Venezuela’s Hyperinflation Drags On For A Near Record—36 Months

by Steve H. Hanke, Market Oracle:

Venezuela is the only country in the world that is suffering from the ravages of hyperinflation. But, you wouldn’t know it from reading the press, where playing fast and loose with words is commonplace. Indeed, the word “hyperinflation” is thrown around carelessly and misused frequently, with claims that multiple countries are suffering from hyperinflation. The debasement of language in the popular press has gone to such lengths that the word “hyperinflation” has almost lost its meaning.

So, just what is the definition of this oft-misused word? The convention adopted in the scientific literature is to classify an inflation as a hyperinflation if the monthly inflation rate exceeds 50%. This definition was adopted in 1956, after Phillip Cagan published his seminal analysis of hyperinflation, which appeared in a book, edited by Milton Friedman, Studies in the Quantity Theory of Money.

Since I use high-frequency data to measure inflation in countries where inflation is elevated, I have been able to refine Cagan’s 50% per month hyperinflation hurdle. With improved measurement techniques, I now define a hyperinflation as an inflation in which the inflation rate exceeds 50% per month for at least thirty consecutive days.

Beyond the theory of PPP, the intuition of why PPP represents the “gold standard” for measuring inflation during episodes of hyperinflation is clear. Virtually all goods and services are either priced in a stable foreign currency (the U.S. dollar) or a local currency (the bolivar). In Venezuela, bolivar prices are determined by referring to the dollar prices of goods, and then converting them to local bolivar prices after observing the black-market exchange rate. When the price level is increasing rapidly and erratically on a day-by-day, hour-by-hour, or even minute-by-minute basis, exchange rate quotations are the only source of information on how fast inflation is actually proceeding. That is why PPP holds and why I can use high-frequency data to calculate Venezuela’s inflation rate.

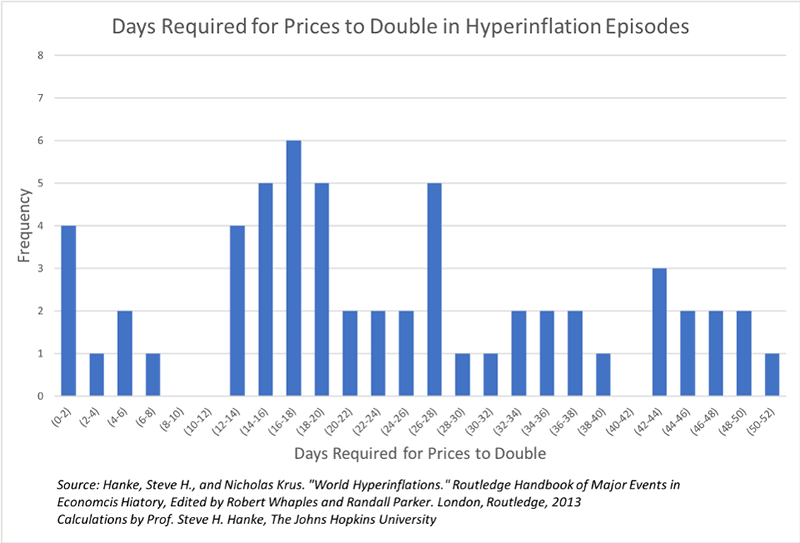

Just how severe is Venezuela’s episode of hyperinflation? Well, that depends on the metrics used to measure severity. If one looks at the rate of inflation itself, Venezuela’s hyperinflation fails to make the Top Ten. Of the world’s fifty-eight episodes of hyperinflation that Nick Krus and I documented in the Routledge Handbook of Major Events in Economic History, Venezuela ranks as the 14th most severe hyperinflation. This is shown below in the frequency distribution of the days required for prices to double in the world’s hyperinflation episodes. At the peak of Venezuela’s inflation, which occurred in January 2019, it took 14.8 days for prices to double. This puts its rate at the upper-end of the mid-range of hyperinflation severity.

Prof. Steve H. Hanke

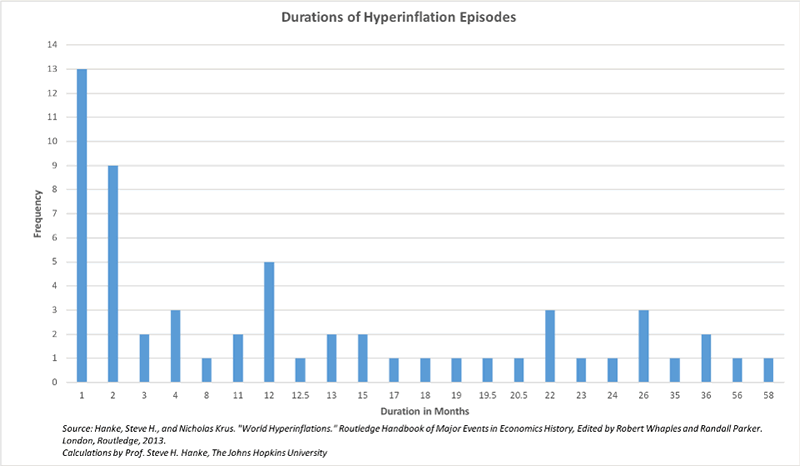

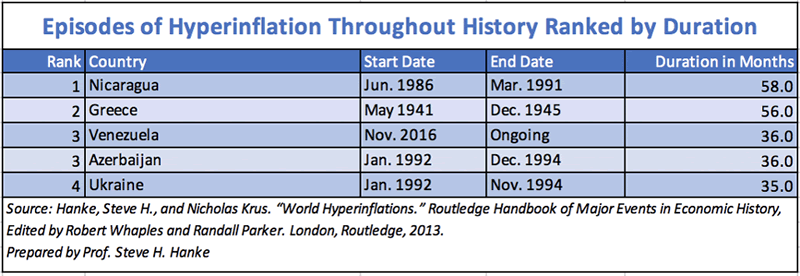

If one measures severity by the duration of a hyperinflation, Venezuela’s hyperinflation, which started in November of 2016 and has yet to end, is severe. It has lasted for thirty-six months and counting. As the frequency distribution and table below show, there have only been two hyperinflations that have lasted longer than Venezuela’s.

Prof. Steve H. Hanke

Prof. Steve H. Hanke

So much for the definition and accurate measurement of Venezuela’s hyperinflation. What about forecasts for the course and duration of Venezuela’s episode? Well, you can’t reliably forecast what heights a hyperinflation will reach, or when those heights will be reached.

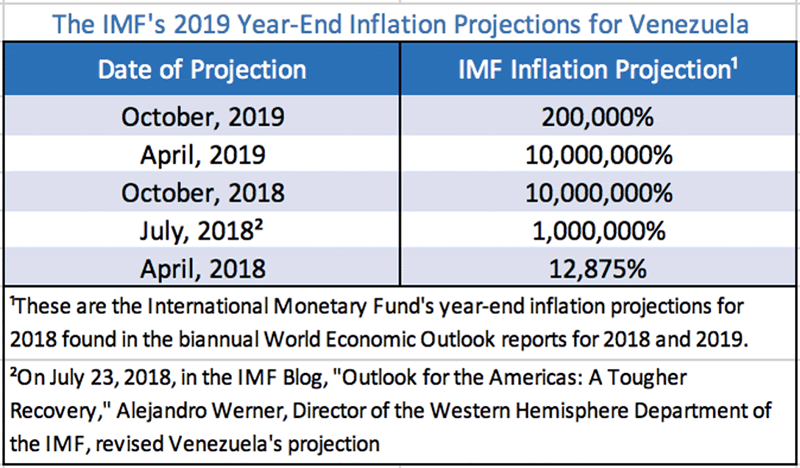

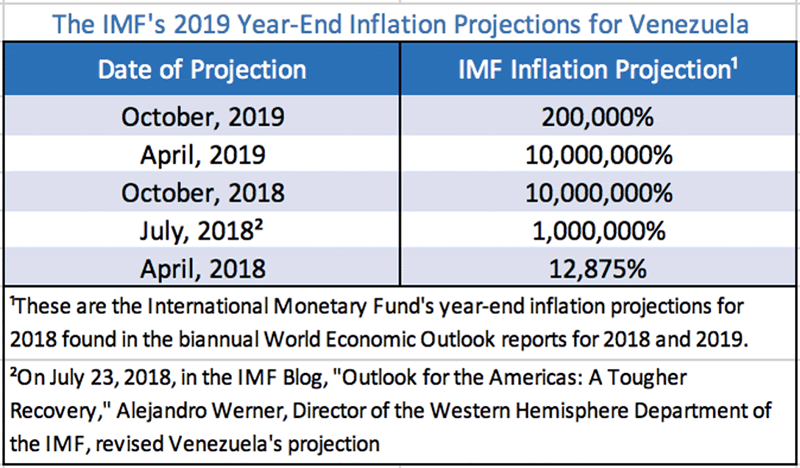

Surprisingly, that impossibility hasn’t stopped the International Monetary Fund (IMF) from throwing economic science to the winds. Yes, the IMF has regularly been reporting what are, in fact, absurd inflation forecasts for Venezuela. The table below presents the IMF’s finger-in-the-wind forecasts (read: nonsensical folly). Indeed, the IMF’s forecasting folly should be apparent to the naked eye. Just look at the table below. The IMF’s forecasts for 2019’s year-end inflation have ranged from 200,000% to a whopping 10,000,000%.

Prof. Steve H. Hanke

Read More @ MarketOracle.co.uk

Loading...