the big bank probably took home a very hefty paycheck for conducting this “service” as a middleman. Later JP Morgan, et al., can report magnificent “profits” from their ”trading activities”, which amounted to little more than calling the Fed the week before and asking how many $billions of these Treasury bills they wanted.

Just a temporary middleman who, if only skimming a single basis point (1/100 of a percent), would have gotten $400,000 in “trading profits” for holding onto a big pile of government paper for less than a single day, with a guaranteed buyer with infinitely deep pockets already lined up. Great work if you can get it, eh?

But not very fair. Nor even remotely in line with the spirit of the Federal Reserve Act. Or what capital markets are supposed to be about. Or the Fed’s actual mandate.

The summary here is this: the Fed is buying US government paper on the day it’s issued.

The Fed is directly monetizing US debt.

Which means…

MMT is Already Here!

The debate over whether or not MMT (“Modern Monetary Theory” see here for background and discussion) should or should not happen is now moot.

It’s already here.

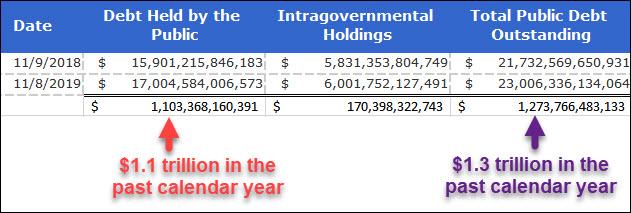

Over the past year, the US government has spent ~ $1.3 trillion more than it took in. To cover the shortfall, it had to raid the Social Security piggy bank for (another) $276 billion and tap the “markets” for another $1.1 trillion.

If not MMT, what other name should we give a program where the US government spends $1.3 trillion more than it takes in and the Federal Reserve covers the shortfall by by purchasing US government debt on the day of issuance?

Does it matter if the US government issues it out of thin air, or if the Fed creates the same cash money out of thin air? Does it really matter in the slightest what the precise mechanisms is if the results are identical?

I would argue they don’t matter in the slightest.

Read More @ PeakProsperity.com

Loading...