Red Gold: China’s Stealth Plan to Use Gold for World Domination

by Marin Katusa, Katusa Research:

Gold used to be important.

During and after World War II, every major developed country amassed as much physical gold as they could. It stabilized currencies and signaled independence.

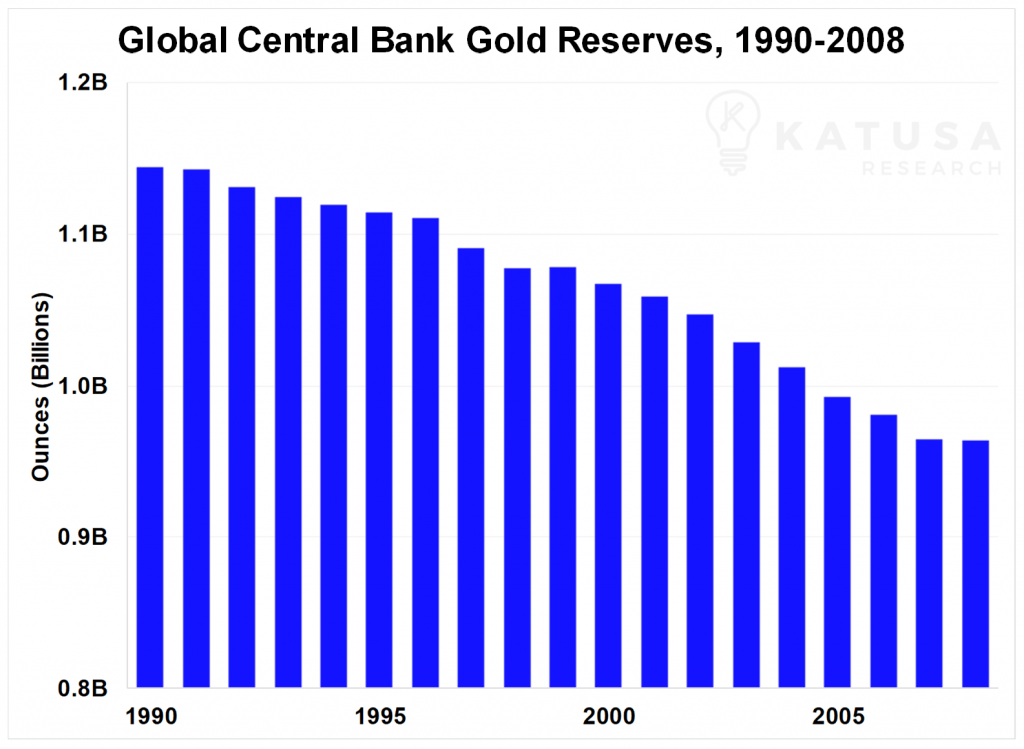

But with the end of the gold standard in 1971, most countries began to sell off their reserves.

So much so that in 1999, an agreement was formed to limit the amount of gold that central banks could sell. Fast forward to today, and Canada’s central bank owns ZERO gold.

Despite the agreement, most countries continued to shed their gold reserves as fast as possible.

That is until a few years ago, when a handful of countries reversed course. Central Banks started buying gold with fury, and they haven’t let up since.

That is until a few years ago, when a handful of countries reversed course. Central Banks started buying gold with fury, and they haven’t let up since.

- In the final quarter of 2018, central banks purchased more gold than in any other quarter on record.

By the end of the year, central banks collectively held around 1.064 billion ounces of gold (equivalent to 33,200 tons).

That’s about one-fifth of all the gold ever mined.

In the first half of 2019, central banks purchased 11.97 million ounces of gold (374 tons). Once again, that was far more than ever before. And it’s equivalent to one-sixth of total gold demand in that period.

And total central bank gold purchases for 2019 were the second highest they’ve been in the last 50 years (2018 being the first).

The Unusual Suspects in Central Bank Gold Purchases

And the Keyser Söze of gold is Vladimir Putin.

I’ve been very quiet about Russia and Putin the last few years as I got swamped with media requests following the success of my NY Times Bestseller The Colder War.

Don’t underestimate what the Russians are doing, as others are starting to follow…

While the world focuses on China, Russia has positioned itself at the center of the global political chessboard.

Here’s what’s interesting with the recent central bank gold purchases: the vast majority of that unprecedented purchasing came from just four countries.

These are places you’d never expect.

- One of those countries is Kazakhstan, whose GDP is smaller than Kansas’s. Kazakhstan grew their reserves from 2.4 million ounces (75 tons) in 2011 to 12 million ounces (375 tons) in 2020 — A 400% increase.

- Turkey moved far faster. In 2017, they had 3.71 million ounces (116 tons). Now, they have 12.32 million ounces (385 tons) of gold. That’s a 232% increase in just the last two years.

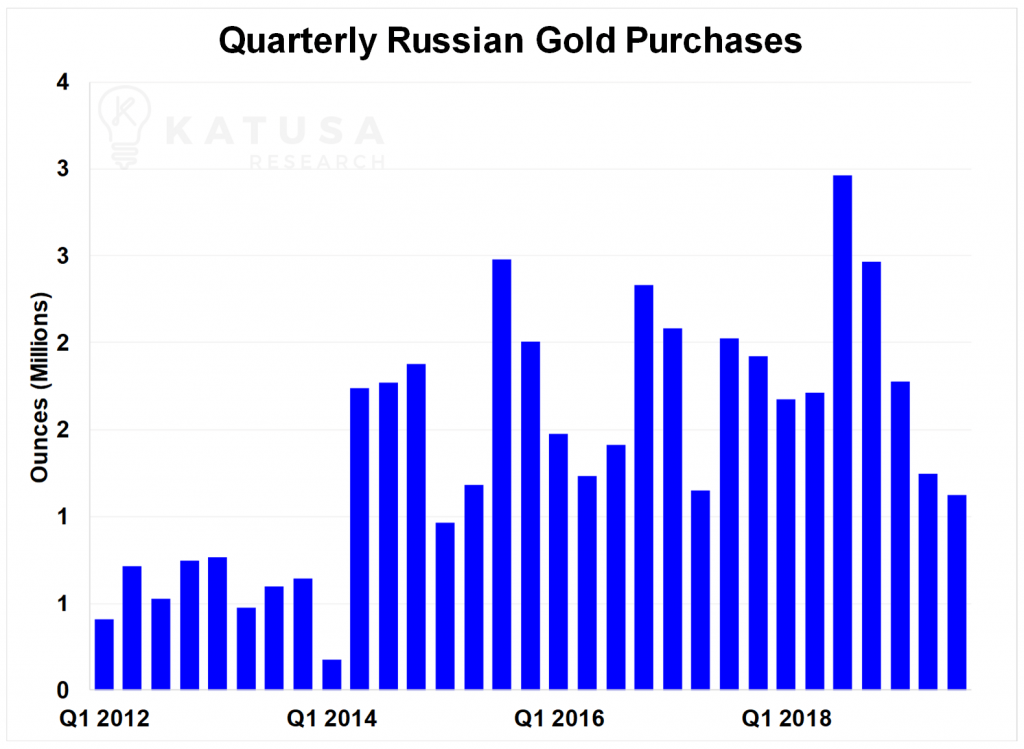

- In 2018 alone, Russia bought 8.78 million ounces (274.3 tons). That’s the most it’s ever purchased in one year, and its fourth year above 6.4 million (200 tons) ounces of gold. For reference, that’s $15.7 billion worth of gold.

Putin is undertaking what’s called a “de-dollarization.” Aware of sanctions from the United States, Russia is positioning itself to not be dependent on U.S. Dollar holdings.

So, the central bank in Russia has sold nearly all of their U.S. Treasury notes. And it’s used the proceeds to buy gold.

Like I said, the Keyser Söze of gold is Vladimir Putin.

Pay attention to the world’s master strategist. This is very bullish for gold.

You might be wondering why Russia doesn’t buy a yielding investment with the cash.

You might be wondering why Russia doesn’t buy a yielding investment with the cash.

The problem is that other reserve currencies, like the euro or the yen, are extraordinarily weak against the dollar and Putin knows this will continue.

Russia bought $100 billion worth of euros, yuan, and yen in 2018… the Keyser Söze of gold won’t make that mistake again.

And over eleven trillion U.S. dollars’ worth of global investment opportunities have a negative yield. So Russia would end up paying money to hold them.

Gold, on the other hand, has paid off handsomely for Putin.

- In 2019, the value of Russian-held gold has increased from $86 billion to more than $112 billion. The rising gold price has generated a windfall for the Russians of nearly $20 billion that the Russians can leverage.

That’s providing plenty of incentive to keep Russia buying in the long run, stoking further demand.

The problem is that Russia’s buying is fairly well-known. Unless it continues to step up gold purchases, its effect on gold prices has mostly already been taken into account.

China’s New Golden Rule

With WuFlu (the Coronavirus) now having infected more people than SARS did in 2003, will China continue their gold purchases?

China stockpiled huge amounts of gold every single month last year.

You’re probably wondering why…

Well, you’ve probably heard the saying, “He who has the gold, makes the rules.” Xi Jinping, President of China, agrees with Putin’s strategy.

WuFlu no doubt has sidetracked China here in the near term, but it’s been proven that the gold insurance strategy is a very wise one.

The Chinese elite are aware of their aging demographics and high debt loads.

The gold will be valuable to potentially backstop any shortfalls without being overly dependent on their foreign exchange reserves.

Read More @ KatusaResearch.com

Loading...