The Chosen Ones? – Rob Kirby

by Rob Kirby, Gold Seek:

What has happened to our capital markets? The reactions to the onset of a global pandemic in our capital markets are, for the most part, fundamentally counter- intuitive and, in my opinion, will not continue.

Incapacitating the second largest and fastest growing economy in the world is no reason to “buy stocks” into record territory or conduct fire sales of precious metals. If you drop a ball and it falls “up” I suggest you not jump to the conclusion that the laws of gravity have been repealed. Instead, you might want to take heed of the old adage, “It’s not nice to fool Mother Nature”.

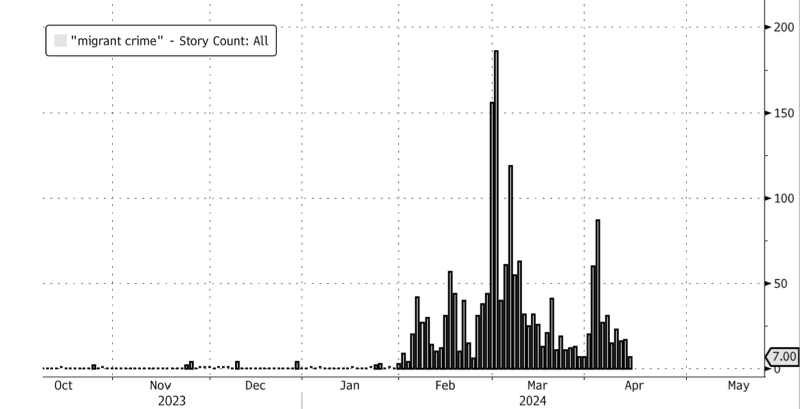

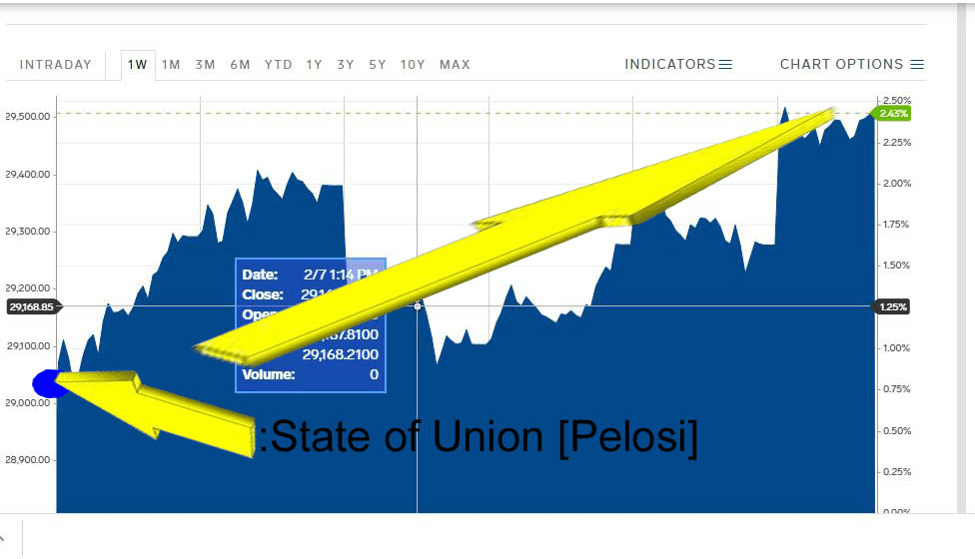

American equity markets have celebrated treasonous, undermining, political assault and subterfuge:

Clearly, the DOW was chosen [ordained] to RISE. Why?: It makes the population at large [in the western world] believe in the narrative that a global pandemic coupled with treason on the home front is nothing to be concerned about – the economy is doing just fine.

Other Managed Outcomes

There is still a large constituency in our dystopian world who does not believe that the powers-that-be would engage in such financial shenanigans.

To begin wrapping your head around the “depths” and skulduggery that monetary officials will stoop to, let’s revisit some of the handiwork performed by Robert Rubin in the Clinton era. The mindset at the Fed and Treasury might be best summed up by Robert Rubin as he reveals the motivation or drivers of crisis management in the interaction between himself, Lawrence Summers, the ESF [exchange stabilization fund], the IMF and presumably the Maestro at the Fed – during the Clinton administration. On pages 290 – 291 of his book, In An Uncertain World, referencing the Brazilian financial crisis of the late 1990’s, Rubin outlines how very expensive “bad decisions” can buy time. Sometimes, he asserts, these bad decisions have a great deal of merit because they can,

“..Probably defer the impact of the collapse for six or eight months, and that will more than justify the effort.”

After reading this passage I could not help but ask myself if this type of thinking perhaps extends to the dollar, gold and the rest of our capital markets to this very day?

Lemonade from Lemons or Money from Thin Air?

Back in the day, Rubin was so adept at financial sleight of hand that his mastery of the “craft” was given its own name – Rubinomics. In layman’s terms, it’s better labeled “making something out of nothing” or just plain old FRAUD. It works something like this:

Back to 1995, in the twilight of the first Clinton Administration, Treasury Secretary Robert Rubin and the U.S. government were facing a sovereign default on financial obligations due to a bitter, partisan debate causing delay on raising the debt ceiling. In the words of Robert Rubin himself in his book, In An Uncertain World, on page 170 he states,

“Without an increase, the federal government would hit the debt ceiling before the end of 1995, possibly as early as October. Default and the President being forced to sign an unacceptable budget were both untenable. We needed to find a way out, rather than simply hoping that at the last minute the opposition would blink and increase the debt limit.”

The response to this dilemma is chronicled by Rubin, on page 172, where he reveals,

“It was Ed Knight, our savvy chief Treasury counsel, who suggested borrowing from the federal trust funds on an unprecedented scale to postpone default.”

You see folks; as Mr. Rubin is/was well aware, the federal trust funds DO NOT AND NEVER DID CONTAIN ANY MONEY. These accounts exist in the minds of accountants and lawyers [ledgerdom] only. So here’s what really happened:

Beginning Nov. 12, 1995, the Treasury started issuing government bonds, IOU’s, and putting them in the Social Security Trust Fund “cookie jar” – with the Fed then PRINTING the corresponding amount of money they needed and called this a ‘legitimate loan’. By accounting for their finances in this manner, the government got to understate their annual budget deficit by the same amount that they were burdening the cookie jar with IOU’s – all the while dramatically increasing the unfunded [off balance sheet] liabilities of the government by the same amount.

Where I come from, this is neither savvy nor a loan. It is better described as both treasonous and outright fraud. Isn’t government finance fun?

Loading...