Quantum leap for banks as ABN AMRO questions gold price discovery

by Ronan Manly, BullionStar:

Earlier this week, an interesting article appeared on the website of the major Dutch bank ABN Amro, written by the bank’s currency and precious metals strategist, Georgette Boele.

The article, titled “A world with two gold prices?”, questions how, if gold is a safe haven asset, its price has not continued to reflect the ongoing crisis and stress in financial markets.

Boele then seeks an explanation of this puzzle in terms of a framework which consists of both safe haven gold demand and speculative gold demand, one of which reflects the purchase of physical gold (safe haven demand), and the other which speculates on the gold price via paper and synthetic gold products (speculative demand) which are not physically backed by gold.

This leads her to the observation that safe haven investors would not not sell their physical gold in the midst of a crisis, as they “would think three times before parting ways with their gold”, and that it is speculative investors (those who are not invested in real physical gold) who are pushing the gold price around.

One Small Step

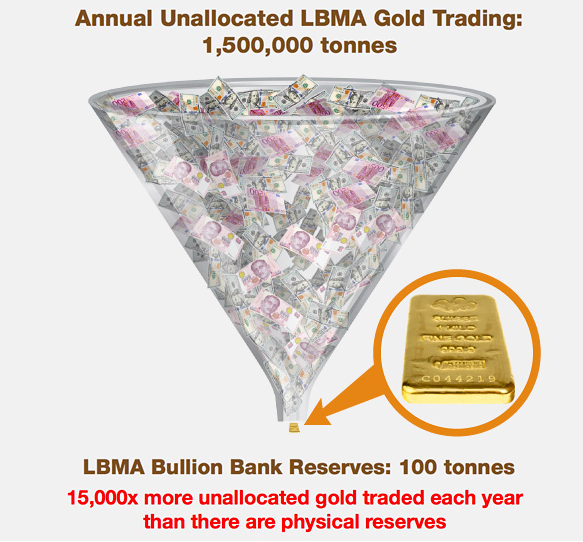

While the ABN AMRO strategist fails to address the reality of how the international gold price is really established, i.e. via gigantic trading volumes of fractional-reserve London unallocated gold and COMEX gold derivatives, she does take a quantum leap, at least for a prominent investment bank, when the penny drops that there are two separate things being traded. Finite tangible physical gold on the one hand, and paper gold synthetics on the other. Shouldn’t these two things have distinct prices? Boele then makes the jump:

“Let’s now go a step further. Suppose there are two gold prices: one for physical gold and one for all other non-physical gold products. How would these two gold prices behave?”

As far as I recall, this is the first time that a major financial institution has broached the subject of two tier, something we have been reiterating here at BullionStar for years, for example “What sets the Gold Price – Is it the Paper Market or Physical Market?”, but this new enlightenment from ABN AMRO is welcome. Perhaps they have been looking at the BullionStar website.

With two gold prices, one for real physical gold and the other for paper speculation, rationalizes Boele:

“In times of financial crisis, the price representing physical gold will increase much faster than its non-physical counterpart

All in all, speculative demand for gold has made the gold price more volatile. In addition, gold is behaving less as a safe haven. When there is zero trust in the financial system, the only safe option for investors is still physical gold.”

While this ‘step further’ from ABN AMRO is a good start, it is still only a small step. Boele still fails to acknowledge that the very nature of the ‘gold price’ as we know it is completely determined by speculation via synthetic gold trading that has got nothing to do with trading of physical gold, with is just a price taker. From the above BullionStar article in March 2017:

“There are two sets of gold markets – on the one side, the COMEX gold futures and London OTC unallocated gold spot markets which are both ultra-leveraged and which both create gold supply out of thin air, and on the other side, the physical gold markets which inherit the gold prices derived in these paper gold markets. Currently the physical gold markets have no effect on the international gold price.”

Two Different Markets – Two Gold Prices

Of course the current gold price is not properly reflecting safe haven demand. That’s because the gold price is not reflecting physical gold demand. The ABN article ends with the conclusion that:

“In a world with two gold prices, the price of physical gold will predominantly behave as a safe haven. The other gold price, by contrast, will act more like a financial asset and can serve as an anti-dollar investment.”

Therefore unfortunately, Boele does not address how the current gold price is actually derived, i.e. that the entire gold price discovery is via London OTC unallocated trading and COMEX gold derivatives. She also fails to mention gold lending, bullion bank gold price manipulation, and central bank intervention into gold markets, topics which cannot go unnoticed when taking about contemporary gold price discovery. Without acknowledging price discovery and behind the scenes shenanigans, ABN AMRO is skirting around the issue and can’t make additional steps of logic in fleshing out how the two gold prices would jettison and detach from each other. But it might go something like this:

Loading...