Brick & Mortar Rent Meltdown, Manhattan Style

by Wolf Richter, Wolf Street:

Asking rents for ground-floor retail space have plunged as landlords struggle with vacancies.

Asking rents for ground-floor retail space have plunged as landlords struggle with vacancies.

These are major shopping corridors in Manhattan, and in nearly all of them, asking rents for ground-floor retail space have been dropping for years – and in some of them by half.

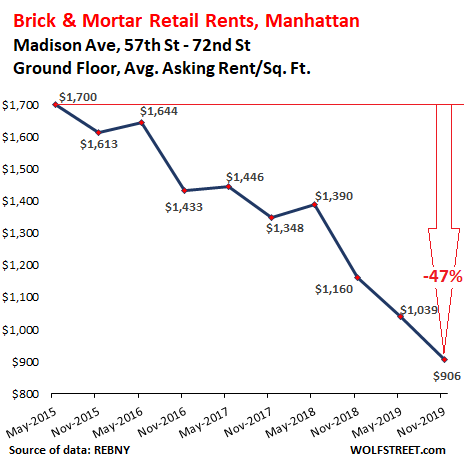

For example, the average asking rent on Madison Avenue between 57th Street and 72nd Street, plunged 22% in the second half of 2019, compared to the same period last year, to $906 per square foot per year, and is down 47% from the first half in 2015, according to the bi-annual Manhattan Retail Report released today by the Real Estate Board of New York:

The REBNY report points out, “An increased amount of leases expiring has contributed to the high availability rates [meaning, vacancies] that has led owners to lower asking rents and offer more short-term lease agreements.”

Falling asking rents and better terms in the Madison Avenue corridor – better deals for prospective tenants – help bring out prospective tenants, according to the report: “Softening rents has led to increased absorption as recent leases consist of retailers relocating to smaller-sized storefronts with better co-tenancy. Notables tenants such as Akris, Mont Blanc, and Morgane Le Fay indicate that apparel tenants still dominate this corridor.”

The report is entirely focused on ground-floor retail spaces. Of the 17 shopping corridors in Manhattan tracked by the REBNY, average asking rents fell in 11 of them. But since 2015, asking rents in all but three of them have dropped sharply. But two of those three have reached new highs (and we’ll get to them in a moment):

- In Downtown: on Broadway between Battery Park and Chambers Street

- In Harlem: on 125th Street, from the Harlem River to the Hudson River

Here are more samples of the 17 shopping corridors that REBNY tracks, showing average asking rents per square foot per year, for available ground-floor retail spaces.

Upper East Side.

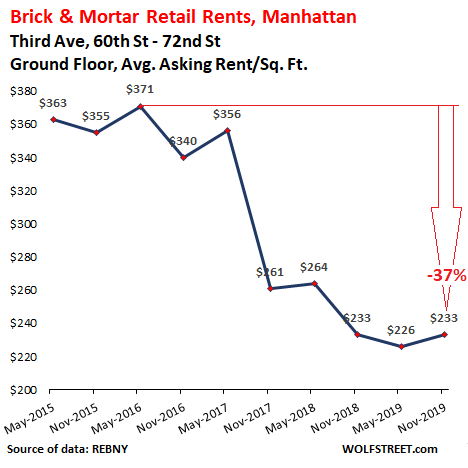

On Third Avenue, between 60th and 72nd Street, according to the report: “In order to fill vacant spaces, owners are becoming more flexible with a steady amount of deal-making occurring with new tenants such as Wells Fargo, TD Bank, and Tudor Salon.” Alas, those three operations are services, two of them financial services, which are booming, not retail (sale of goods to consumers):

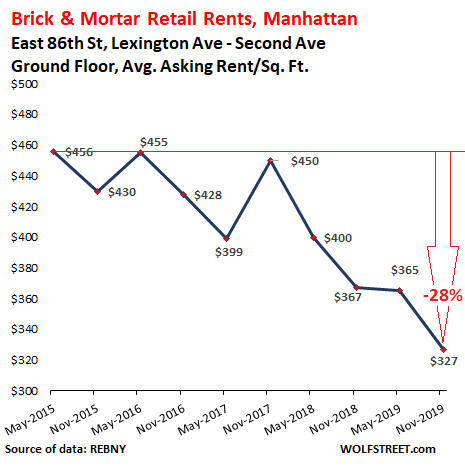

On East 86th Street, between Lexington Avenue and Second Avenue, the average asking rent fell 11% year-over-year adding a big portion to the decline since the first half in 2015:

Midtown.

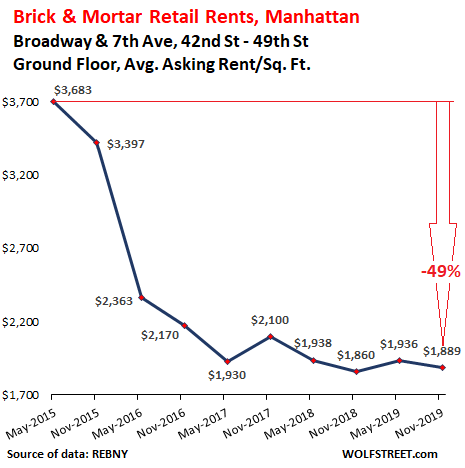

Some of Manhattan’s most expensive shopping corridors are in Midtown, but they have not been spared.

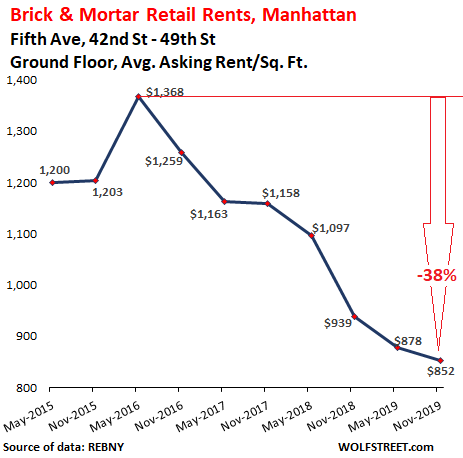

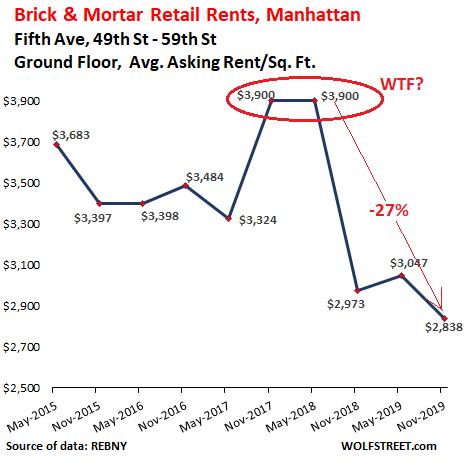

And the two stretches on Fifth Avenue, between 42nd Street and 59th Street:

These are asking rents. It doesn’t mean that tenants agree to them. In the second half of 2017 and the first half of 2018, valiant but futile attempts were made on Fifth Avenue between 49th Street and 59th Street to ignore reality and ask for record rents, but apparently that didn’t work out, and aspirations then got slashed by 28% in two years:

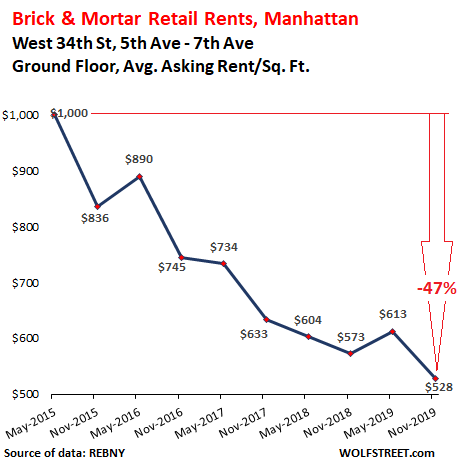

Midtown South.

Asking rents for ground-floor retail space along West 34th Street between Fifth Avenue and Seventh Avenue are among the worst-hit in Manhattan in terms of the plunge since the first half of 2015:

Downtown.

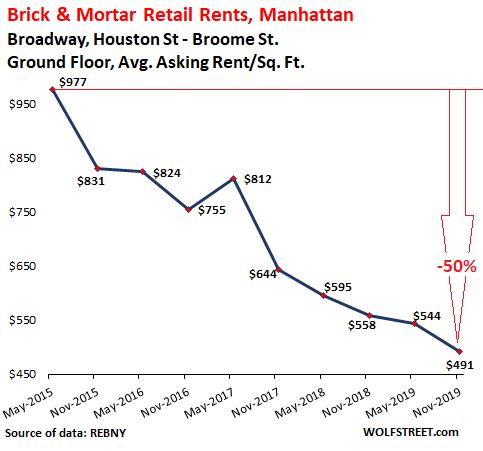

Concerning the 50% plunge since 2015 in SoHo on Broadway, between Houston Street and Broome Street (chart below), REBNY reported:

Broadway is composed of loft buildings with large retail spaces that are difficult to subdivide due to historic regulations. Further complications stem from restrictive zoning that places limits on food/beverage uses in SoHo.

The decline in asking rents is attributed to post-recession asking rents nearly doubling to historic peaks, as flagship brands were considered ideal tenants capable of affording expensive large retail spaces. As asking rents continue to adjust, Broadway is witnessing increased activity by pop-ups and digitally native brands experimenting with retail space.

Concerning the 46% plunge in asking rents on Bleecker Street (chart below), REBNY explains:

Asking rents on Bleecker Street continue to decline from post-recession all-time highs, as lesser foot traffic and a more neighborhood-centric retail landscape has caused flagship brands to look for Downtown retail space elsewhere.

But dramatically lower asking rents make new things possible:

Bleecker Street has gained new traction with Brookfield Properties filling in its new portfolio of 7 storefronts with a mix of digitally native and e-commerce brands, which has encouraged similar retailers to search for space along the corridor. Examples of new digitally native and e-commerce tenants include LoveShackFancy, Hill House Home, Slightly Alabama, and Bonberi.

Loading...